This page provides DRFA information about the Victorian bushfires that started on 7 January 2026 (AGRN 1242).

If you require further help, please contact the Natural Disaster Financial Assistance (NDFA) team via ndfa@justice.vic.gov.au(opens in a new window)

Last updated: 23 January 2026

Supporting documents

A list of documents referred to throughout this page:

The Department of Transport and Planning Presentation provided to impacted councils on 22 and 23 January 2026:

List of local councils notified for assistance under the Disaster Recovery Funding Arrangements (DRFA)

Twenty-three local government areas (LGAs) and one Alpine Resort have been particularly impacted by the bushfires. Those notified for assistance under the DRFA are:

- Alpine Shire Council

- Ararat Rural City Council

- Benalla Rural City Council

- Campaspe Shire Council

- Colac Otway Shire Council

- Corangamite Shire Council

- East Gippsland Shire Council

- Golden Plains Shire Council

- Greater Bendigo City Council

- Horsham Rural City Council

- Lake Mountain Alpine Resort

- Macdeon Ranges Shire Council

- Mansfield Shire Council

- Midura Rural City Council

- Mitchell Shire Council

- Moira Shire Council

- Mount Alexander Shire Council

- Murrindindi Shire Council

- Pyrenees Shire Council

- Strathbogie Shire Council

- Towong Shire Council

- Wellington Shire Council

- Wodonga City Council

- Yarra Ranges Shire Council

Note: additional LGAs may be added to the Commonwealth notification as LGAs advise of impacts. This includes eligible activities undertaken by surrounding councils to assist neighbouring disaster impacted councils.

Council does not need to be directly impacted by the disaster event however can be included in the AGRN on the basis that eligible DRFA expenditure was incurred as a result of the event.

How can a council be included in the Commonwealth notification for the event?

Local councils incurring expenditure as result of the Victorian bushfires that started on 7 January 2026 (AGRN 1242) are to submit an event notification via Emergency Recovery Victoria’s claims management system.

Those councils already included in the Commonwealth notification are still required to submit an event notification in the claims management system.

Emergency accommodation

Can a council seek reimbursement for assisting impacted households with emergency accommodation if they are displaced following the January 2026 bushfires under AGRN 1242?

Generally, councils are able to provide emergency accommodation to individuals residing in impact areas for up to 5 days following displacement as a result of the disaster. Councils may provide up to 28 days emergency accommodation in exceptional circumstances such as severe damage or destruction of a principal place of residence and no other accommodation options are available (for example, living with family or friends).

Beyond the emergency accommodation period, temporary accommodation needs are to be discussed with the Department of Families, Fairness and Housing.

Temporary accommodation is intended to support permanent residents of impacted areas. It is the expectation that tourists and visitors make their way out of impact areas, adhering to emergency and evacuation orders. In exceptional circumstances such as road closures preventing leaving, limited emergency accommodation may be provided.

Reimbursable costs include:

- expenditure associated with emergency accommodation for those eligible (accommodation must be occupied for reimbursement to occur)

- extraordinary costs (for example, overtime) associated with the assessment and coordination of emergency accommodation and, or temporary housing needs for eligible impacted individuals as well as transportation to emergency accommodation.

In addition to the emergency accommodation, the Department of Families, Fairness and Housing will make assistance payments under its Personal Hardship Assistance Program. This includes emergency relief payments for those who have had to evacuate their homes and need immediate things like food and medicine.

Assistance under the program includes a one-off payment of $680 per adult and $340 per child, up to a maximum of $2,380 per eligible family.

In addition, emergency re-establishment assistance is provided to assist with supporting emergency affected residents to re-establish their homes by providing:

- alternative accommodation

- removing debris

- repairs

- rebuilding

- replacement of essential household contents.

The assistance only applies to residents whose principal places of residence has been damaged, destroyed or rendered inaccessible for more than 7 days. The assistance is also subject to insurance coverage and income tests. Assistance can be up to $52,250.

For more information, Councils should refer to:

- Tip Sheet 1 – Relief and Recovery Centres and Temporary Accommodation – Category A

- VicEmergency relief and recovery tab payment section for the Department of Families, Fairness and Housing (DFFH) contact details.

Council resourcing

How can a council seek approval for a bushfire or storm recovery support officer position description to assist with undertaking eligible activities under Categories A of the DRFA?

Roles must link to delivery of eligible activities under Category A, for example:

- the operation of a relief or recovery centre, that is recovery centre manager or recovery centre support office

- organising impact assessments on impacted private properties

- coordination of counselling services for impacted individuals and households.

If eligibility is uncertain, council can seek advice from their assigned assessor or submit a formal request to review a proposed position description via the DRFA funded position module in the claims management system.

For more information, please refer to the relief and recovery expenditure in:

- Victorian DRFA Guidline 3

- Tip Sheet 1 – Relief and Recovery Centres and Temporary Accommodation – Category A.

What is the process for councils not directly impacted by the disaster event however providing assistance to neighbouring councils to seek reimbursement of eligible costs?

Two resource sharing scenarios have been outlined below.

Scenario 1

A disaster affected council (council 1) leads the relief and recovery activities in its local government area and uses the workforce (secondment) of another non-disaster affected council (council 2). Costs can be claimed on the following basis:

- communication from council 1 that demonstrates that the disaster impacted council has exhausted its own internal staff capacity;

- council 2 can seek to recoup the full workforce costs for the seconded staff member from council 1. Council 2 required to provide appropriate supporting documentation including relevant payroll reports verifying the amount seeking recoupment (excluding margins and overheads) and

- the activities the workforce from council 2 are undertaking relate to the delivery of eligible DRFA activities or measures. Apportionment percentages can be applied.

Scenario 2

Where the relief and recovery activities are directly undertaken by a non-disaster impacted council (council 2) in their local government area to assist a disaster affected council (council 1), council 2 is able to claim the same DRFA eligible costs as for a council directly impacted by the disaster on the following basis:

- council 2 provides written evidence that assistance was requested from council 1 (via an appropriate senior council officer) or from the incident or regional or State Control Centre that is, an email trail requesting or agreeing to delivering activities on its behalf;

- council 2 workforce costs are extraordinary, that is, costs would not have been incurred if the disaster had not occurred (that is, overtime). Time in lieu is not an eligible cost; and

- the same DRFA evidentiary requirements apply for council 1 and 2.

Reimbursement process

Under both scenarios, council 2 is able to invoice council 1 seeking reimbursement for the activities undertaken.

However specific to scenario 2, council 2 is also able to directly submit a claim via the claims management system with a confirmation that council 1 has reviewed council 2’s activities.

Where this is the preference, council 2 will need to submit an event notification in the claims management system to be included in the notification to the Commonwealth specific to AGRN1242.

The non disaster impacted council does not need to be directly impacted by the disaster event however can be included in the AGRN on the basis that eligible DRFA expenditure was incurred as a result of the event.

For further information, refer to the Victorian DRFA Guideline 3.

How can a council seek approval for a bushfire or storm recovery support officer position description to assist with undertaking eligible activities under Categories B of the DRFA?

Eligible expenditure for day labour

Council owned plant and equipment costs that are directly engaged in the delivery of:

- eligible emergency works

- immediate reconstruction works

- reconstruction of essential public asset activities

are eligible.

Direct salary and wages (including overtime) for physical work activities undertaken and associated salary on-costs (as per the salary on-cost benchmark).

Eligible physical works activities includes direct labour, supervision and project management of the works, over the period that the eligible works were undertaken.

Plant and equipment costs pro-rated for the period of that the eligible activities were undertaken. Please refer to the eligible benchmark rates for plant and equipment.

Evidence required to claim day labour eligible expenses

In addition to the existing Category B requirements for:

- eligible emergency works

- immediate reconstruction works

- reconstruction of essential public asset activities

listed below is the supporting documentation that will be required. All direct costs must be claimed on a per asset basis.

- Detailed general ledger or transactions reports outlining all expenditure.

- Details of resources claimed for the eligible activities including staff names, position descriptions of roles, internal costing or payroll reports or timesheets for any payroll costs.

- In relation to plant and equipment used for the event, utilisation details (by asset, hours, dates).

- Plant and equipment purchase date, purchase cost, written down value, residual value, asset life, depreciation to-date.

- Detailed calculation of claimable hourly rate for all plant and equipment items including details of costs incurred per year that form the basis of the charge out rates.

- The basis of apportionment of the expenses.

Councils are to engage with their assigned assessor when preparing a day labour claim to agree on the methodology and rates before submitting the claim for assessment.

For further information, please refer to the :

- Day labour section in the Victorian DRFA Guideline 1

- Tip Sheet 11 – Category B excluding counter disaster operations – day labour – February 2025

- Tip Sheet 11a – Delivery agency day labour template – June 2024

- Tip Sheet 11b – Delivery agency plant rates template – June 2024.

Can council staff claim expenses incurred while travelling to and from recovery centres (and other sites) with their private vehicles to assist with emergency works?

Private vehicle usage is eligible to be claimed under the DRFA.

Supporting documentation is required, such as:

- the activity each staff member was undertaking (for example, assisting in the relief or recovery centre)

- dates worked

- private vehicle usage amount (this is calculated as per coucil staff private vehicle use policy)

For more information, refer to the Victorian DRFA Guideline 3.

What are extraordinary workforce payroll cost?

From a Commonwealth DRFA determination perspective, councils are deemed to be part of the Victorian Government consolidated entity for DRFA expenditure incurred. Extraordinary expenditure is defined as expenditure that would not have been incurred if the disaster event had not taken place. Hence the reallocation of council staff resources is not considered an additional cost or the pausing of other council activities.

Also, the DRFA excludes financial impacts resulting from pausing of other council activities and the cancelling of events. Time in lieu is not considered as extraordinary expenditure.

Eligible extraordinary workforce costs include overtime and also staff seconded from other councils (specific exception provided to Victoria by the Commonwealth).

Relief and recovery

Can councils provide food to community members through their community houses, community hubs or drop-in centres? How long can a council continue to provide this service?

Impacted councils can choose to use a community house, community hub or drop-in centre in the same function as a relief and recovery centre.

Councils are able to claim extraordinary (additional) costs associated with the establishment and, or operation of these centres. The includes the cost of food which is eligible to be claimed under Category A for the establishment of a relief and or recovery centre.

The DRFA claim will need to be supported with the following documentation:

- dates of when the facility was opened and when it was closed

- dates of when residents experienced power outages

- number of meals prepared

- approximate number of residents the facility is providing catering for

- approximate number of residents impacted by this event.

For more information, refer to:

- Relief and Recovery Expenditure in the Victorian DRFA Guideline 3

- Tip Sheet 1 – Relief and Recovery Centres and Temporary Accommodation – Category A.

Services provided by the Red Cross will be directly reimbursed by Emergency Recovery Victoria

Specific to this event, it has been agreed, that the Red Cross will directly invoice Emergency Recovery Victoria (and not council) for any services provided. Before seeking reimbursement, councils will need to verify the services provided by the Red Cross in each of the local government areas.

A council has been holding a community debrief in a relief hub which may or may not transition to a recovery hub. Is this activity eligible?

A community relief hub is considered to be operating as a recovery centre and eligible costs will be able to be claimed under Category A of the DRFA however, please note that not all impacted councils will need a community relief hub or recovery centre to be established.

For more information, refer to the Relief and Recovery Expenditure in:

- Victorian DRFA Guideline 3

- Tip Sheet 1 – Relief and Recovery Centres and Temporary Accommodation – Category A.

How can councils seek reimbursement for those costs associated with the use of the recovery hub if used as a relief centre or information centre or as a community recovery hub?

Facilities that opened and operated as a relief or information centre as a result of the current bushfires can be claimed under Category A of the DRFA, with claims lodged in Emergency Recovery Victoria’s claims management system.

Facilities that were called a community recovery hub or information centre which were operating prior to the ‘transition to recovery’ can also be claimed under Category A.

Those community recovery hubs which were called a community recovery hub or information centre which operated after the ‘transition to recovery’, are to can be claimed under Category C Community Recovery program set up. Eligible councils will be provided with the program guidelines when developed.

For more information, refer to the Relief and Recovery Expenditure in:

- Victorian DRFA Guideline 3

- Tip Sheet 1 – Relief and Recovery Centres and Temporary Accommodation – Category A

- January 2026 Victorian bushfires

Can an impacted council claim the expenses related to laying crushed rock in the car park, where they have set up portable showers and hot meals for impacted residents?

As the damage has occurred as a direct result of providing emergency assistance to impacted individuals (via the operation of community hubs and drop-in centres which are acting as relief centres) this is eligible as a counter disaster operation under Category A of the DRFA.

For more information, refer to the:

- Relief and Recovery Expenditure in the Victorian DRFA Guideline 3.

Other assistance packages

What other DRFA assistance packages will be made available?

A State of Disaster has been declared by the Premier on 10 January 2026 for the bushfires which occurred under AGRN 1242 commencing 7 January 2026.

These bushfires are still ongoing and impact assessment are underway.

A $10 million State Clean up Program was announced on 13 January 2026 to support uninsured and underinsured Victorians to remove damaged structures and hazardous materials as well as $5 million towards waiving waste levies in eligible local government areas and fully cover landfill operator gate fees – ensuring all bushfire waste can be disposed of free of charge.

For advice on other assistance packages, please refer to Emergency Recovery Victoria's web page January 2026 Victorian bushfires.

Fallen or damaged trees

How can councils claim contractor costs to manage residential trees that have fallen or are threatening to fall on properties?

Councils are required to provide supporting documentation that can clearly demonstrate how the debris is impacting the household's ability to return to live in their home. Supporting documentation must be provided for each residential property where works are to be undertaken.

Supporting documentation could include:

- photos clearly showing how the debris is impacting the ability for the household to live in their home including access being impeded, that is, the driveway (for significantly impacted local government areas, representative photos across impacted residential properties should be provided that is, 30 out of 100 properties – councils should discuss this with their Department of Transport and planning assessor) or

- contractor invoice(s) that can clearly identify:

- the address of each residential property assisted

- the location of the debris and how it is preventing the impacted household in returning to live in their home.

Where photos or information on the actual property address is not available, documentation could include:

- a bushfire or storm map from the Incident Control Centre, State Control Centre or council outlining where a disaster occurred in the local government area along with other information including but is not limited to:

- representative photos on a sample basis

- evacuation orders

- SES call or incident logs, or

- council customer service requests.

For more information, refer to the Victorian DRFA Guideline 3.

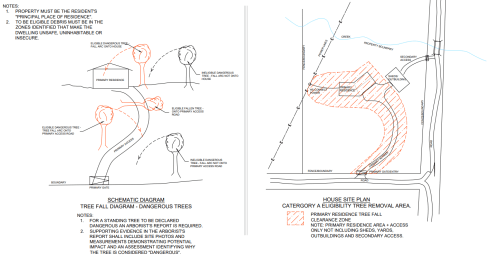

The diagram below shows:

- the residential area that is considered eligible for clean-up activities

- the tree fall arc that shows eligible trees that would impact the primary access and, or primary residence and

- the tree fall arc for ineligible trees that would not impact the primary access or primary residence if it fell.

The above diagram refers to the clean-up works undertaken by the councils.

Disaster-related waste may include:

- green waste

- hazardous materials

- whitegoods

- electrical waste, and

- furnishings.

For further information about assets that are not eligible under the DRFA, please refer to the Emergency Works section in the Victorian DRFA Guideline 3.

What can a council include in their DRFA claim if a gum tree is damaged but has not fallen down?

As the tree is still standing, the council will need to demonstrate that the tree:

- is hazardous as a direct result of the event

- poses an imminent threat of falling on houses, driveways or is impeding direct access.

An arborist assessment and report is required to identify the address, hazard, cause, risk and recommended treatment. Photos of the tree and its likely impact on property if it were to fall should be included.

Once the above requirements are met, council can engage a contractor to remove the trees and seek to claim reimbursement through the DRFA.

For more information, refer to the Victorian DRFA Guideline 3.

What can a council do if there is a tree that has fallen into private land?

Some costs for the removal of debris and temporary repairs to dwellings are eligible under the DRFA, providing the following can be demonstrated.

- Debris and damage are directly impacting the resident's ability to live in their home. For example, debris impeding access to the property.

- Must be the principle place of residence. For example, the property cannot be a holiday house.

- Supporting documentation is provided which demonstrates a link between the event, damage, impact to resident, works undertaken and cost incurred.

- Each residence is treated separately. Photos must be able to show the extent of the damage and the impact is has on the residents' ability to stay in the property.

- Works must be undertaken or engaged by the council.

- Contractor invoice descriptions must support the photo evidence, and be able to sufficiently describe the damage, impact and works undertaken.

The following are not eligible under the DRFA:

- cost to remove debris that has fallen outside the immediate vicinity of the dwelling and are not impeding access.

- damage to fences, sheds, swimming pools and holiday houses.

- claims made against a council.

For more information, refer to the Victorian DRFA Guideline 3.

Can costs related to trees that have fallen on road reserve fence lines be claimed?

Replacement of fencing on a road reserve is not considered an eligible cost under the DRFA.

For more information about the removal of trees please refer to the question below.

For further information about assets that are not eligible under the DRFA, please refer to the Emergency Works section in the Victorian DRFA Guideline 1.

Which bushfire and storm damaged trees on a road are eligible to be included?

Councils can claim costs associated with the removal of trees from eligible roads if:

- the damaged trees are associated with an eligible disaster and a significant portion of the tree is impacting on the function of an essential public asset, and

- the removal of damaged or dangerous trees are to make the essential public asset safe and functional.

Eligible roads include:

- local government owned roads and road infrastructure.

Ineligible roads include:

- roads that are privately owned, managed, or maintained, and

- fire trails or access tracks.

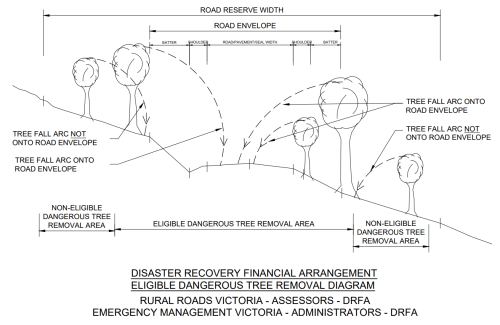

The diagram below shows how a council can determine if a fallen tree is impacting on an essential public asset. The diagram shows:

- the road envelope (which includes the road, shoulders and batter) within the wider road reserve, and

- the tree fall arc, which shows how a non-eligible tree would not impact the road envelope if it fell.

For more information on the types of emergency works, please refer to the Emergency Works section in the Victorian DRFA Guideline 1.

Can a council claim for clearing fire access tracks?

Fire access trails or fire access tracks are ineligible for any type of works under the DRFA.

Please refer to the Definition of Essential Public Assets in Victorian DRFA Guideline 1 for examples of assets that are not eligible.

Removal of debris on impacted residential properties including bushfire and storm waste collection points and landfills

Can councils claim costs associated with bushfire and storm-related waste at fire and storm collection points and landfills?

Councils are able to offer a free fire and storm waste collection point at their local waste centre and claim their costs under Category A (debris on impacted residential properties) and B (debris impacting on essential public assets that is, roads, bridges, culverts) of the DRFA (the net cost of the EPA waste levy and, or gate fee charge waived at these waste collection points) but the council will need to be able to demonstrate that the debris being claimed for are directly associated to the January 2026 Victorian bushfires as opposed to normal collection of household and, or green waste from residents. Councils are able to undertake this under 2 options.

Option 1 (preferred)

Councils need to record the actual address (at minimum street level address) to confirm that the debris came from in an impacted local government. If the local government area (LGA) consists of rural and, or residential properties (larger residential land property sizes), an apportionment exercise needs to be agreed as to the debris collected outside the immediate residential footprint. The percentage outside of the residential footprint is not eligible under Category A of the DRFA.

Debris relating to parks, gardens, recreations clubs, reserves or commercial is not eligible under either Category A or B of the DRFA.

Option 2

If councils have not recorded and, or collected sufficient details at point of disposal, councils will need to work with their Department of Transport and Planning (DTP) assessor to determine an apportionment approach. Apportionment takes into account, normal household debris or other debris coming within the impacted local government area. Councils will need to provide:

- a fire and, or storm map from the Incident Control Centre or State Control Centre or council outlining where the event occurred in the local government area to support the nexus of this activity to the disaster

- the demographic data which illustrates the land use of the area (residential, parks, gardens, reserves and commercial) where the waste collection point collects debris outside of residential areas;

- comparison to green waste collected to the same period in the previous year;

- costs associated the expenditure incurred at the waste centre and, or collection point excluding any indirect costs and margins.

How can councils claim costs associated with the removal of disaster related debris on private properties by the council employees (overtime) and, or council engaged contractors?

Councils are required to provide the following supporting documentation when seeking reimbursement for costs associated with the removal of debris from within the residential footprint of impacted private properties:

- a bushfire and, or storm map from the Incident Control Centre, State Control Centre or council outlining where flooding incurred in the local government area to support the nexus of this activity to the disaster, along with

- contractor invoice(s) that can clearly identify that works were associated with the January 2026 Victorian bushfires (and ideally capturing AGRN 1242 Victorian bushfires commencing 7 January 2026) the date the works occurred, and the location (at a minimum at the street level) where these works occurred. For example, January 2026 debris clean up on Smith Street, Corryong, 8 January 2026. Note: where contract costs relate to a hazardous material clean-up such as asbestos, a hazard inspection report should also be provided.

Where council staff have undertaken the clean-up works, councils should provide approved timesheets, payroll reports, email trails that detail the role and location of the employee undertaking these clean up works relating to the overtime being claimed for that employee.

Should bushfire and, or storm mapping be unavailable, other information can be used including but not limited to the following:

- representative photos on a sample basis

- evacuation orders

- SES call and incident logs, or

- council customer service requests.

Disaster-related waste may include:

- green waste

- hazardous materials

- whitegoods

- electrical waste, and

- furnishings.

For further information about assets that are not eligible under the DRFA, please refer to the Emergency Works section in the Victorian DRFA Guideline 1.

Can a council claim costs associated with a skip placed on an impacted street for residents to place their bushfire or storm debris into?

Yes, councils can seek reimbursement where they choose to provide a skip service on impacted streets so that impacted households can place their disaster debris into. This includes a council engaged contractor undertake the works on private properties, or a council using their existing kerbside contractors to collect the additional disaster-related debris on nature strips.

Councils are required to provide the following supporting documentation when seeking reimbursement for these costs including:

- a bushfire and, or storm map from the Incident Control Centre, State Control Centre or council outlining where a bushfire and, or storm occurred in the local government area to support the nexus of this activity to the disaster, along with

- contractor invoice(s) that can clearly identify that works were associated with the January 2026 Victorian bushfires (and ideally capturing AGRN 1242 Victorian bushfires commencing 7 January 2026) the date the works occurred, and the location (at a minimum at the street level) where these works occurred. For example, January 2026 debris clean up on Smith Street, Corryong, 8 January 2026. Note: where contract costs relate to a hazardous material clean-up such as asbestos, a hazard inspection report should also be provided.

Where councils are using existing their kerbside contractors for additional services to collect disaster-related debris in impacted areas, councils will need to provide the following supporting documentation when seeking reimbursement for these costs:

- a bushfire and, or storm map from the Incident Control Centre, State Control Centre or council outlining where a bushfire and, or storm occurred in the local government area to support the nexus of this activity to the disaster, and

- advice or information on the additional costs of the existing contractor undertaking the kerbside service including the street names that these additional and, or increased services have taken been undertaken on.

Disaster-related waste may include:

- green waste

- hazardous materials

- whitegoods

- electrical waste, and

- furnishings.

For further information about assets that are not eligible under the DRFA, please refer to the Emergency Works section in the Victorian DRFA Guideline 1.

Can a council claim costs associated with undertaking fire suppression activities at the direction of the Incident Control Centre?

In the first instance, councils should liaise with the Incident Control Centre requesting the activity to be undertaken to claim any costs incurred including the clearing of trees and branches which have been pushed away from local roads on to fence lines to assist fire suppression activities. This process is managed directly by the Department of Energy, Environment and Climate Action (DEECA) or the Country Fire Authority (CFA).

Should a council miss the deadline set by DEECA or the CFA, councils can seek reimbursement under Category B Counter Disaster Operations. Councils are requested to refer to:

- Victorian DRFA Guideline 3

- Tip Sheet 5 Counter Disaster Operations Category B May 2024

- How to Guide 2 – Photographic Evidence – July 2024

- How to Guide 2a – Photo.zip folder to be used for photo evidence – July 2024

- How to Guide 2b – QGIS compatible photo report template – July 2024

- How to Guide 2c – How Assessing Authority used QGIS to validate photo information – July 2024

Required DRFA supporting documentation

What supporting documentation will be needed if using contract building surveyors and, or environmental health officers to complete secondary impact assessments?

Invoices provided to councils by contractors will need to clearly state that the work undertaken relates to 'Victorian bushfires commencing 7 January 2026 (AGRN 1242)' and outline that the work is associated with completing damage assessments on private properties.

The claim will need to include:

- the invoices showing which properties were inspected, and

- damage reports for each inspected property with photos showing the link between the damage and the event.

The claim lodgement timeframe has recently moved towards a half yearly cycle.

Invoices for works conducted up until 30 June 2026 will need to be lodged by 31 August 2026 in Emergency Recovery Victoria's claims management system.

For more information on damage assessments please refer to:

• Victorian DRFA Guideline 3

• Tip Sheet 2 – Category A – Removal of debris on residential properties

• How to Guide 2 – Photographic Evidence – July 2024

• How to Guide 2a – Photo.zip folder to be used for photo evidence – July 2024

• How to Guide 2b – QGIS compatible photo report template – July 2024

• How to Guide 2c – How Assessing Authority used QGIS to validate photo information – July 2024

• Category B – Supporting documentation required for emergency works – September 2024

For more information on supporting documentation required for contractors please see refer to:

- Victorian DRFA Guideline 3

- Tip Sheet 2 – Category A – Removal of debris on residential properties.

What pre-condition evidence will a council need to provide?

Pre-disaster condition supporting documentation is required to establish a basis that the damage sustained was a direct result of the bushfires commencing 7 January 2026.

No pre-disaster condition assessment is required when submitting an emergency works claim.

For immediate and reconstruction works the pre-disaster condition of an essential public asset can be demonstrated through one or more of the following means:

- pre-disaster photographic evidence, including details of latitude, longitude and date taken. It is recommended that the latest available data be adopted, but no older than 4 years before the eligible disaster for local government assets.

- if pre-disaster photographic evidence is not available, a pre-disaster asset condition assessment report is required to be provided. This must be conducted or verified by a suitably qualified professional.

- a suitably qualified professional may be defined as a person with undergraduate qualifications and a minimum of 5 year’s experience, and relevant certifications in the appropriate field of work for the asset type, or a person with the appropriate level of expertise and experience within the delivery agency at the director level, for example, director of infrastructure or its equivalent

- this evidence can be supported by other supplementary evidence that may include:

- satellite or aerial imagery that depicts pre-disaster condition of asset prior to being damaged, and

- maintenance records.

For more information, please see Damage Assessments for Essential Public Assets in Victorian DRFA Guideline 1.

What can a council do if the area they are photographing is remote and there is limited GPS capability to capture metadata?

Photographic supporting documentation is required to support a councils DRFA claim and show the extent of the damage to an eligible asset. Ideally a photo or video will include geospatial metadata of longitude, latitude and the date taken, as this is considered the strongest form of evidence to demonstrate post-disaster damage.

If the geospatial metadata cannot be embedded in the photo, the council is to raise this concern with their assessor from the Department of Transport and Planning who can verify the location of the damaged asset during a site visit. Photos will still be required with the location identified. The assessor will verify this location during claim assessment and recommendation.

When taking post-disaster photos, it is important to consider:

- photos should be clear, in colour and must contain geospatial metadata of longitude, latitude and date taken

- close-up photos are encouraged. Close-up photos can be used to demonstrate the disaster damaged components to support the proposed treatment(s).

- the photos should identify the full extent of the damage.

- take photos of the damage at each asset location. Make sure photos are a representation of the event damage sustained. The photos need to show consistent damage and variances in the degree of damage.

What to avoid:

- photos that do not contain geospatial metadata of longitude, latitude and date taken as it is then difficult to ascertain the exact location of the damage (where possible).

- photos taken from inside the car through the windscreen.

- any objects that obscure the view of the damage (for example, structures, vehicles and people).

- photos with glare or dark shadows on the ground. These can obscure the view of the damage.

For more information on photo requirements, please see:

- Damage Assessments for Essential Public Assets in the Victorian DRFA Guideline 1

- How to Guide 2 – Photographic Evidence – July 2024.

Can a council seek reimbursement for costs associated with the purchase of road closure signs if they are unable to be hired?

If equipment such as road closure signs are unable to be hired and are required to be purchased, impacted councils may claim the cost of the purchase as an eligible expense so long as the purchase amount is less than that of the hire cost.

Appropriate evidence would need to be provided to demonstrate this is the most cost effective solution. If the purchase cost is more than the hire cost, the impacted council is able to claim equivalent hire costs for the equipment including operational costs if not covered by the hiring arrangement. If that equipment is issued in subsequent DRFA notified disasters, operating costs (for example, fuel, transportation) will be considered as eligible expenses.

DRFA allowable time limits

What is the process if a council has identified that they are unable to complete emergency or immediate works required within the 3 month time period allowed?

A council will need to discuss with their assigned assessor from Department of Transport and Planning if they are concerned whether the works required will not be completed within the 3 month period post access to the asset.

Step 1

An asset is determined as accessible when:

- the disaster is no longer occurring (for example, flood waters have receded, or a bushfire is out or under control) and the site of the damaged asset can be safely accessed by surveyors, and, or reconstruction workers, or

- the council has capacity to undertake the required restoration works. In this situation, the council must be able to demonstrate that they have made a reasonable attempt to undertake works as soon as the disaster was no longer occurring (as per the point above) but was not able to complete the works because of:

- competing reconstruction priorities associated with a significant program of works caused by a severe disaster or multiple disasters, or

- the unavailability of specialised equipment and, or resources.

Step 2

The council in consultation with their assessor are to complete a request for an extension of time period for Emergency and Immediate Works form 2 weeks prior to the end of the allowable time period in the via the online claims management system.

Step 3

The NDFA team will review the extension of time request and send a request for consideration by the National Emergency Management Agency. The assessor will discuss the outcome with the requesting council.

For more information, please refer to the Emergency Works, Immediate Reconstruction works and Essential Public Assets Reconstruction work in Victorian DRFA Guideline 1.

Other

Can a council organise a specialised pump truck to support residents with maintaining their septic systems that have been impacted during the bushfire event?

Cleaning and refilling residential septic tanks to make them operational, is eligible as a counter disaster operation under Category A of the DRFA, therefore the council can hire or externally contract in resources for this activity.

The purchase of equipment is ineligible under the DRFA. However, where equipment are required to be purchased as they are unable to be hired, and the purchase amount is less than that of the hire cost, impacted councils may claim the cost of the purchase as an eligible expense.

Appropriate evidence would need to be provided to demonstrate this is the most cost effective solution. If the purchase cost is more than the hire cost, the impacted council is able to claim equivalent hire costs for the equipment including operational costs if not covered by the hiring arrangement. If that equipment is issued in subsequent DRFA notified disasters, operating costs (fuel, transportation) will be considered as eligible expenses.

For further information, refer to the Counter Disaster Operations in the Victorian DRFA Guideline 3.

Updated