Definitions

Below is a list of terms which are used throughout this Handbook and their definitions.

| Term | Definition |

| Contract | The standard executive employment contract published by DPC. |

| DPC | Department of Premier and Cabinet. |

| Executive | For the purposes of this Handbook, a person employed in a prescribed public entity under PEER Policy. |

| Employer | The employer of an executive is the relevant public entity head. In the case of a public entity Head, this will generally be the governing Board. This will be clear in the entity’s establishing legislation. |

| PAA | The Public Administration Act 2004, which is the foundational legislation for public sector employment in Victoria. |

| PEER Policy | The Public Entity Executive Remuneration Policy. |

| Prescribed Public Entity | A public entity prescribed under the Victorian Independent Remuneration Tribunal and Improving Parliamentary Standards (Prescribed Public Entities) Regulations 2021. |

| Public entity | Defined under section 5 of the PAA as a body, whether corporate or unincorporated that is established by or under legislation, by the Governor in Council or by a Minister. Excludes Departments, Administrative Offices, special bodies and other bodies as listed under the PAA. |

| Public sector | Comprises the VPS, public entities and special bodies. |

| Public service body | Defined under section 4 of the PAA as a Department, an Administrative Office or the VPSC. |

| Tribunal | Victorian Independent Remuneration Tribunal. |

| TRP | Total remuneration package, comprising of:

|

| VPS | Victorian public service – made up of people employed under Part 3 of the PAA (see definition for public service body above). |

| VPSC | Victorian Public Sector Commission, established under Part 4 of the PAA. |

Introduction

This Handbook is intended to support executives and their employers in interpreting and understanding the contract.

Specifically, the handbook:

- assists public entities to manage employment contracts, remuneration and employment matters relating to executives,

- provides further guidance to executives and public entity employers on executive employment and the Public Entity Executive Remuneration Policy.

- outlines the government’s expectations around executive employment practices, and

- provides direction to other related policies, resources and materials.

Disclaimer

The interpretation of this Handbook depends on an individual’s executive contract. It should be read in conjunction with the PAA, PEER Policy and the executive employment contract. This Handbook does not form part of an executive’s contract. If there is inconsistency between an individual contract and information contained in this document, the contract prevails.

This Handbook is managed by the Department of Premier Cabinet..

Responsible agencies and who to contact

Entities and their portfolio departments provide day-to-day advice and support on executive workforce matters such as remuneration, classification, employment and performance.

On employment related matters, executives should contact the human resources unit, executive employment coordinator or manager within their organisation.

Department of Premier and Cabinet

DPC has primary responsibility for whole of government executive workforce policy, including:

- the standard executive contracts, remuneration and employment policy

- the Premier's annual remuneration adjustment guideline rate

- the Public Entity Executive Remuneration Policy

- the Executive Motor Vehicle Scheme.

Victorian Independent Remuneration Tribunal

The Tribunal is responsible for setting the values of the remuneration bands for executives employed in VPS bodies and prescribed public entities and for making Guidelines relating to the placement of executives within the remuneration bands.

The Tribunal also:

- advises on proposals to pay an executive above their relevant remuneration band

- conducts reviews and publishes reports on remuneration trends in the public sector

- determines salaries and allowances for local government Councillors and Members of Parliament.

The Victorian Public Sector Commission

The VPSC supports the public sector and its employees by:

- strengthening the efficiency, effectiveness and capability of the public sector in order to meet existing and emerging needs and deliver high quality services, and

- maintaining, and advocating for, public sector professionalism and integrity.

The VPSC has published materials specifically in relation to executive employment, including:

- VPS executive classification framework sets out the work value methodology for assessing and classifying executive positions into one of three bands, using tailored work value assessments.

- VPS executive performance management handbook provides the foundational principles that shape and drive executive performance and behaviours.

- Managing separation risks of VPS executives provides a guide for employers to manage separation risks with VPS executives.

Executive employment resources

The following links provide resources that support this Handbook and the key stages of employment.

Pre-employment

- VicFleet Services – Manages operation and procurement of executive vehicles

- Executive vehicle cost to package calculator – Tool to determine the total cost of packaging a vehicle into a remuneration package

- Standard contract for public entity executives – Template setting out mandatory terms and conditions for executive employment

- Conflict of interest – Guidance on managing and declaring conflicts

- Public sector values – Overview of the core values guiding behaviour and decision-making in the Victorian Public Service

- Pre-employment and misconduct screening – Processes for background and probity checks before appointment

- Code of conduct for Victorian public sector employees – Expected standards of behaviour and integrity obligations for all staff

- Public entity executive classification framework – Explains how executive roles are classified and remunerated

- Victorian public entity executive employment – Practical guidance on recruitment, management, and termination of executives

- Victorian Independent Remuneration Tribunal – Provides determinations on remuneration, allowances and benefits for public sector Executives

During employment

- Flexible work policy – Sets out the VPS approach to flexible work arrangements

- The Victorian Government Professional Lobbyist Code of Conduct – Rules governing interactions between lobbyists and public officials

- Gifts, benefits and hospitality – Guidance on declaring, refusing, and managing offers of gifts or hospitality

- Diverse and inclusive teams – Strategies and expectations for building inclusive, fair, and equitable workplaces

- Remuneration bands for executives employed in prescribed public entities – Outlines remuneration bands for public entity executive classifications

- Annual remuneration changes – Outlines the annual guideline rate and remuneration band changes

- Public entity executive remuneration policy – Policy outlining how executive pay is determined and administered across the VPS

- Proposals to pay a public sector executive above the remuneration band – Requirements and approval process for exceeding top of remuneration band

- 2025 Capability Development Statement - Defines the core skills and capabilities expected of public sector leaders. While the statement applies to the VPS, it is a useful resource for all public sector staff

Post employment

- Managing separation risks of VPS executives – A guide for employers to manage separation risks with VPS executives

Public entity executives

A public entity executive is a senior public official employed by the board or CEO of a public entity in accordance with the PEER policy and PAA

Summary

- the standard public entity executive employment contract should be used as a model contract in employment.

- public entity executives are public sector employees under the PAA and must comply with the Public Sector Values and the relevant Code of conduct under the PAA, including related internal policies

- public entity executives are classified into bands according to their work value under a standard framework.

Who are public entity executives?

The two primary cohorts of executives employed in the Victorian public sector are:

- public entity executives - employed under their entity’s establishing legislation. Their employment framework is the Public Entity Executive Remuneration (PEER) Policy.

- VPS executives - VPS executives are senior public officials employed by public bodies exercising VPS employment powers (i.e. under, or with reference to Part 3 of the PAA). They are employed in departments, administrative offices, the VPSC and other public bodies. The heads of these bodies may also be VPS executives. A reference to executive in this Handbook includes this cohort.

If there is uncertainty, the VPSC’s website lists public sector bodies by their employment type.

Values and conduct

Public entity executives, like all public sector employees, should demonstrate and promote the public sector values (values) and comply with the relevant Code of conduct (Codes).

Further information on the values and Codes, including supporting guidance, is available on the VPSC’s website.

Public sector values

Public entity executives should familiarise themselves and act in accordance with the following values, which are listed in section 7 of the PAA:

The values underpin the behaviours expected of all public sector employees.

As senior leaders, executives are responsible for making significant decisions, managing budgets and overseeing critical functions of government. Executives play a key role in setting culture across their organisation. An executive’s conduct directly influences workplace standards, expectations and the broader public sector reputation.

Codes of conduct

The VPSC has issued the following Codes of conduct:

- Code of conduct for Victorian public sector employees

- Code of conduct for Victorian public sector employees of special bodies

- Code of conduct for directors of Victorian public entities

- The Victorian Government Professional Lobbyist Code of Conduct, which includes obligations applying to executives when interacting with lobbyists (see also the post-employment obligations section).

Executives should review the relevant Codes to ensure they are aware of their obligations. The relevant Code binds executives and any contravention may constitute misconduct under the contract and may result in disciplinary action.

Public sector body heads

Public sector body heads, who are themselves executives, will have additional obligations under the PAA such as promoting the values to their employees and promoting an organisation-level statement of values.

Public sector body heads are responsible for establishing employment processes which adhere to the public sector employment principles under section 8 of the PAA. They must also ensure to inform employees about the application of those principles and standards issued by the VPSC.

Employment principles and standards

Public sector employers must make sure their hiring and employment practices follow the public sector employment principles and any mandatory standards issued by the VPSC. These principles and standards help create fair, respectful and inclusive workplaces across the public sector.

They set clear expectations for how employees should be treated—ensuring fairness, equal opportunity, and support for career development. They also help build a positive work environment where staff feel safe to raise concerns and are supported to grow professionally. These principles are outlined in section 8 of the PAA and include:

- employment decisions are based on merit; and

- public sector employees are treated fairly and reasonably; and

- equal employment opportunity is provided; and

- human rights as set out in the Charter of Human Rights and Responsibilities are upheld; and

- public sector employees have a reasonable avenue of redress against unfair or unreasonable treatment; and

- in the case of public service bodies, the development of a career public service is fostered.

The VPSC has issued binding standards on the application of the employment principles. They identify the essential concepts that must be incorporated in an organisation’s employment processes to ensure that the employment principles apply at work.

Integrity

Public entity executives are required to disclose any conflicts of interest upon and during employment, and to comply with integrity policies set by government. The standard contract emphasises that executives comply with all legal requirements, statutory or otherwise, pertaining to responsibilities as an executive. This includes applicable standards, Codes and policies, as may be in place and apply from time to time.

Disciplinary action consistent with the relevant industrial instrument and legislation, including dismissal, may be taken where an employee fails to adhere to integrity policies.

Conflicts of interest

In line with the Codes, when executives are performing public duties, private interests must not influence decisions, nor allow a perception that they have influenced decisions. Personal interests can change over time as personal circumstances change. Conflicts of interest must be continually declared and managed, or avoided.

Executives must disclose their interests and take reasonable steps to identify and manage a conflict, or a perceived conflict, of interest. All executives are required to complete a Declaration and Management of Private Interests Form upon appointment (prior to their contract being entered into) and annually after appointment or within five working days after a change in circumstances (i.e. to any part of information that an executive has previously disclosed in their form, for example, change of residence). Conflicts of interest should be declared using the organisation’s Declaration and Management of Private Interests Form.

Gifts, benefits and hospitality

Executives must identify, declare and manage a conflict of interest which may arise related to gifts, benefits and hospitality.

The VPSC has issued a Gifts, Benefits and Hospitality Policy Guide and minimum accountabilities for public sector employees.

The VPSC has issued policies on:

Classification

All public entity executive roles must be classified in line with the VPSC’s Public entity executive classification framework (PEECF). The PEECF sets out the work value methodology for assessing and classifying executive positions into bands, using tailored work value assessments. This is essential to ensure that executive roles are classified objectively and consistently.

The last row shows the remuneration band that applies to Chief Executive Officers (or similar positions) whose positions have been assessed using the PEECF and do not meet the minimum work value score required for their classification to be determined (21 points).

The classification bands are:

- Public Entity Senior Executive Service Band 1

- Public Entity Senior Executive Service Band 2

- Public Entity Senior Executive Service Band 3

- Chief executive officer with a work value score below 21 points

Ways of working

The contract requires executives to work the hours necessary to perform their duties and responsibilities. This may require working additional hours, including on weekends and public holidays. An executive’s remuneration recognises this. See the section on Hours and place of work.

As a matter of best practice, employers should support and encourage work-life balance.

Executives may enter into flexible working arrangements, including hybrid working, flexible start and finish times, working part-time, job sharing, etc. Executives can negotiate with their employer their working hours to fit with their other commitments, balanced against the business needs and demands of the role.

Processes will differ from organisation to organisation, but the goal should be to reach an outcome in which an individual’s needs for flexibility are met, consistent with business requirements, industrial instruments and legislative requirements.

Capability development

There is an expectation that public sector employees will continue to learn, develop and grow in their role. This expectation is emphasised for executives, recognising the critical impact of senior leaders on culture and performance. This may be embedded in an executive’s performance plan.

Each employer will have their own approach to leadership development and executives should contact their employer or human resources unit directly.

Support programs available

Executives can access support programs through the Employee Assistance Program (EAP). The EAP is a personal coaching and counselling service that offers confidential, short-term support for a variety of work-related and personal issues that may be affecting an executive at work or at home.

A qualified advisor from the EAP can talk with the executive or a member of the executive’s immediate family over the phone or arrange a face-to-face consultation.

Safe and respectful ways of working

Employers must take proactive steps to provide an inclusive, safe and respectful workplace culture, and have a zero-tolerance approach with respect to sexual harassment.

Executives must adhere to all relevant legislative requirements and obligations in their conduct and decision-making, including:

- Equal Opportunity Act 2010 – the employer has a positive duty to take reasonable and proportionate measures to eliminate discrimination, sexual harassment, and victimisation, as far as possible.

- Gender Equality Act 2020 – requires public sector bodies to take positive action towards workplace gender equality, including preparing Gender Equality Action Plans and reporting progress.

- Charter of Human Rights and Responsibilities Act 2006 – outlines civil, political and cultural rights that must be respected and upheld in public sector decision-making.

Employers and executives should familiarise themselves with the VPSC’s guidance on:

The contract

The public entity standard executive contract sets out the terms and conditions of employment in writing.

Context

While the use of the contract is not mandatory, it is strongly encouraged to ensure consistency with government policies. The contract has been drafted with clauses in bold reflecting core terms and conditions which are mandated by the PEER policy.

The standard contract consists of:

- the body, which includes the standard terms and conditions which apply to all VPS executives

- four schedules, which are tailored to an executive’s role and employment, including:

- Schedule A: the position, duties and workplace location

- Schedule B: the remuneration package

- Schedule C: superannuation

- Schedule D: detailed leave provisions

Executive contracts for executives employed in public entities are required to include the following mandatory contractual terms and conditions under the PEER Policy:

- contract of employment to be offered for a maximum term of up to five years

- TRP includes base salary, superannuation contributions, employment benefits (i.e. non-salary) and the annual cost to the employer of providing the non-monetary benefits, including any fringe benefits tax payable

- termination of contract provisions – the employer may terminate a contract by providing the executive with four months’ notice in writing

- no compensation for termination of a contract beyond payment in lieu of notice and accrued leave

- an unexpired portion of a contract may only be paid out in exceptional circumstances, with the written consent of the relevant department Secretary capped bonus opportunity for executives employed on or before 3 February 2020 (see below).

Victorian public entities executive contract

About the contract

Entire agreement

The contract constitutes the entire agreement between the parties. This Handbook does not create any additional legal rights or obligations. The contract prevails to the extent of any inconsistencies.

The contract is signed by the employer and executive. Only an individual can enter into an employment contract. An executive cannot be paid via a private company.

Variations

The contract may be varied at any time upon written agreement between the executive and employer. Variations may be made to reflect minor to moderate changes to an existing role’s duties and responsibilities, or the executive’s remuneration or other entitlements.

In the event of more significant changes, parties may instead agree to enter into a new contract.

Contract length

The term length of an executive contract is limited to five years under the PEER Policy.

Parties may renew or extend the contract. Although there is no limit on the number of extensions, each total contract length must not exceed 5 years.

Renewals

The renewal of a contract should be decided before the existing contract expires.

Under clause 14 of the contract, an executive should be consulted at least 6 months before expiry (or 3 months if the contract length is one year or less), and the renewal decision must be made no later than 4 months before expiry (2 months if the contract length is one year or less). While the contract does not make these requirements mandatory, it is expected that employers will have processes in place to ensure these timeframes are met. They should only be departed from in exceptional circumstances.

There is no limit to the number of times an employer and an executive can renew a contract.

There is no probation period under the contract.

Interaction with the Fair Work Act 2009

The Fair Work (Commonwealth Powers) Act 2009 (Vic) excludes VPS executives and persons “employed at higher managerial levels in the public sector” from the referral of industrial relations powers to the Commonwealth. The Commonwealth does not have the power to make laws with respect to the employment of this cohort, which may include public entity executives, and they are generally not subject to requirements under the Fair Work Act 2009 (FW Act).

To encourage mobility between executive and non-executive roles, many of the terms and conditions which apply to non-executive public entity employees by virtue of their coverage under the FW Act should be applied to executives under the contract.

Duties and obligations

An executive’s duties and obligations are outlined in the contract.

The more general requirements within clauses 3 and 4 of the contract apply to all executives, while Schedule A lists the duties specific to the role.

While individuals will bring different skills and experiences to an executive role, to the duties in the contract capture the role objectively, rather than reflect the individual candidate.

In practice, the specifics of a role caThe more general requirements within clauses 3 and 4 of the contract apply to all executives, while Schedule A lists the duties specific to the role.n change over time. It is good practice to update the contract to ensure expectations are clear and aligned.

Duties and responsibilities in Schedule A of the contract

Schedule A should clearly describe the duties and responsibilities the executive will be required to perform during their employment in the role. The contract should also be clear about the role to whom the executive reports. This forms the basis of expectations for the life of the contract, unless varied. Duties will also inform performance planning and reviewing. This should typically reflect the advertised position description.

Employers should also consider including duties which emphasise and promote objectives and priorities of the government and employer. This may include:

- sound financial management

- promoting equality and diversity

- commitment to fostering a professional and high-performing public service.

For some roles, it may be appropriate to include any relevant or required qualifications or registrations.

Failure to comply or acting inconsistently with the role’s duties and responsibilities, or failing to fulfil those duties to the requisite standard, may give rise to termination for performance or conduct reasons under the contract.

Universal requirements for executives

Standards of conduct, conflicts of interest and general responsibilities

The contract outlines an executive’s core requirements. These requirements are drafted generically as they apply equally to all executives.

Failure to comply or acting inconsistently with any of the requirements in this provision may be considered misconduct, giving rise to termination under the contract.

Executive warranties

At the time of signing the contract, an executive confirms they have disclosed any conflicts of interest, are not in breach of any legal obligations and have provided accurate information as to their qualifications, skills, experience, and employment history.

A breach of these warranties constitutes serious misconduct, which may give rise to summary termination under the contract.

Travel for work

Depending on the requirements of their role, executives may be required to travel for work. The contract confirms there is no entitlement for an executive to additional remuneration for travel. However, an executive is entitled to reasonable reimbursements, subject to appropriate authority, provision of evidence and any relevant policies.

Relocation

The contract does not include a standard provision for executives relocating from another city, state or country for their employment.

The government’s relocation policy is provided at Appendix A to this Handbook.

Relocation costs may be considered at the start and conclusion of an executive’s appointment and should be negotiated and agreed before a contract is signed. These terms should be appropriately documented, either in the contract or letter of offer.

There is no obligation on the employer to pay an executive’s relocation costs at the conclusion of a contract where this was not negotiated as part of the original contract.

An executive who is temporarily required to live away from home may receive an allowance that reimburses additional costs incurred. This arrangement would be for a short-term assignment and the allowance must be negotiated between the executive and employer. Reimbursements may be subject to FBT, which must be included in the executive’s TRP.

Hours and place of work

An executive’s remuneration under the contract compensates for the hours necessary to perform their duties and responsibilities. On occasion, this may require the executive to work outside of normal business hours, including on weekends and public holidays.

Executives are not eligible for overtime payments. Any arrangements for time-in-lieu are at the employer’s discretion.

The right to disconnect under the FW Act, which applies to non-executive public entity staff may not apply to executives.

Subject to the Employer’s reasonable request, executives are entitled to be absent from work on public holidays without deduction of pay.

Under the contract, an employer may agree to substitute a holiday in place of Australia Day or to observe religious or cultural occasions or like reasons.

Training

An employer may provide a lawful and reasonable direction to an executive to undertake training relevant to their role. This may be incorporated into an executive’s performance planning process.

Refusing to carry out an employer’s lawful and reasonable instruction may be considered misconduct or serious misconduct.

Qualifications and certifications

Depending on the nature of an executive’s role, the employer may direct an executive to obtain and/or maintain certain qualifications and certifications that are relevant to their duties and responsibilities. This may include professional registrations and supervised practice.

As with other general responsibilities under the employment contract, the employer can terminate the contract if there is a serious failure by the executive to comply with such a direction.

Outside employment

Public entity executives should seek prior approval from their employer before undertaking any secondary or outside employment. Any secondary work must not create a conflict of interest or interfere with the performance of official duties.

Post-employment obligations

Restraint of trade

The executive contract does not include a standard restraint of trade clause.

A restraint of trade is a clause in an executive’s contract that prevents them from performing work for particular employers outside the Victorian public sector for a period of time after their employment ends. For certain executive roles, the employer may wish to consider including an appropriately drafted restraint of trade clause in the executive’s contract prior to entry into the contract.

Restraint of trade clauses can only be used in limited circumstances and should be informed by legal advice. Before deciding whether to include a restraint of trade clause in an executive’s contract, the employer should consider whether this is appropriate in the circumstances. Some of the relevant considerations include:

- the seniority of the role including whether the role involves access to sensitive information that could provide an unfair advantage

- whether the role includes significant interaction with private sector clients or contractors, and

- whether the role involves negotiating commercial agreements.

The duration, area and nature of activities restrained will need to be carefully considered. Both the employer and executive should seek, and keep a record of, legal advice before including a restraint of trade clause.

Lobbying

The following obligations apply to executives in the public sector:

- executives must not knowingly and intentionally be party to lobbying activities by a lobbyist or government affairs director who is not listed on the Victorian Register of Lobbyists and Government Affairs Directors.

- when first contacted by a lobbyist, executives should ensure they are informed of which clients the lobbyist is representing, the nature of the clients’ issues, and whether the clients are involved in a government tender process.

- executives must not be party to lobbying activities when they are involved in a government tender process.

- executives must not, for a period of 12 months after they cease their employment, engage in lobbying activities relating to any matter with which they had official dealing in their last 12 months of employment.

The VPSC has issued a Code of conduct for lobbying.

Intellectual property

Ownership of any intellectual property generated by an executive in the course of their employment vests in the State of Victoria regardless of whether or not the intellectual property is created during work hours, on work premises or using the employer’s equipment.

Confidentiality

Confidential information obtained by an executive during their employment must not be used for personal gain or to advantage a prospective employer or business, or disadvantage the Victorian Government. It must be handled in accordance with the contract and any applicable legislation.

Confidential information is extensively defined in the contract. In the event of any uncertainty, all information should be considered by the executive to be confidential and treated as such.

On termination, the executive must ensure all confidential information is returned to their employer. This includes any property of the employer. If an executive has worked on a personal device, an employer may request reasonable access to this device to ensure any confidential information has been removed.

Improper use of official information may be considered misconduct under the contract.

Remuneration and other benefits

Setting remuneration

Remuneration is agreed between the employer and executive at the time of appointment.

Schedule C of the contract provides a breakdown of an executive’s remuneration, and includes:

- base salary

- employment benefits (i.e. non-salary benefits) – full cost of any benefits is met by the executive;

- the annual cost to the Employer of providing the non-monetary benefits, including any fringe benefits tax payable

- employer superannuation contributions.

An executive may request at any time to re-structure their remuneration, but it cannot be retrospective.

An executive’s remuneration must not be be conditional on their performance.

The Tribunal determines the remuneration bands for executives in VPS bodies and in prescribed public entities.

Under section 25(4) of the PAA, an executive’s remuneration must be within their relevant remuneration band, unless the employer has obtained advice from the Tribunal. The Public Entity Executive Remuneration Policy similarly requires executives employed in prescribed public entities be remunerated within their relevant remuneration band. An executive’s remuneration band is determined with reference to the relevant classification framework.

Executive roles will typically be advertised with a remuneration range. Actual remuneration for the role is subject to negotiation ahead of the executive’s appointment.

The Tribunal has published guidelines for the placement of executives within their relevant remuneration band. This includes a set of overarching guiding principles and factors an employer should consider when setting remuneration.

When negotiating remuneration, some research indicates asking employees about their previous salary during the recruitment process can reinforce gender pay gaps from previous employers. Employers should consider gender equality when setting remuneration, consistent with the Tribunal’s guidelines and guidance from the Public Sector Gender Equality Commissioner

Salary

Salary is the component of an executive’s remuneration which is sometimes referred to as take-home pay. Any post-tax deductibles, including post-tax employee superannuation contributions are considered salary.

Other non-salary benefits and associated costs

Executives may include non-salary benefits as part of their remuneration. Items that may be salary sacrificed as non-salary benefits include:

- contributions made towards a motor vehicle accessed through the Executive Vehicle Scheme or Novated Leasing Arrangement;

- salary sacrificed superannuation arrangements.

Non-salary benefits may attract fringe benefits tax. While FBT is payable by the employer, any FBT payable will be factored into the executive’s remuneration.

Executives should seek independent financial advice to assist with their decision making. The ATO publishes useful material on FBT, including rulings and handbooks detailing salary sacrifice items and FBT status.

Employers must:

- keep records of FBT liability;

- complete and lodge an annual FBT return with ATO by 21 May each year; and

- provide executives with a payment summary of the total taxable value of the fringe benefits received in an FBT year exceeding $2,000 (from 1 July 2007). The ATO uses the payment summary in income tests for a number of government benefits, e.g. Medicare Levy.

The conditions for an effective salary sacrifice arrangement have been decided by ATO rulings and policy. Executives are strongly advised to obtain independent financial advice before entering a salary sacrifice arrangement. Employers accept no liability for an executive’s decision to request a salary sacrifice arrangement.

Visit the Australian Taxation Office for more information.

Superannuation

Employers are required to make superannuation contributions in accordance with Commonwealth law.

It is strongly recommended that executives seek financial advice before making decisions relating to superannuation.

Executives joining the public sector, or who are already a member of superannuation fund, must ensure their scheme is a complying superannuation fund or choose a complying superannuation fund to which employer contributions can be paid. A complying fund is one that meets certain regulatory requirements listed on the Australian Prudential Regulation Authority’s website (see below).

Executives are required to provide the necessary documentation to their employer to prove their fund is a complying fund if a fund other than the default fund is chosen by an individual. Most funds provide this proof by way of a ‘complying fund status’ letter which can be accessed on their website.

When commencing a new contract, executives must nominate a super fund for their employer to make contributions.

The contract distinguishes between the two main types of superannuation funds: accumulation and defined benefits (or statutory superannuation) schemes.

APRA register of superannuation institutions

Accumulation fund

An accumulation fund is a lump sum fund where the investment of the individual and earnings on that investment determine the outcome for the individual on retirement. The employer contribution required under the Superannuation Guarantee (Administration) Act 1992 (Cth) is made into the accumulation fund.

An employer’s contribution is calculated on the basis of a notion of salary called “ordinary time earnings” in accordance with the Superannuation Guarantee (Administration) Act 1992 (Cth). This is multiplied by the superannuation guarantee rate of 12 per cent (from 1 July 2025).

An employer is required to make contributions up to the maximum super contribution base (MSCB), as determined by the ATO and indexed yearly. Under the contract, employers must bear the cost of any changes to the superannuation guarantee rate or the MSCB without any impact to base salary.

Employers do not need to seek the Tribunal’s advice to increase an executive’s superannuation benefits to comply with the Superannuation Guarantee (Administration) Act 1992 (Cth) if this results in the executive being paid above the relevant remuneration band.

Defined benefits fund

A defined benefits fund provides a benefit by way of lump sum, pension, or a combination of the two. These schemes are established by legislation and have a prescribed level of contribution.

A member of a statutory superannuation scheme, as defined in section 3 of the Superannuation (Public Sector) Act 1992 (Cth), who is about to enter an executive contract, must elect to either continue or cease to be a member of that scheme. An executive should carefully consider their decision because once a choice has been made to cease membership of a statutory superannuation scheme that decision cannot be reversed. The choice to remain in a statutory superannuation scheme may be changed prospectively at any time in the future.

Employers and executives are required to make employer and employee superannuation contributions if they are under a defined benefits scheme.

These schemes include the Emergency Services Superannuation Scheme (ESSS), Revised Scheme, New Scheme, Transport Scheme and the State Employment Retirement Benefits Scheme. Most of these schemes closed to new members in the 1990s and 2000s. Only the ESSS is open to new membership (for operational emergency services workers).

Under the Superannuation (Public Sector) Act 1992 (Vic), superable salary for the purposes of a defined benefits scheme is:

- 70 per cent of the total remuneration package

- the pre-contract superable salary, if that salary is higher.

Where an executive has elected to remain in a defined benefits scheme, membership of that scheme ceases on cessation of employment. The nature of any payment from the superannuation fund will be determined by the fund in accordance with the Superannuation (Public Sector) Act 1992 and will depend on the reasons for the cessation of employment.

Employee contributions

Employees may make additional contributions to their fund either before tax (which can include through a salary sacrifice arrangement or concessional contribution) or after tax as a personal contribution (also called a ‘non-concessional contribution’). This can occur through regular deductions or as a lump sum contribution.

Employees who are members of accumulation schemes may contribute additional voluntary contributions (whether concessional or non-concessional) subject to the rules of the relevant fund.

Limits apply with respect to concessional and non-concessional contributions. If contributions are made above these limits, additional tax may apply. Please check with your super scheme or the ATO website.

Employee contributions to defined benefits schemes are defined in the State Superannuation Act 1988.

Temporary changes to remuneration

Where an assignment is for a period of more than 12 months, the higher level of remuneration may be included in salary for superannuation purposes in a defined benefit scheme and also will constitute “ordinary time earnings” for Superannuation Guarantee purposes for members of accumulation funds.

Superannuation contributions during periods of parental leave

Superannuation payments will be made with respect to a period of Primary Caregiver Parental Leave to 104 weeks. The superannuation contribution amount paid will be the applicable contribution rate under the Superannuation Guarantee (Administration) Act 1992 (Cth) at the time the payment is made, on “ordinary time earnings”.

The employer will pay the superannuation contribution as a lump sum to the executive’s superannuation fund on or before the first superannuation guarantee quarterly payment due date following the executive’s return to work at the conclusion of their Primary Caregiver parental leave.

Reviewing remuneration and adjusting salary

An executive’s remuneration can be reviewed annually or, if an employer agrees, at any time requested in writing by the executive.

An employer must notify the executive in writing if there are any changes to base salary or employment benefits. The executive does not need to be separately notified for changes to superannuation.

A review does not guarantee an increase in any element of an executive’s remuneration.

Annual reviews

Employers are required under the contract to review an executive’s remuneration on an annual basis.

The annual remuneration adjustment guideline rate

The Premier determines an annual remuneration adjustment guideline rate for executives. Employers may increase an executive’s salary component (including any non-monetary benefits and/or fringe benefits tax payable) by an amount up to the guideline rate.

The guideline rate applies from 1 July of the relevant year. The annual adjustment may be made at any time during the 12-month period to 30 June of the current year, but not backdated prior to 1 July of the previous year.

An executive absent on paid or unpaid Primary Caregiver parental leave is also eligible to have any guideline rate issued during the first 52 weeks of their absence applied to their salary.

Employers are not to offset the cost of changes to superannuation by passing on less of the annual adjustment to an individual executive than they otherwise would have.

Employers may choose to pass on the guideline rate to executives on secondments and higher duties arrangements.

Employers may determine not to pass on the guideline rate if the executive was appointed to the role within six months of the date the guideline rate takes effect, or if an executive has recently received a separate remuneration increase. An executive’s remuneration may be increased up to the amount of the guideline rate for the relevant financial year. Employers are not required to pass on the guideline rate, and any increase to remuneration is subject to the employer's discretion.

Changes to the remuneration bands set by the Tribunal

The Tribunal sets the value of remuneration bands for executives. The Tribunal regularly reviews the bands and publishes them on its website.

An executive must not be remunerated below the base of their relevant remuneration band.

An executive whose remuneration drops below the base of their relevant band following a Determination made by the Tribunal must have their remuneration increased to the base of the new band in accordance with section 25(4)(a) of the PAA.

These requirements apply even if an executive's remuneration was increased following the application of the guideline rate. It is never permissible to pay an executive below the minimum of their relevant remuneration band.

Employers are responsible for implementing required changes to an executive's remuneration due to a change in the remuneration bands. Any changes in remuneration due to the Tribunal's Determinations must be consistent with the Determination's effective date, which may require backdating changes. Employers should implement any changes in a timely manner.

Ad hoc reviews

An employer may agree to review remuneration at any time as requested by an executive. This may be to acknowledge changes in responsibility, accountability or for retention purposes.

If a review results in an increase to base salary or employment benefits (including as a result of a change in the annual cost to the employer of providing the non-monetary benefits), the executive must be notified in writing.

If an executive’s responsibilities significantly change, the employer should consider undertaking a new work value assessment of the role. The outcome of the work value assessment will determine whether the role should be reclassified.

Payment above the band

If an employer proposes to pay an executive above the maximum of their relevant remuneration band, it is required by law to seek and consider the Tribunal’s advice. This is required under section 37 of the Victorian Independent Remuneration Tribunal and Improving Parliamentary Standards Act 2019 (Vic). This includes any remuneration proposal for a new appointment, reappointment or a mid-contract remuneration adjustment.

There are occasions when the Tribunal’s advice may not be required, such as when passing on mandatory superannuation increases.

Further guidance on seeking the Tribunal’s advice

Vehicles

An executive may access a vehicle as part of their remuneration package through either:

- the Executive Motor Vehicle Scheme or

- entering into a novated leasing arrangement.

Executive Motor Vehicle Scheme

An executive may elect to salary sacrifice for a motor vehicle benefit in accordance with the Executive Motor Vehicle Scheme.

An executive may choose a vehicle from a list of approved vehicles published by VicFleet for business and private use. The scheme is based on sharing costs between the executive and employer.

The cost of the motor vehicle to the executive’s total remuneration package is calculated using a formula based on whole of fleet costs. Employers must use the cost-to-package calculator to determine an executive’s contributions.

Novated leasing

Executives, as with non-executives, may select to enter into a novated lease for the private use of a vehicle.

This arrangement is entered into with the agreement of the employer. The vehicle is arranged through a finance company and the employer facilitates the payments through a salary sacrificing arrangement. The executive bears all costs of the vehicle. If the executive’s employment ends, the arrangement continues between them and the finance company.

Executives should refer to their employer for further information.

Health check

Contracts may hold an entitlement to receive a reimbursement of $1,000 (inclusive of FBT payable) for an annual medical check to review their overall health and fitness for work. An employer may agree to rollover this amount.

This is not considered part of an executive’s remuneration.

An employer may also require an executive to undergo a medical examination to ensure the executive is able to perform duties set out in the contract. This is at the employer’s expense.

Higher duties allowance

The employer may pay a higher duties allowance for a temporary assignment that is at a higher band level. If the employer wishes to pay an allowance, the employer will determine an appropriate remuneration level for the period of the temporary assignment, in accordance with the employer’s higher duties policy.

Leave

Leave entitlements under the contract

An executive’s leave entitlements are detailed in Schedule D of the contract.

Leave entitlements under the contract will generally align with the minimum requirements under the National Employment Standards.

Employers should rewrite leave provisions to ensure consistency with the Employer’s policies and industry standards and promote mobility between executive and non-executive staff, reflecting additional requirements for eligibility and other conditions. Entitlements may be generally with industrial instruments, but may need to be structured differently.

Some entitlements may vary to reflect the nature of contract employment and executive duties.

Executives are not entitled to annual leave loading.

Other leave entitlements under policy

Under clause 10.2 of the contract, an executive may access forms of leave under the employer’s policies, at the employer’s discretion. If an executive accesses a more favourable leave entitlement under policy, they cannot separately access that entitlement under the contract (i.e. double-dipping).

Frequent queries

Long service leave

An executive is entitled to long service leave in accordance with the provisions of the Long Service Leave Act 2018.

Accident compensation leave

The employer will pay the difference between compensation benefits under the Workplace Injury Rehabilitation and Compensation Act 2013 (Vic) and the executive’s remuneration package, minus the superannuation component of that remuneration package. Superannuation is not payable whilst on accident compensation leave.

Transferability of leave

An executive’s previous and future employer may agree to transfer leave entitlements. Such agreement should be clearly documented.

Performance management, grievances and disputes

The contract covers a high-level framework for performance management, grievance and dispute resolution. This approach may be supported by an employer’s policies and processes.

Performance management

Performance plan

The contract requires the employer to determine an annual performance plan, in consultation with the executive, within three months of appointment. The employer and executive share responsibility for ongoing performance monitoring and development, with the plan reviewed annually.

A performance plan must include outcomes and expectations aligned with the Employer's priorities, public sector values and leadership capabilities. An executive’s expectations should be clearly articulated and their performance able to be measured.

At a minimum, the performance plan should appropriately reflect the executive’s duties and responsibilities under the contract.

An executive’s performance must be measured against objective criteria. Employers should ensure they take all reasonable steps to remove any unconscious bias from performance conversations.

Performance review

An executive’s performance is reviewed and assessed under the performance management framework. Performance reviews should occur regularly. An employer can determine the frequency of formal reviews to best suit their operating environment.

The outcomes of a performance review may inform the content of the next performance plan and also the executive’s duties and responsibilities under the contract.

Where the performance of an executive is considered as requiring improvement, it is both the executive’s and the employer’s responsibility to:

- identify the cause(s)

- design a development plan with measurable performance standards – both the executive and employer should agree to this plan

- monitor improvement – the monitoring period should be between one and three months.

If the executive’s performance does not improve after the second review period, this may be considered as a basis for terminating the executive’s contract.

How to manage your CEO's performance

Executive Performance Management Framework*

* although this is intended for VPS executives, public entities may use this as a guide.

Grievances and disputes

Grievances or disputes that arise out of the contract may be resolved by following the procedure in the contract. This procedure requires parties to a dispute to undertake best efforts to reach a mutually satisfactory resolution in a timely manner. Work will continue with no party prejudiced by this.

Discussions must first occur between the executive and their immediate supervisor. The executive may then escalate the matter to the next reporting level.

If the parties have been unable to reach a resolution, the executive may choose to formally raise it with the employer. The employer then has 14 days to nominate someone who will conduct a further investigation, be involved in discussions and make a recommendation to the employer. The contract requires this nominated person must not have been previously involved in the dispute. The employer’s final decision is binding on all parties.

Suspension

An employer may suspend an executive (with no impact on remuneration) at any time during their employment. This can include amending the executive’s duties, restricting professional contact and/or exclusion from the Employer’s premises. This may be appropriate while an employer investigates a potential disciplinary issue.

End of employment

An executive’s employment may end in different circumstances.

Termination by the executive

An executive may terminate their employment at any time by providing four weeks’ written notice. The employer may choose to pay out part or all of this notice period in lieu. Employers may elect to seek a longer notice period, where appropriate, with considerations to the nature of the role, operational requirements or existing industry practice.

Termination by the employer

An employer may terminate an executive’s employment under three main categories.

In enacting termination under any of these categories, the employer is required to act within their statutory obligations, including:

- the public sector values

- the applicable Codes

- the public sector employment principles (and the standards concerning their application)

- the Charter of Human Rights and Responsibilities Act 2006.

- Where the employer is required to give notice, they may elect to pay this out in part or in full.

- Termination of employment for executives is covered in section 34 of the PAA.

- A sample step-by-step guide is provided at Appendix B of this Handbook.

Termination on notice by the employer for performance or conduct reasons

The employer may terminate the contract under clause 13.2 with four weeks’ notice (and an additional week if the executive is aged over 45) if the executive has failed to fulfil their duties and responsibilities under clause 3 and Schedule A of the contract or otherwise engages in misconduct.

Misconduct is defined under the PAA as including situations when the executive:

- contravenes the PAA, associated regulations or the applicable Codes

- engages in improper conduct (e.g. bullying, harassment, discrimination or engaging in conduct that could compromise the organisation’s reputation)

- does not follow their employer’s reasonable and lawful directions

- refuses to perform duties reasonably assigned by their employer

- improperly use their position for personal benefit

- improperly uses official information.

Misconduct also includes wilful, deliberate or reckless acts or omissions that are inconsistent with an executive’s duties, responsibilities, standards of conduct, conflict of interest as detailed in clause 3 and Schedule A of the contract.

Misconduct includes serious misconduct, which provides the employer with flexibility to respond with termination provisions depending on the gravity of the conduct.

Summary termination by the employer

The employer may terminate the contract under clause 13.3 if the executive has committed any act of serious misconduct. This includes:

- a breach of the warranties in clause 4 of the contract

- serious, persistent or repeated misconduct

- wilful or deliberate behaviour inconsistent with the continuation of the contract

- conduct causing serious and imminent risk to the health or safety of a person, or the reputation, viability or operations of the State or the employer

- theft, fraud, assault or sexual harassment

- being intoxicated at work

- refusing to carry out a lawful and reasonable instruction that is consistent with the contract of employment

The definition of serious misconduct under the contract broadly reflects the Fair Work Regulations 2009, which otherwise do not apply to an executive’s employment.

Termination under this provision is effective immediately and the employer does not need to provide notice. No counselling or warning is required.

Termination on notice by the employer

The employer may terminate an executive’s employment under clause 13.1 of the contract at any time by giving four months’ written notice.

An employer should only enact termination under this provision if the other termination provisions are not appropriate in the circumstances.

An employer must offer reasonable outplacement support to an executive terminated under clause 13.1. This assistance provides the executive with support and enables them to search for a new job for up to 4 months.

Notice period when contract is ending

If the notice period is longer than the time left before the contract’s end date, the notice period is reduced so it only covers the remaining time until the contract ends.

Under the contract, employers and executives should hold discussions in advance of this four-month-period.

Redeployment

An executive is not automatically entitled to redeployment under the contract. However, an employer may consider a vacancy at a similar level for an executive. This may occur during the executive’s outplacement period.

Other reasons employment may be terminated

There may be other reasons for ending the employment, which are not expressly dealt with by the contract.

Retirement

Under section 20(4) of the PAA, an executive may choose to retire at any time after reaching the age of 55. Some defined benefit superannuation funds may provide for a lower age for retirement benefits.

It is unlawful to discriminate against an employee on the basis of age or for the employer to compulsorily retire an employee due to age (refer to the Equal Opportunity Act 1995). An exemption from the Attorney-General can be sought for compulsory age retirement in certain circumstances.

Abandonment of employment

While there is no provision specifically covering abandonment in the contract, in practice an executive may abandon their employment by failing to attend work without a reasonable excuse or approved leave.

In this event, it will likely constitute a failure of the executive to perform their role or to comply with lawful and reasonable directions to do so, which may give rise to termination under the contract.

Death

In the unfortunate event of an executive’s death, the executive’s family or representative must be paid any outstanding remuneration, along with the payment of accrued annual and long service leave entitlements, provided that all legal requirements are satisfied.

It is important that employers have in place processes to deal with an executive’s family, friends and colleagues, should an executive die during their employment. The employer should provide such persons access to an Employee Assistance Program.

Payments upon termination of employment

Executives must be paid out any accrued entitlements (i.e. annual leave and long service leave) at the end of their employment, as appropriate. Any payments in lieu of accumulated annual leave and long service leave entitlements are not considered to be ordinary time earnings so the employer is not required to pay a superannuation contribution on them. Payments in lieu of these leave entitlements are calculated in accordance with the source of the entitlement (for example, the ‘base rate of pay’ as defined in the Fair Work Act 2009 (Cth) or the ‘ordinary time rate of pay’ as defined in the Long Service Leave Act 2018 (Vic)).

Executives are not entitled to have personal leave paid out under the contract.

Under paragraph 7.1 of the PEER Policy, an executive is not entitled to compensation for termination of a contract beyond payment in lieu of notice and accrued leave.

Appendix A – Relocation policy

An executive who is relocated for a position may be reimbursed necessary and reasonable expenses of relocation for themselves, their family and their effects (for example, airfares, temporary accommodation costs during settling in and settling out periods, and insurance). Relocation expenses may be considered appropriate at the start and conclusion of a term of appointment. Optional expenses may also be reimbursed on a case by case basis.

Any caps on relocation allowances decided between an employer and executive should be considered as an upper limit, not as an entitlement. The need and reasonableness of each individual item should be considered by the executive and employer.

The executive should keep track of expenses against agreed relocation terms and provide receipts for reimbursements as required by the employer.

Relocation costs may be considered appropriate at the start and conclusion of an executive appointment and should be negotiated and agreed before a contract is signed.

There is no obligation on the employer to pay an executive’s relocation costs at the conclusion of a contract where this was not negotiated as part of the original contract.

Necessary and reasonable expenses are defined as:

- economy airfares for staff member and immediate family

- accommodation costs incurred during travel and during settling-in and settling-out periods

- removal expenses relating to furniture, motor vehicles and effects including comprehensive insurance cover

- storage costs.

Other optional expenses an employer may consider reimbursing, on a case-by-case basis include:

- costs associated with the sale of existing residence, including estate agent fees, legal costs, stamp duty and fees relating to the discharge of a mortgage.

- costs associated with the purchase of permanent accommodation in Victoria, including legal costs, stamp duty, mortgage transfer, buyer’s advocate and valuation fees. An appropriate depreciation allowance may also be paid.

- transport costs (return economy airfares) for a maximum of one return trip in each of the first three months of the period of employment from their new place of work to their former Australian residence to visit immediate family for a limited period while immediate family they continues to live at their former residence – (this benefit would be subject to fringe benefits tax).

Reimbursement of short-term accommodation costs during settling in and settling out periods such as:

- an allowance to cover actual cost of reasonable temporary accommodation of up to 10 weeks pending the purchase or lease of permanent accommodation; and

- where the temporary accommodation is in a hotel, reimbursement for breakfast and dinner, noting the hotel chosen should comply with relevant travel policy.

Employers and executives should note that the purchase of assets, such as new furnishings, are not considered relocation expenses.

Employers should ensure that relocation caps or allowances are understood to be an upper limit, not an entitlement to be paid in full regardless of the specific factors of the relocation. The need and reasonableness of each individual item should be considered by the executive and employer.

Note: Reimbursement of expenses associated with purchase of a new residence would usually only be considered where the residence at the previous location is sold. Any real estate agent’s commission applicable to the purchase of a new residence or any fee associated with a mortgage would not be reimbursed.

Appendix B – Step by step guide for ending employment

Below is a generic step-by-step guide for human resource administrators to consider when ending the employment of an executive.

It is provided as a guide only and will not be applicable in all circumstances.

Decision making

- Determine reason for ending employment.

- Discuss end of employment scenario with the employer (head of the organisation).

- Reach a consensus on the proposed decision to end employment.

- An appropriate person (e.g. a senior manager) is delegated to consult with the affected executive.

Administration

The employer has been consulted with and has agreed to:

- any minimum process requirements;

- proposed date for termination;

- any redeployment options (if applicable); and

- any outplacement support.

Consultation with Executive

The executive has been advised of:

- the intention to end employment;

- the reasons for proposed termination;

- expected formal notification date;

- expected employment end date.

Formal Notification

- Written notice is signed by the Agency Head.

- Notice or payment in lieu is provided (if applicable).

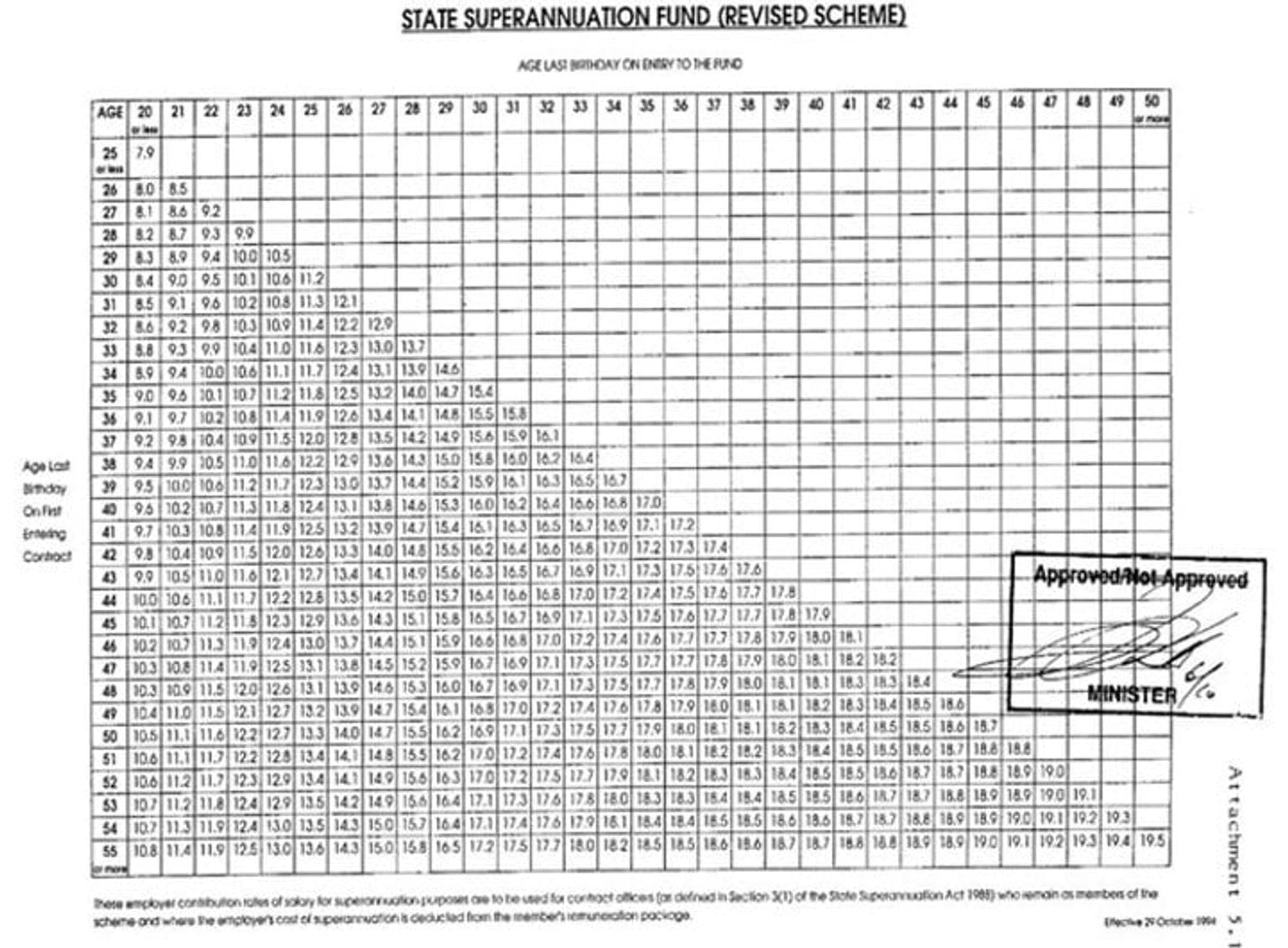

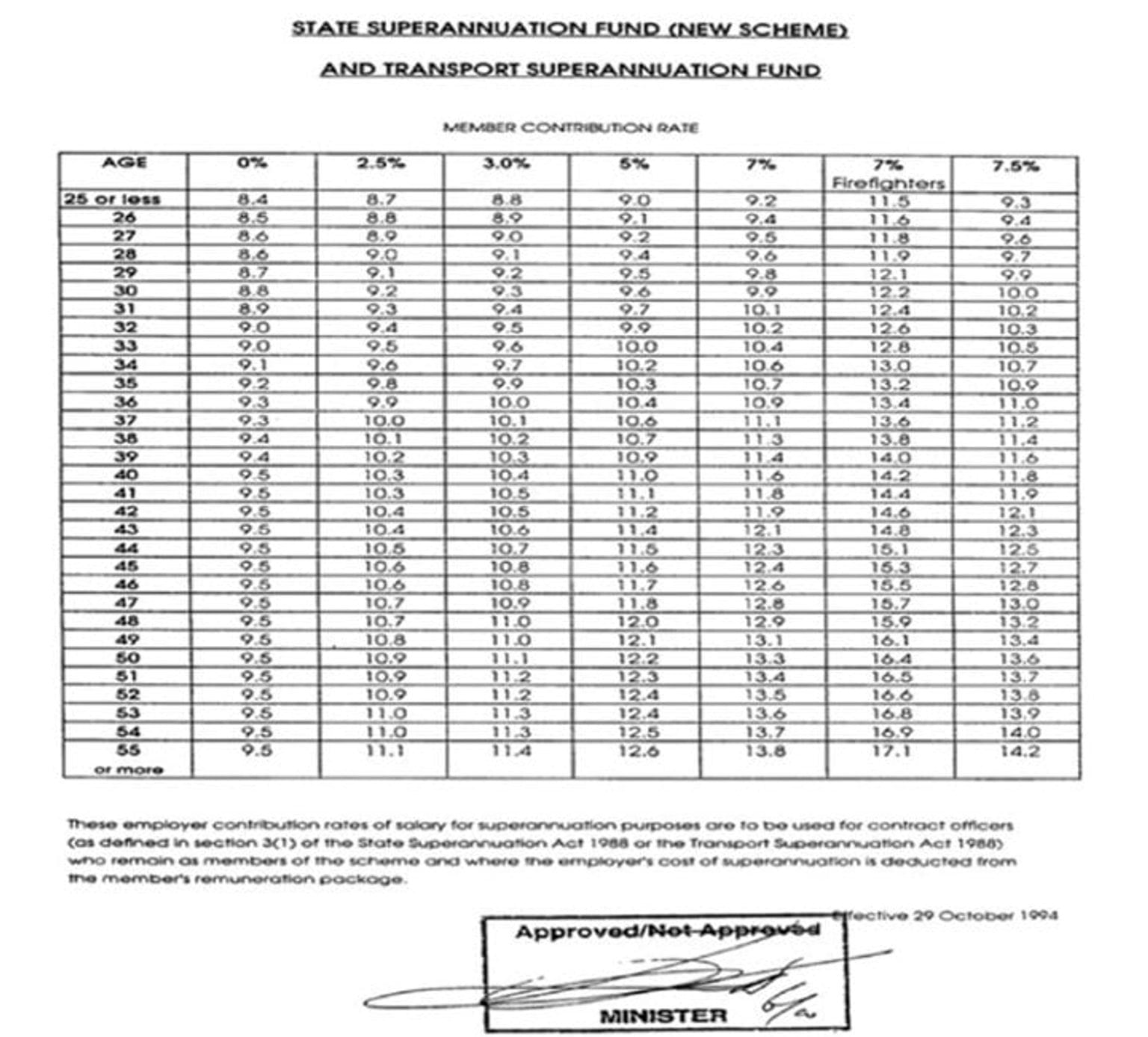

Appendix C – Employer contributions required to be made to defined benefits scheme

Benefits schemes related to Victorian Public Entity executives