Bushfire Prone Area: An area that has been or is likely to be affected by bushfire.

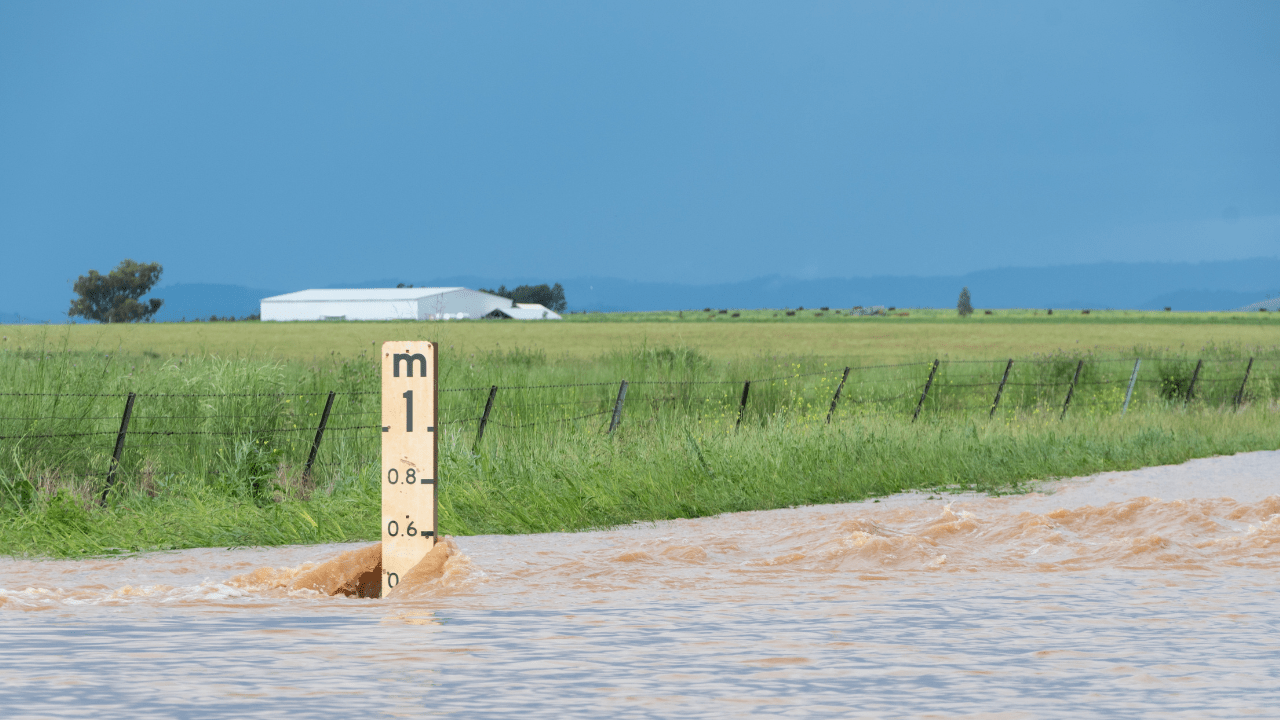

Flood Prone Area: An area that can be affected by flooding.

Coverage: The property or people covered by your policy, the risk you are insured against and the amount of money or compensation you are insured for.

Premium: The amount you pay your insurer each year to be insured.

Renewal: Continuing your insurance policy for another year. You should read the renewal notice and check for changes you may need to make to your coverage.

Excess: The amount you will pay if you make a claim. You may have to pay the excess before a claim is settled.

Exclusions: Things not covered by an insurance policy.

Insurance Policy: The annual contract between you and your insurer detailing what you have insured. Each policy has a Product Disclosure Statement (PDS), which you should read so you know what you are covered for during the term of your policy.

Product Disclosure Statement (PDS): A document your insurer must give you with the terms and conditions of your policy. This is an important document, and you should read it.

Market value: The amount your home would be worth if sold today. This is rarely the same as what it would cost to rebuild your home. This is different to the settlement amount.

Sum insured: The maximum amount your insurer may pay if you make a claim. For home insurance, it’s the highest amount your insurer will pay to rebuild your home, while for contents insurance, it’s the highest amount your belongings are insured for.

Claim: When an incident such as property damage has occurred and you seek payment from your insurance company.

Scope of works report: If your claim is approved, you will receive a scope of works report. This report will outline all the repairs that are required. It’s important to check the report to make sure everything that is needed to be repaired or replaced is outlined in this report before you sign it off.

Settlement: What you get from your insurer if your claim is approved. Your insurer may organise the repair or rebuild of your home or give you the money to organise it yourself. Giving you money is sometimes referred to as a payout or cash settlement. Settlement values do not always reflect market value.

Embargo: Insurers may place embargoes on the purchase of new insurance policies to prevent people buying insurance when a natural disaster is imminent, such as a bushfire, flood or cyclone.

Disclaimer: The information provided on this website is intended for general information purposes only and no reliance should be placed on its contents or accuracy. It is not a definitive guide and is not intended to constitute legal or financial advice and does not take into consideration your particular circumstances or needs. If you require assistance in respect of your personal circumstances, please seek independent advice. In an emergency, please also contact official sources for information. Every effort has been made to ensure the accuracy and completeness of this page and the references to the links included within it. However, we cannot guarantee that the information is complete, current or free from errors. We do not control, endorse or take responsibility for the content of any external websites linked on this page.

Updated