- Date:

- 6 Sep 2022

DPC’s 2021–22 Annual Report and accompanying financial statements present a summary of the department’s performance over the 2021–22 financial year.

Further information about DPC portfolio entities can be obtained, where applicable, from their individual 2021–22 annual reports.

Secretary’s foreword

As Victoria’s First Minister’s department, the Department of Premier and Cabinet (DPC) provides strategic leadership across the Victorian public service through its guidance and coordination of whole of government policy and performance.

Since 2020, there have been changes in how we live and work that have impacted us all — as individuals, as a community and as a public service.

In this context, DPC continues to demonstrate excellence through its delivery of strong policy outcomes. During 2021–22 this has been evident in our response to the persistent challenges of COVID-19 and the ongoing work to support the recovery and revitalisation of Victoria’s economy, industry, and communities.

In close partnership with the Department of Health, DPC has advised on significant investment in Victoria’s health system, to ensure it remains strong even in the face of the sustained peaks caused by COVID-19.

Supporting Victoria’s economic revitalisation has also seen DPC providing advice and coordination on the delivery of major infrastructure projects, new planning processes for state projects and a suite of other economic recovery initiatives.

DPC has also achieved major milestones for a number of key government policy commitments and reforms such as the establishment on 1 July 2021 of Wage Inspectorate Victoria as a statutory authority. Since then, Wage Inspectorate Victoria has worked to protect the safety and welfare of children working in Victoria, and a range of fundamental employment rights of workers and employees in Victoria.

Looking more broadly, following its establishment within DPC in April 2021, the First Peoples–State Relations group has been foundational to DPC’s support for First Peoples in Victoria to be strong and self-determining. This includes through participation in negotiations with the democratically elected First Peoples’ Assembly of Victoria, and leading whole of government reforms to progress the government’s commitment to treaty. First Peoples–State Relations has also provided leadership and coordination on the whole of government response to the historic Yoorrook Justice Commission since the Commission’s establishment in May 2021.

Another key pillar of our work is to uphold and improve the standards of professional public administration.

Changes in previous years to the way the public service works have now become enduring features, reflecting our capacity to adapt to a rapidly evolving environment. I am proud to see the public service embedding practices that ensure modern, responsive, innovative and collaborative delivery, reflecting the experiences of all Victorians.

DPC’s whole of government leadership has also been evident in the digital transition of services and supports to enable evidence-based policy making and the provision of safer, more efficient and accessible government services. Digital Victoria’s leadership of this transition in 2021–22 culminated with the release of the Victorian Government Digital Strategy 2021–2026. This strategy outlines whole of government objectives to create better, fairer and more accessible services, a digital-ready public sector and a thriving digital economy.

The Office of the Chief Parliamentary Counsel has continued to excel in its provision of legislative services, critical to progress government reforms, while also working with Digital Victoria to improve its project management practices and systems.

These improvements across the breadth of public administration have been achieved with a view to efficiency and effectiveness. Together with the Department of Treasury and Finance, DPC has provided advice to the government on the implementation of a range of budget efficiency initiatives to ensure the provision of government services to Victorians remains economical and delivers strong public value.

I look forward to the privilege of continuing to work alongside my colleagues at DPC and the Victorian Secretaries’ Board, to lead a department and a public service always committed to improving outcomes for all Victorians.

Jeremi Moule

Secretary

About us

DPC’s vision, mission, values and objectives.

Our vision

The Department of Premier and Cabinet’s (DPC) vision is to be a recognised and respected leader in whole of Victorian Government policy and performance.

Our mission

DPC’s mission is to support the people of Victoria by:

- helping government achieve its strategic objectives

- providing leadership to the public sector to improve its effectiveness

- promoting collaboration across government to drive performance and improve outcomes.

DPC supports the Victorian Government’s commitment to a stronger, fairer, better Victoria by promoting excellence in government service delivery and reform.

Our values

DPC upholds the public sector values as outlined in the Public Administration Act 2004.

Responsiveness

- Providing frank, impartial and timely advice to the government

- Providing high-quality services to the Victorian community

- Identifying and promoting best practice

Integrity

- Being honest, open and transparent in our dealings

- Using powers responsibly

- Reporting improper conduct

- Avoiding any real or apparent conflicts of interest

- Striving to earn and sustain public trust of a high level

Impartiality

- Making decisions and providing advice on merit without bias, caprice, favouritism or self-interest

- Acting fairly by objectively considering all relevant facts and applying fair criteria

- Implementing government policies and programs equitably

Accountability

- Working to clear objectives in a transparent manner

- Accepting responsibility for our decisions and actions

- Seeking to achieve best use of resources

- Submitting ourselves to appropriate scrutiny

Respect

- Treating others fairly and objectively

- Ensuring freedom from discrimination, harassment and bullying

- Using others’ views to improve outcomes on an ongoing basis

Leadership

- Actively implementing, promoting and supporting these values

Commitment to human rights

- Making decisions and providing advice consistent with the human rights set out in the Charter of Human Rights and Responsibilities Act 2006

- Actively implementing, promoting and supporting human rights

Our objectives

DPC’s objectives are as follows.

Strong policy outcomes

- Pursue policy and service delivery excellence and reform

- Lead the public sector response to significant state issues, policy challenges and projects

- Support the effective administration of government

First Peoples in Victoria are strong and self-determining

- Improve outcomes and services for First Peoples through prioritising actions to enable self-determination, including advancing treaty, protecting and promoting cultural rights and conducting a truth telling process

- Address trauma and support healing; address racism established through colonisation

- Provide culturally safe systems and services; and transfer power and resources to communities

Professional public administration

- Foster and promote a high-performing public service

- Ensure effective whole of government performance and outcomes

- Protect the values of good public governance, integrity and accountability in support of public trust

Our ministers

Ministers supported by DPC.

Premier of Victoria

The Hon Daniel Andrews MP

The Premier is Victoria’s head of government. DPC advises and supports the Premier and his portfolio.

The Premier is the main channel of communication between the Governor, as Head of State, and Cabinet, and between the Victorian Government and other state and territory governments.

The following DPC entities are part of the Premier’s portfolio:

- Office of the Governor

- Breakthrough Victoria Pty Ltd.

Contact details

1 Treasury Place

East Melbourne VIC 3002

Email: daniel.andrews@parliament.vic.gov.au

Website: www.premier.vic.gov.au

Minister for Government Services

The Hon Danny Pearson MP

DPC advises and supports the Minister for Government Services and his portfolio, which includes Digital Victoria and public sector administration and reform.

The Minister for Government Services is also responsible for the following DPC portfolio entities:

- Cenitex

- Office of the Chief Parliamentary Counsel

- Office of the Victorian Government Architect

- Public Record Office Victoria

- Service Victoria

- Victorian Electoral Commission

- Victorian Independent Remuneration Tribunal

- Victorian Public Sector Commission.

In addition to his DPC responsibilities, Minister Pearson is the Minister for Housing, Assistant Treasurer and Minister for Regulatory Reform.

Contact details

1 Treasury Place

East Melbourne VIC 3002

Email: danny.pearson@parliament.vic.gov.au

Website: www.dannypearson.com.au

Minister for Industrial Relations

Tim Pallas MP

DPC advises and supports the Minister for Industrial Relations and his portfolio. This includes Industrial Relations Victoria, which works towards achieving a positive working environment for all Victorians.

The Minister for Industrial Relations is also responsible for the following DPC portfolio entities:

- Labour Hire Authority

- Portable Long Service Authority

- Wage Inspectorate Victoria.

In addition to his DPC responsibilities, Minister Pallas is the Treasurer, the Minister for Economic Development and the Minister for Trade.

Contact details

1 Treasury Place

East Melbourne VIC 3002

Email: tim.pallas@parliament.vic.gov.au

Website: www.timpallas.com.au

Minister for Treaty and First Peoples

Gabrielle Williams MP

DPC advises and supports the Minister for Treaty and First Peoples* and her portfolio. This includes oversight of First Peoples–State Relations, which focuses on promoting cultural rights, self-determination, treaty and truth.

The Minister for Treaty and First Peoples is also responsible for the following DPC portfolio entity:

- Victorian Aboriginal Heritage Council.

In addition to her DPC responsibilities, Minister Williams is the Minister for Mental Health.

Contact details

50 Lonsdale Street

Melbourne VIC 3000

Email: gabrielle.williams@parliament.vic.gov.au

Website: www.gabriellewilliams.com.au

Other officials

Mr Steve McGhie, Cabinet Secretary

DPC’s Cabinet Office provides support to the Cabinet Secretary for the operations of the Cabinet process and supports the Cabinet Secretary in his role.

Contact details

Email: steve.mcghie@parliament.vic.gov.au

Website: www.stevemcghie.com.au

The Hon Sonya Kilkenny MP was the Cabinet Secretary until 27 June 2022, when she was appointed to the ministry.

Mr Nick Staikos, Parliamentary Secretary to the Premier

Mr Staikos assists the Premier with his portfolio responsibilities.

Contact details

Email: nick.staikos@parliament.vic.gov.au

Website: www.nickstaikos.com.au

The Hon Steve Dimopoulos MP was the Parliamentary Secretary to the Premier until 27 June 2022, when he was appointed to the ministry.

Organisational chart

DPC organisational chart.

DPC as at 30 June 2022:

The Secretary is Jeremi Moule, who leads the department comprised of 7 groups and its associated entities and agencies.

Department of Premier and Cabinet

Secretary, Jeremi Moule

Office of the Secretary

Executive Director, Jane Gardam

Social Services Workforce Reform

Deputy Secretary, Sandy Pitcher

Delivery and Strategy

Executive Director, Marcus Walsh

Legal, Legislation & Governance

Deputy Secretary and General Counsel, Toby Hemming

Office of the General Counsel

Executive Director, Miriam Holmes

Governance

Executive Director, Jennifer Barton

Victorian Independent Remuneration Tribunal

Director, Nick Voukelatos

Diversity on Boards

Executive Director, Vicky Hudson

Digital Victoria

Chief Executive Officer, Michael McNamara

Digital

Deputy CEO and Chief Digital Officer, Lisa Tepper

Cyber Security

Chief Information Security Officer, John O’Driscoll

Strategy and Performance

Chief of Strategy and Operations, Suzanne Aitken

Technology and Transformation

Chief Technology Officer, Luke Halliday

Victorian Centre for Data Insights

A/Chief Data Officer, David Cullen

Cabinet, Communications & Corporate

Deputy Secretary, Vivien Allimonos

Cabinet Office

Executive Director, Rachel Cowling

Corporate Services

Executive Director, Genevieve Dolan

Corporate Governance

Director, Evelyn Loh

Strategic Communications, Engagement and Protocol

Chief Communications Officer and Chief of Protocol, Fin Bird

Social Policy and Intergovernmental Relations

Deputy Secretary, Kate Houghton

COVID-19 Coordination & Performance / Education / Social Recovery, Families, Fairness & Housing

Executive Director, Lucy Toovey

Health / Mental Health

Executive Director, Ross Broad

Intergovernmental Strategy

Executive Director, Lauren Kaerger

Justice / Community Security and Emergency Management

Executive Director, Emma Catford

Office of Family Violence Reform Implementation Monitor

Director, Shasta Holland

Economic Policy and State Productivity

Deputy Secretary, Tim Ada

Economic Development and International

Executive Director, Rob Holland

Economic Strategy

Executive Director, Heather Ridley

Energy, Resources and Environment

Executive Director, Matt Minchin

Infrastructure, Planning and Major Projects

Executive Director, Andrew Witchard

First Peoples–State Relations

Deputy Secretary, Elly Patira

Self-Determination, Transformation and Policy

Executive Director, Ruth Barson

Traditional Owner Relationships and Heritage

Executive Director, Travis Lovett

Treaty Negotiations and Strategy

Lead Negotiators:

- David McAuley

- Shen Narayanasamy

Industrial Relations Victoria

Deputy Secretary, Matt O’Connor

Private Sector

Executive Director, Lissa Zass

Public Sector

Executive Director, Jesse Maddison

Portfolio entities

Administrative Offices

- Office of the Governor

- Office of the Chief Parliamentary Counsel

- Office of the Victorian Government Architect

- Public Record Office Victoria

- Service Victoria

Other entities

- Victorian Public Sector Commission

Special bodies

- Victorian Electoral Commission

- Electoral Boundaries Commission

- Victorian Independent Remuneration Tribunal

Public entities

- Breakthrough Victoria Fund Pty Ltd

- Cenitex

- Labour Hire Authority

- Portable Long Service Authority

- Victorian Aboriginal Heritage Council

- Wage Inspectorate Victoria

Who we are

Find changes to the department, our groups, senior executives, administrative offices and other entities.

Changes to the department during 2021–22

On 1 July 2021 Wage Inspectorate Victoria was transferred from DPC and established as a statutory entity following the appointment of its first commissioner. Wage Inspectorate Victoria promotes and enforces Victoria’s laws on wage theft and child employment, long service leave entitlements and owner driver, forestry contractor, hirer and freight broker obligations.

On 1 September 2021 the Public Sector Reform branch transferred from DPC to a DPC entity — the Victorian Public Sector Commission. Public Sector Reform was responsible for leading and coordinating work on major issues relating to the management and operations of the Victorian Government including the strategic direction and reform of the public sector and public sector performance.

On 28 February 2022 the Social Services Workforce Reform branch was established as a new project office within DPC to lead and coordinate whole of government reform efforts to support workforce development within the social services sector. The Social Services Workforce Reform project office focuses on addressing the challenges of training, recruiting and retaining the critical social services workers needed to deliver the government’s significant investments in prevention of family violence and mental health reforms, as well as reforms in child protection and family services, youth justice, housing and homelessness, early childhood and other areas.

Our groups

DPC consists of 7 groups:

- Legal, Legislation and Governance

- Digital Victoria

- Cabinet, Communications and Corporate

- Social Policy and Intergovernmental Relations

- Economic Policy and State Productivity

- First Peoples–State Relations

- Industrial Relations Victoria.

Legal, Legislation and Governance

The Legal, Legislation and Governance group delivers public sector legal, legislation and governance expertise and combines the Office of the General Counsel (OGC) and the Governance branch.

OGC provides legal and policy advice, including in the areas of administrative, constitutional and corporate law. OGC’s policy focus is on issues in the Premier’s and the Minister for Government Services’ portfolios, principally in relation to Victoria’s public sector, electoral system and subordinate legislation. OGC advises on the government’s legislative agenda and supports DPC in developing legislative and regulatory proposals. It also manages the department’s freedom of information and privacy functions.

Governance branch unifies DPC’s efforts to promote good governance and public administration, high-quality decision and policymaking, government integrity and accountability, and trust in public institutions. It also supports the critical work of the Victorian Independent Remuneration Tribunal.

Digital Victoria

Digital Victoria drives digital transformation across the Victorian Government to create better, fairer, more accessible services, a digital-ready public sector and a thriving digital economy. Digital Victoria launched the first Victorian Government Digital Strategy 2021–2026 in November 2021, setting a unified vision for a digital, thriving Victoria. As the steward of the whole of government digital agenda, Digital Victoria is building the foundations required to solve systemic whole of government or interdepartmental digital challenges and prepare the government to be future ready and digitally enabled for all Victorians. Digital Victoria comprises 5 branches: Digital; Cyber Security; Strategy and Performance; Technology and Transformation, and the Victorian Centre for Data Insights.

Cabinet, Communications and Corporate

The Cabinet, Communications and Corporate group provides services and Victorian public service-wide advice to support robust public administration and promote DPC’s role as the First Minister’s department. The group provides timely and practical guidance on the operation of Cabinet, Cabinet committees and the Executive Council. The group leads work to support DPC to meet integrity, financial accountability and institutional governance obligations to parliament and ministers and provides specialist communication, event, behavioural insights and protocol advice across government. The group also provides the operational backbone to DPC and its entities through finance; operations; people and culture; and procurement services and assistance.

Social Policy and Intergovernmental Relations

The Social Policy and Intergovernmental Relations group brings together social policy expertise by coordinating the state’s intergovernmental relations. The group provides policy advice on the following areas: health; mental health; education; skills and training; justice; community security and emergency management; and families, fairness and housing.

The group also leads oversight and coordination of intergovernmental advice, COVID-19 pandemic response efforts and the government’s response to the Royal Commission into Victoria’s Mental Health System. It also supports the Office of the Family Violence Reform Implementation Monitor.

Economic Policy and State Productivity

The Economic Policy and State Productivity group leads economic policy advice to the Premier. The group collaborates with relevant departments and agencies to support a coordinated whole of government approach to policy and projects in the areas of economic development and industry recovery; fiscal policy; regional and suburban development; local government; regulatory reform; consumer affairs; racing; workplace safety; creative industries; major events, tourism and sport; innovation; small business; employment; international engagement; infrastructure and planning; precincts; public transport; agriculture; resources; energy and climate change; and water and the environment.

First Peoples–State Relations

The First Peoples–State Relations group was established in April 2021 and is responsible for an extensive program of nation-leading work in the areas of cultural rights, self-determination, treaty and truth with First Peoples. The group recognises Victoria’s First Peoples as the self-determining drivers of Aboriginal affairs in Victoria and is committed to building ongoing, just and respectful relationships between self-determining First Peoples and the State.

Industrial Relations Victoria

Industrial Relations Victoria (IRV) provides strategic industrial relations legislative, policy and technical advice to government and departments. IRV engages with Victorian employers, employees and their representatives to support a positive industrial relations environment, and to advocate for fair and productive workplaces, secure work and gender pay equity. IRV also oversees industrial relations matters and enterprise bargaining policy and processes across the Victorian public sector. IRV comprises of the Private Sector Industrial Relations branch, the Public Sector Industrial Relations branch and the Office of the Deputy Secretary. IRV supports 3 portfolio entities: the Labour Hire Licensing Authority, the Portable Long Service Authority and Wage Inspectorate Victoria.

DPC’s senior executives

Secretary

Jeremi Moule was appointed as the Secretary of DPC in October 2020. Prior to this role, he was DPC’s Deputy Secretary of Governance Policy and Coordination, a position he held since August 2018.

Jeremi has held various executive positions in the Victorian and South Australian public services for more than 20 years. He started his career as a journalist and was the CEO of a registered training organisation. Jeremi lives in Bendigo and has worked extensively in regional Victoria.

He holds a journalism degree from the University of South Australia and is a graduate of the Australian Institute of Company Directors.

Deputy Secretary/General Counsel, Legal, Legislation and Governance

Toby Hemming was appointed as General Counsel in May 2018.

Toby has significant experience in the Victorian public sector, having held senior positions in organisations including the County Court of Victoria, the Victorian Managed Insurance Authority and the Emergency Services Telecommunications Authority.

Toby holds degrees in the areas of law, arts and corporate governance. He is a graduate of the Australian Institute of Company Directors and has completed Executive Fellows programs at Harvard University’s Kennedy School of Government and the Australia and New Zealand School of Government.

Chief Executive Officer, Digital Victoria

Michael McNamara was appointed CEO for Digital Victoria in September 2021.

Michael has more than 25 years of experience in the digital transformation paradigm. Prior to DPC, Michael was the Chief Information Officer and Deputy CEO for Services Australia where he was responsible for major digital transformation programs. Before joining the public sector, he had a lengthy private sector career supporting the likes of ANZ and other banking and energy providers to build and modernise their digital infrastructure. Michael was ranked in the top 10 in the CIO50 awards in 2021.

Deputy Secretary, Cabinet, Communications and Corporate

Vivien Allimonos is Deputy Secretary of Cabinet, Communications and Corporate. Vivien also acted as the Chief Executive Officer of Digital Victoria from March 2021 until September 2021. Prior to DPC, Vivien was the Chief Communications Officer at the Department of Education and Training. Vivien has more than 20 years of experience in public administration, with a focus on international affairs, trade and communications. She has held various executive positions in the Victorian and Australian public services as well as the US State Department. She holds an honours degree in commerce/arts from the University of Melbourne and was listed in IPAA Victoria’s Top 50 Public Sector Women 2020.

Deputy Secretary, Social Policy and Intergovernmental Relations

Kate Houghton PSM was appointed as a Deputy Secretary in DPC in November 2018, initially looking after Social Policy and Aboriginal Affairs. In April 2021 Aboriginal Affairs became the separate First Peoples–State Relations group and Kate took on responsibility for intergovernmental relations.

Kate has led many teams across a variety of portfolios within the Victorian public service. Before joining DPC she was Deputy Secretary of Police and Crime Prevention at the then Department of Justice and Regulation. Kate spent many years working within the natural resources and environment portfolio. She led the Water and Catchments group as Deputy Secretary and the Environment Policy Division as Executive Director.

Kate has an honours degree in economics and a Master of Environment. She is also an IPAA Fellow. In the June 2022 Queen’s Birthday Honours List, Kate was awarded the Public Service Medal in recognition of her contribution in support of Australia’s response to the COVID-19 pandemic.

Deputy Secretary, Economic Policy and State Productivity

Tim Ada began in the role of Deputy Secretary of Economic Policy and State Productivity in April 2019. Previously, Tim was Deputy Secretary at the Department of Jobs, Precincts and Regions, where he was responsible for the strategic development of key industry sectors including manufacturing, life sciences, international education and delivering telecommunications and employment programs.

Tim has a Master of Agriculture Sciences from the University of Melbourne. He grew up in rural Victoria.

Chris Miller acted in the role of Deputy Secretary of Economic Policy and State Productivity from April to October 2021. Chris substantively served as Executive Director of the Infrastructure, Planning and Major Projects branch at DPC. Chris departed DPC in February 2022.

Deputy Secretary, First Peoples–State Relations

Elly Patira was appointed as the Deputy Secretary of First Peoples–State Relations in April 2021. Elly is a lawyer and policy adviser with broad experience across constitutional, Indigenous and minority rights law and policy, both domestically and internationally. She holds a Bachelor of Arts and a JD (Juris Doctor) from the University of Melbourne and a Master of International Human Rights Law from the University of Oxford. Elly has held various executive positions in the Treaty and First Peoples portfolio at DPC. She has previously worked as an academic, in the corporate sector, for Aboriginal organisations and as an adviser during the Fijian constitution-making process.

As Deputy Secretary, Elly is responsible for an extensive program of priority work with First Peoples in the areas of treaty, truth and transitional justice, self-determination and cultural rights and protection.

Deputy Secretary, Industrial Relations Victoria

Matt O’Connor was appointed as the Deputy Secretary of Industrial Relations Victoria in April 2015.

Matt has worked in the Victorian Government since 2003. He has overseen the development of significant industrial relations legislative policy reforms including wage theft, labour hire licensing, long service leave and child employment.

Matt provides strategic input on a range of whole of government industrial relations matters. He has overseen the government’s participation in significant legal proceedings in the Fair Work Commission, advocating for secure and fair employment through increases to the national minimum wage; paid family and domestic violence leave; and a minimum wage floor for piece rates in the horticultural award. He has also represented the Victorian Government in consultations with the Commonwealth Government on federal industrial relations legislative proposals including amendments to the Fair Work Act 2009.

Matt has steered the government’s public sector industrial relations strategy for several years and, more recently, played a pivotal role in developing enduring flexible working arrangements and managing COVID-19 workforce issues.

Deputy Secretary, Social Services Workforce Reform

Sandy Pitcher began as Deputy Secretary, Social Services Workforce Reform in February 2022. Sandy has around 15 years of executive experience across the Victorian, South Australian and Commonwealth public sectors as well as the Commission for Racial Equality in the UK. Sandy was the inaugural Secretary of the Department of Families, Fairness and Housing in 2021, after co-leading the contact and case management COVID-19 response for Victoria from July 2020. She was the Secretary of the South Australian Department of Environment, Water and Natural Resources from 2015 to 2018. Sandy has held a number of community and university board positions. She also had a stint in an ASX company from 2018 to 2019.

Sandy holds degrees in law and arts from Adelaide University and was appointed an IPAA National Fellow in 2013, as well as being awarded the National Telstra Businesswoman of the Year in 2012.

Administrative offices

Administrative offices are established and abolished through orders under section 11 of the Public Administration Act, and each is established in relation to a department.

DPC is responsible for the effective, efficient and economical management of the following administrative offices.

Office of the Chief Parliamentary Counsel

The Office of the Chief Parliamentary Counsel transforms policy into legislation and advises the government on its legislative program. The office is responsible for ensuring up-to-date public access to authoritative Victorian legislation. The Office of the Chief Parliamentary Counsel is also the Government Printer for Victoria, responsible for printing Victorian legislation.

Office of the Governor

The Office of the Governor supports the Governor of Victoria in carrying out all aspects of their official duties for the benefit of the Victorian community. It also maintains Government House and grounds as a unique heritage community asset. The Governor’s role includes constitutional and ceremonial duties, community and international engagement as well as official municipal, regional and overseas visits.

Office of the Victorian Government Architect

The Office of the Victorian Government Architect (OVGA) provides leadership and independent advice to government about architecture and urban design. OVGA puts quality of design at the centre of all conversations about the shape, nature and function of our cities, buildings and landscapes. OVGA’s activities include reviewing significant state and local government projects as well as commercial projects with a significant impact on the public. OVGA also leads on significant good-design initiatives and provides input, advice and advocacy on policies and issues of relevance to the Victorian Government.

Public Record Office Victoria

Public Record Office Victoria (PROV) maintains the archives of the State Government of Victoria, holding records dating from the mid-1830s to today. PROV manages these for use by the government and people of Victoria. PROV’s collection contains records of decisions, events, people and places that have shaped our history. PROV sets mandatory recordkeeping standards for state and local government agencies and provides support and advice on recordkeeping to government.

Service Victoria

Service Victoria is a whole of government service capability with responsibility for improving and modernising the way government transactions are delivered online.

Service Victoria brings together more than 80 government services into a central access point — the Service Victoria app and website — making it easier for Victorians to transact with government.

Service Victoria is responsible for implementing the Service Victoria Act 2018, which helped Victoria to become the first jurisdiction to offer Level of Assurance 3 online identity verification, which is the highest rigour possible online.

Other entities

DPC supports the Premier and its ministers in their responsibilities for the Victorian Public Sector Commission and the following special bodies and public entities.

Special bodies

Special bodies are defined in section 6 of the Public Administration Act and are created under separate legislation:

- Electoral Boundaries Commission

- Victorian Electoral Commission

- Victorian Independent Remuneration Tribunal.

Public entities

Public entities include statutory authorities, state-owned enterprises, state-owned corporations and formally constituted advisory boards that perform functions outside of the public service:

- Breakthrough Victoria Pty Ltd

- Cenitex

- Labour Hire Authority

- Portable Long Service Authority

- Victorian Aboriginal Heritage Council

- Wage Inspectorate Victoria.

Five-year financial summary

Summary of factors that affected our performance in 2021–22 and the preceding 4 reporting periods.

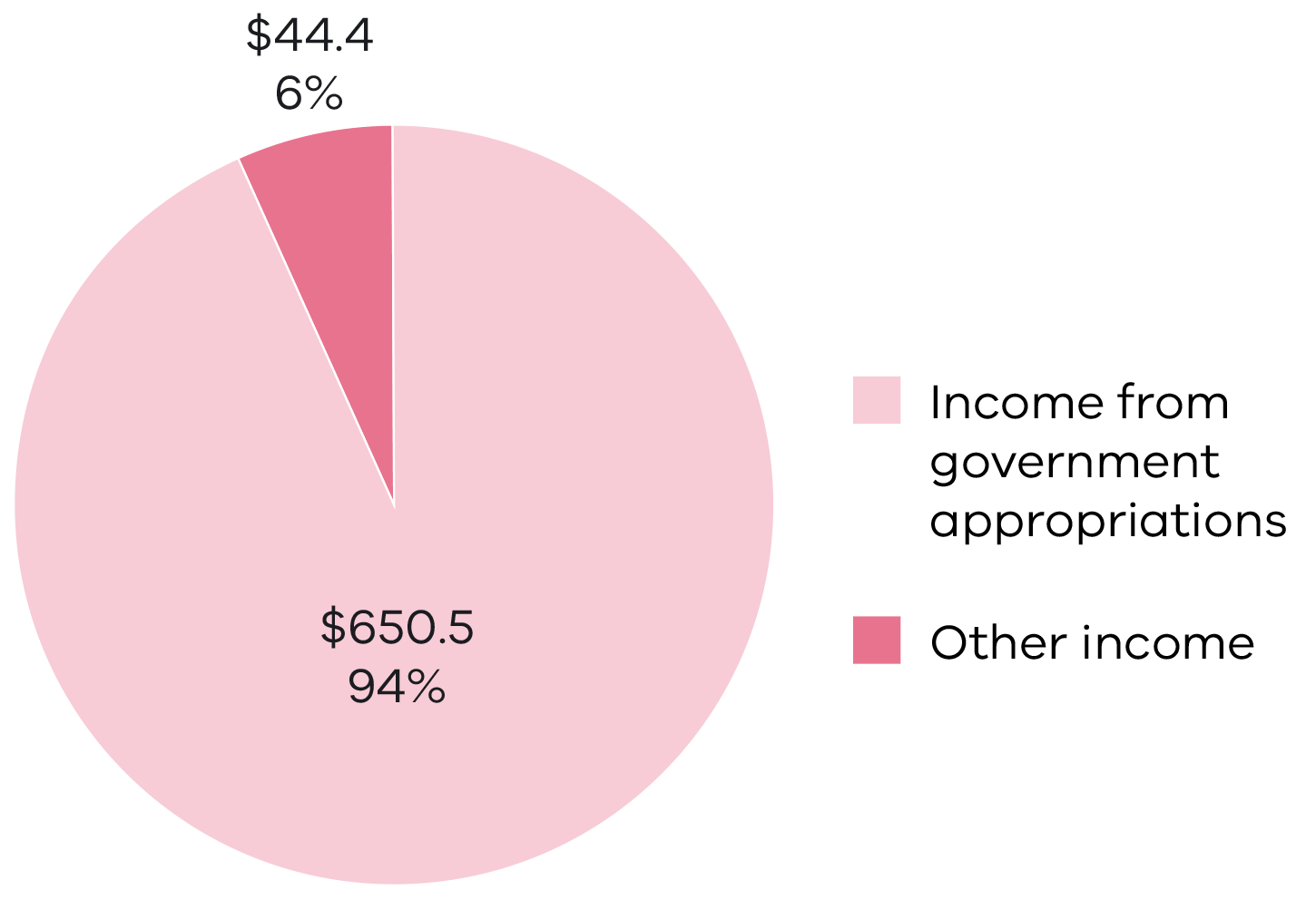

Key financial indicators from 2017–18 to 2021–22

|

Department-controlled activities |

2021–22 |

2020–21 |

2019–20 |

2018–19 |

2017–18 |

|

$’000 (1) |

$’000 (2) |

$’000 (3) |

$’000 (4) |

$’000 (5) |

|

|

Income from government |

650,501 |

607,413 |

726,920 |

720,119 |

520,002 |

|

Total income from transactions |

694,868 |

642,804 |

818,062 |

760,318 |

580,778 |

|

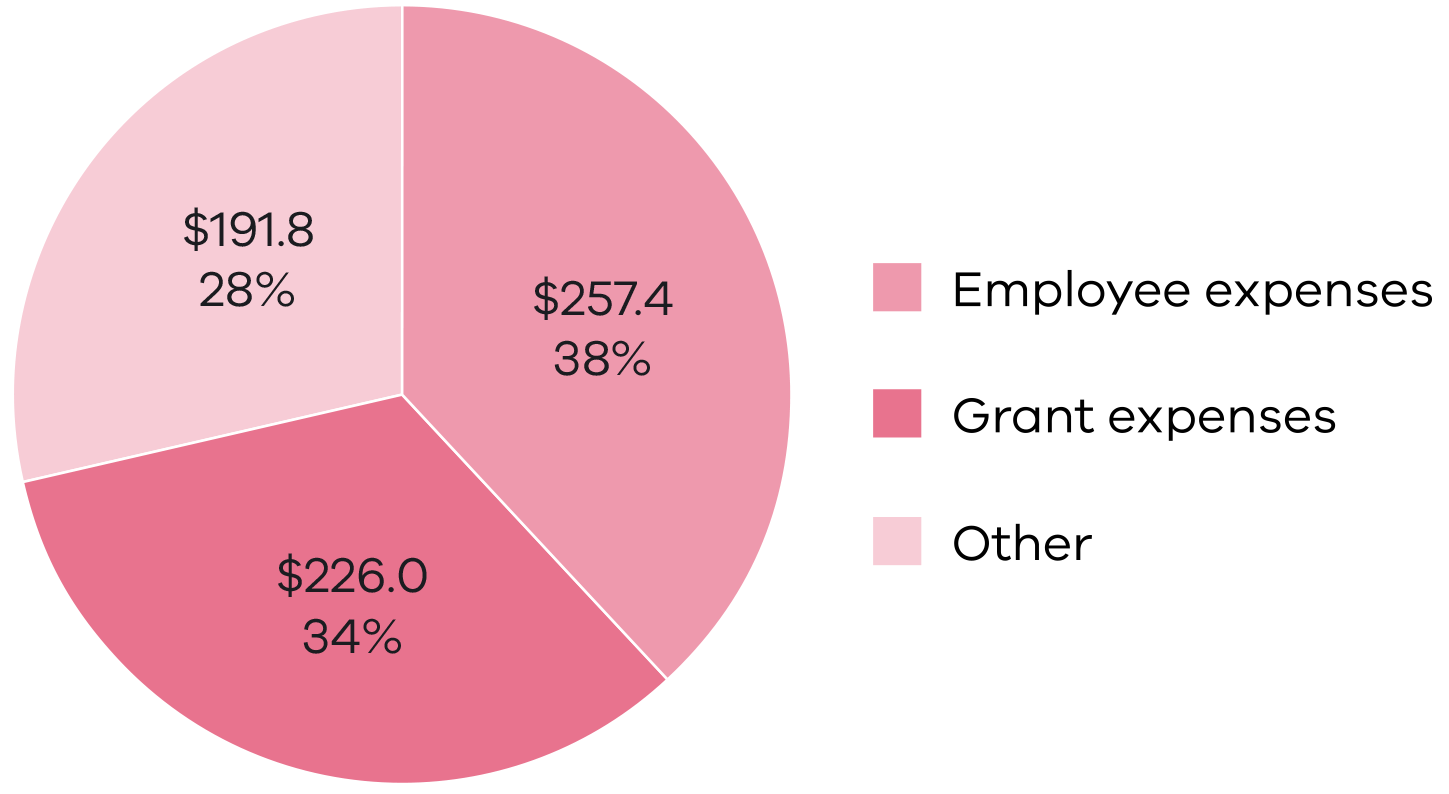

Total expenses from transactions |

(675,126) |

(632,174) |

(825,276) |

(750,323) |

(573,028) |

|

Net result from transactions |

19,742 |

10,630 |

(7,214) |

9,995 |

7,750 |

|

Net result for the period |

21,986 |

13,048 |

(7,666) |

8,583 |

7,966 |

|

Net cash flow from operating activities |

29,706 |

35,597 |

17,883 |

35,134 |

15,980 |

|

Total assets |

1,118,658 |

881,214 |

866,022 |

876,813 |

847,231 |

|

Total liabilities |

106,858 |

95,703 |

116,514 |

116,711 |

90,268 |

The above table shows a summary of key financial indicators for DPC.

Notes:

(1) The increase in 2021–22 income and expenditure is mainly due to new government initiatives delivered during the year including digital vaccination certification, business licensing initiatives and the development of the Digital Victoria Marketplace. In addition, there is an increase associated with 2022 State Election readiness. Assets increased as a result of revaluation from formal valuation of property, plant and equipment. Department liabilities increased as a result of higher employee leave liabilities and provision for the early retirement packages announced during the year.

(2) The decrease in 2020–21 income and expenditure is mainly due to machinery of government changes where Fairer Victoria transferred from DPC to the Department of Families, Fairness and Housing on 1 February 2021, and Bushfire Recovery Victoria transferred to the Department of Justice and Community Safety from 1 July 2020. An increase in assets is driven by asset revaluations. Transfer of employee and supplier liabilities to the Department of Families, Fairness and Housing contributed to a decrease in liabilities.

(3) The increase in 2019–20 income and expenditure is mainly due to bushfire recovery activities and responses to the COVID-19 pandemic. DPC’s assets decreased due to reductions in financial assets from the use of funding received in prior financial years and machinery of government decisions where functions were transferred from DPC.

(4) The increase in 2018–19 income and expenditure is mainly due to new government initiatives delivered during the year including Pick My Project, Multicultural Community Infrastructure programs and the Victorian Jobs and Investment Fund. Separately, there was increased income and expenditure due to the 2018 State Election. Assets increased due to investments in modernising DPC’s office spaces and further investments in Service Victoria’s digital services platform. DPC’s liabilities increased due to higher payables and employee liabilities because of growth and machinery of government transfers into DPC.

(5) The increase in income from transactions and an increase in expenses from transactions in 2017–18 relate to new government initiatives carried out during the year. Separately, the increase in total assets is mainly due to building Service Victoria's digital services platform.

Progress towards achieving departmental objectives

Outcomes we achieved during the year against our key initiatives and projects.

Progress towards achieving departmental objectives

This section reports on the outcomes the Department of Premier and Cabinet (DPC) achieved during the year against key initiatives and departmental objectives.

Departmental output changes during 2021–22

Following the transfer of departmental outputs to the Department of Families, Fairness and Housing on 1 February 2021, DPC established a new departmental objective and made the following changes to its output structure in 2021–22.

|

2021–22 objective |

Indicator |

Output |

|

First Peoples in Victoria are strong and self-determining |

First Peoples in Victoria have increased control over decisions that impact their lives |

Aboriginal policy, strengthening Aboriginal cultural heritage and communities |

Departmental objectives, indicators and linked outputs

DPC’s medium-term objectives, associated indicators and linked outputs as set out in the 2021–22 Victorian Budget Paper No. 3 — Service Delivery are shown below.

|

Objectives |

Indicators |

Outputs |

|

Strong policy outcomes |

DPC’s policy advice and its support for Cabinet, committee members and the Executive Council are valued and inform decision making The development and effective use of technology supports productivity and competitiveness |

Government-wide leadership, reform and implementation |

|

Strategic advice and government support |

||

|

Digital government and communications |

||

|

Office of the Victorian Government Architect |

||

|

Industrial relations |

||

|

First Peoples in Victoria are strong and self-determining |

First Peoples in Victoria have increased control over decisions that impact their lives |

Aboriginal policy, strengthening Aboriginal cultural heritage and communities |

|

Professional public administration |

A values-driven, high-integrity public service characterised by employees who collaborate across government and in partnership with the community and other sectors, and who use evidence to support decisions that drive the progress of Victoria socially and economically |

Advice and support to the Governor |

|

Chief Parliamentary Counsel services |

||

|

Management of Victoria’s public records |

||

|

Public administration advice and support |

||

|

State electoral roll and electoral events |

Strong policy outcomes — key initiatives

This objective pursues policy, service and administration excellence and reform. It leads the public sector response to significant state issues, policy challenges and projects. It supports the effective administration of government and the delivery of policy and projects that enable increased productivity and competitiveness in Victoria.

DPC’s outcomes on the following key initiatives have helped us achieve the ‘Strong policy outcomes’ strategic objective.

Provide support for core government systems and activities vital to the Victorian response to, and recovery from, the COVID-19 pandemic

COVID-19 communications evolved throughout 2021–22 to promote self-protective decision making, supporting public health orders and integration with COVID-19 advertising campaigns.

Behavioural insights were further applied to communications and campaigns to encourage individuals and communities to take proactive steps to protect themselves and others against COVID-19, and to adhere to public health measures.

COVID-19 communications continued to ensure consistency of message, reinforced accessibility requirements, advocated for in-language communications for First Nations and culturally diverse audiences, and facilitated collaboration across departments to ensure coronavirus.vic.gov.au remained the central source of COVID-19 information.

The Public Sector Administration Committee (PSAC) met regularly during 2021–22 to consider a range of issues connected with ensuring the public service could continue to deliver core services through the pandemic.

PSAC coordinated advice to the Emergency Management Commissioner at the beginning of 2022 on risks to critical services in the face of rising COVID-19 case numbers due to the emergence of the Omicron variant. PSAC has been a central coordination point for developing and implementing the Victorian public service (VPS) approach to flexible working, including on matters such as COVIDSafe workspaces, staff wellbeing and vaccination policy.

Suburban Hubs have been established to support flexible and remote working for VPS staff. The Health, Safety and Wellbeing team provided audit and COVIDSafe compliance support to the project team while establishing and opening the hubs.

Supporting the government’s response to COVID-19

DPC has continued to support government decision making on Victoria’s approach to COVID-19 management, including at National Cabinet. DPC played a key role in coordinating and delivering strategic communications in year 2 of the pandemic and has worked with departments to provide advice on significant policy changes throughout 2021–22. The key COVID-19 measures that DPC supported throughout 2021–22 included: delivering COVID-19 vaccinations; implementing the Victorian vaccinated economy; changing quarantine requirements for international arrivals; delivering rapid antigen tests through testing sites, schools and early childhood education and care services; and continued engagement and support for at-risk and priority communities.

Throughout the year DPC continued to collaborate with the Department of Health (DH) to deliver equitable access to vaccinations for all eligible Victorians, particularly with the increased availability of booster doses in late 2021. Extension of state sites in early 2022 ensured Victorians had safe, efficient and easy access to vaccines as soon as they were eligible. Over time the vaccination program transitioned to be predominantly delivered through primary care settings, with Victoria continuing targeted engagement and outreach to support vaccination for at-risk and priority communities.

DPC worked closely with COVID-19 Quarantine Victoria and the Commonwealth Government to deliver the Victorian Quarantine Hub, which started accepting residents from February 2022 and provides a safe place for community members to self-isolate or quarantine.

DPC collaborated with DH to implement Victoria’s new pandemic management framework under Part 8A of the Public Health and Wellbeing Act 2008. DPC briefed the Premier to consider making and extending the pandemic declaration and helped prepare reports to parliament as a key measure to promote transparency and accountability in relation to the government’s COVID-19 response. The reports are tabled in parliament and publish the Premier’s statement of reasons for making or extending a pandemic declaration. They also include advice from the Chief Health Officer and the Minister for Health in respect of the making or extending of the pandemic declaration. They summarise pandemic orders made, the public health risk powers and pandemic management powers exercised and the reasons for exercising those powers.

Supporting the Victorian Government to deliver improved health outcomes for Victorians in the context of unprecedented challenges

Working closely with DH, DPC plays a key role in ensuring the Victorian health system is prepared and supported to manage fluctuations in demand, including COVID-19 demand, across the state. This year DPC continued to provide advice to government on the investment and responses needed to respond to COVID-19, including supporting significant investments in workforce, hospital-based and primary care, critical infrastructure and equipment.

DPC has also worked closely with DH to support the recovery of Victoria’s health system — for example, the Victorian Government’s COVID Catch-Up Plan to address non-urgent surgery that had been deferred due to the pandemic.

Providing advice on current and future economic challenges and opportunities, including related to Victoria’s economic recovery from the COVID-19 pandemic

In 2021–22 DPC continued to work closely with the Department of Treasury and Finance and other departments to support the government’s economic recovery following COVID-19. This included advising on budget and fiscal strategy, industry recovery, employment, consumer affairs, local government, transport policy and infrastructure delivery. DPC also supported the Premier in the annual State Budget process and in implementing budget efficiency initiatives. Since the onset of COVID-19, DPC has actively supported the Victorian Government to identify and implement measures to assist businesses and individuals affected financially by the pandemic.

Advocate for Victoria’s interests in intergovernmental forums, including supporting the Premier at National Cabinet

In 2021–22 DPC led the provision of advice to the Premier and senior departmental officials to support their participation in a high volume of formal intergovernmental meetings. In the 12-month period DPC supported and coordinated strategic advice for more than 90 intergovernmental meetings. The highest number of meetings took place in the period from July 2021 to March 2022. Issues included vaccine rollout and implementation of the national plan for transitioning Australia’s response to COVID-19. This addressed recovery and financial measures to support workers and businesses.

DPC also provided strategic policy advice and collaborated across government to support the negotiation of key National Cabinet reform matters and priority portfolio agreements. These covered health, education and energy, maintaining a focus on Victorian priorities and maximising benefits to the Victorian community. In total, DPC helped negotiate more than 20 agreements including multilateral and bilateral Mental Health Agreements, Public Dental Services for Adults and the National Plan to End Violence against Women and Children.

Ensure strategic decision-makers are supported in their efforts to strengthen the disaster resilience and security of all Victorians, including through implementing the recommendations of state and national reviews and inquiries

Through coordination and collaboration with all Victorian Government departments, DPC has continued to strengthen emergency management arrangements and to support a strong reform agenda in response to several reviews and inquiries. These included the Inspector-General for Emergency Management (IGEM) Inquiry into the 2019–20 Victorian Fire Season, IGEM’s Review of 10 Years of Reform in the Emergency Management Sector, the COVID-19 Hotel Quarantine Inquiry and the ESTA Capability and Service Review. DPC, in partnership with Emergency Management Victoria, also continues to work with other jurisdictions through the Australia–New Zealand Emergency Management Committee to strengthen disaster resilience.

Further in 2021–22 DPC supported national counterterrorism reforms through the Australia–New Zealand Counter-Terrorism Committee. DPC also supported reforms to tackle the early warning signs of radicalisation and violent and extremist behaviour, delivering on recommendations of the Expert Panel on Terrorism and Violent Extremism Prevention and Response Powers. DPC continued to provide protective security measures for government personnel and its information and physical assets through coordinating VPS personnel vetting and the Member of Parliament Protective Security Program.

Support the Victorian Government to deliver critical social policy reforms, including recommendations from the Royal Commission into Victoria’s Mental Health System, continuing to strengthen the VET system, justice reforms, and continuing the rollout of Three-Year-Old Kindergarten

DPC has continued to support landmark social policy reforms through providing a whole of government lens to ensure their successful implementation.

In 2021–22 DPC continued to support implementation of reforms across the justice system, including helping to progress legislation to transform financial assistance for victims of crime, with the existing Victims of Crime Assistance Tribunal set to be replaced with an administrative Financial Assistance Scheme built around the needs of victims and aiming to minimise trauma. DPC also supported development of the government response to the Parliamentary Inquiry into Historical Forced Adoption in Victoria, with work underway to design Australia’s first redress scheme for historical forced adoption practices and administer an exceptional circumstances fund. DPC also continued to support work to modernise Victoria’s youth justice system via oversight of the new youth justice facility, Cherry Creek, which is set to open in mid-2023. DPC also continued to support work to modernise Victoria’s youth justice system via oversight of the new youth justice facility, Cherry Creek, which is set to open in mid-2023.

In partnership with DH, DPC has continued to support a coordinated government response to the Royal Commission into Victoria’s Mental Health System. In the year since the final report was tabled, work has begun on more than 90% of the Royal Commission’s 74 recommendations to lay the foundations for Victoria’s future mental health system.

Key achievements in 2021–22 include introducing the new Mental Health and Wellbeing Bill into the Victorian Parliament, releasing the Mental Health and Wellbeing Workforce Strategy 2021–2024 and Victoria signing the National Mental Health and Suicide Prevention Agreement. DPC also continues to work with DH to facilitate government-wide decision making to improve the mental health and wellbeing system, including a Mental Health and Wellbeing Cabinet Committee, a Mental Health and Wellbeing Victorian Secretaries’ Board Committee, a Suicide Prevention and Response Victorian Secretaries’ Board Committee and an interdepartmental Committee on Mental Health and Wellbeing Promotion.

DPC continued to play a key role in supporting the design and delivery of major education and training reforms in 2021–22. In the past year, DPC worked closely with the Department of Education and Training (DET) to strengthen the training and skills system, including:

- helping establish the Victorian Skills Authority to respond to Victoria’s training needs

- supporting the introduction of a new TAFE funding model to strengthen Victoria’s economic and social recovery and improve the sector’s financial sustainability

- progressing the Senior School Pathways Reform agenda to provide greater vocational and applied learning opportunities for school students.

During 2021–22 DPC continued to support DET’s implementation of universal funded three-year-old kindergarten. The reform has progressed according to the public rollout schedule, and in 2022 all services across the state are delivering at least 5 hours of funded three-year-old kindergarten each week. Further, DPC informed the design and ongoing implementation of the newly announced Best Start, Best Life agenda, which will overhaul early childhood education and care in Victoria including making kindergarten free from 2023 and introducing a new year of universal Pre-Prep for 4-year-olds.

Support the successful delivery of the Victorian Government’s Big Housing Build to help increase the state’s social housing supply by 10% in 4 years and support Victorians in need

DPC continues to support the work of Homes Victoria in delivering the Big Housing Build, including through key governance forums and ongoing engagement in policy reform to enable system improvements. DPC co-chairs the Housing Interdepartmental Committee, supporting coordinated discussion of housing policy issues across government, and is a member of a range of other governance forums across the housing portfolio. DPC will continue to support regular reporting on delivering the Big Housing Build to the Victorian Government, to support appropriate oversight and monitoring of this generational reform to the social housing system.

Provide clear, timely and practical guidance, expertise and support to our stakeholders in relation to Cabinet, parliament, legislation, Executive Council and ministerial correspondence-related matters

In 2021–22 DPC provided strong policy advice and administration to support Cabinet, parliament, legislation, Executive Council and ministerial correspondence matters. This included guidance and support for the Premier and DPC ministers, as well as across all departments and the ministry where needed, as well as for the Governor in relation to Executive Council matters.

Provide behavioural science capability to all Victorian Government departments to support the delivery of behaviourally informed programs and services

Throughout 2021–22 the Behavioural Insights Unit provided advice and research support and delivered projects across a range of policies and services. This included the uptake of grant initiatives, enhancing the accessibility of forms and website communications and improving internal government processes such as procurement and recruitment activity.

The Behavioural Insights Unit also continued to support departments and agencies to understand the likely impact of policies and programs on Victorians’ behaviours in relation to COVID-19. The unit used international evidence to support effective implementation of policies, programs and communications for COVID-19–related requirements, including getting vaccinated, mask wearing and other COVIDSafe behaviours.

Provide central media relations, communications, advertising and research governance advisory services to Victorian departments and stakeholders in relation to private and ministerial offices

DPC’s Strategic Communications, Engagement and Protocol Branch delivered a range of products and services including speeches, media releases, internal communications and events, video production, photography and live streaming throughout 2021–22. It also fulfilled its key role of coordinating and delivering COVID-19 strategic communications.

As part of its strategic governance and central advisory role for all government advertising campaigns, DPC:

- ensured adherence to the Victorian Government Communication Guidelines and relevant legislation

- supported the consistent development of campaign creative and media buying across government

- provided strategic advice on communicating with diverse and regional audiences

- led coordinated communications for COVID-19 policies and projects to ensure a consistent and cohesive approach across government.

DPC’s dedicated media team provided media and communications support to the department. In 2021–22 the team:

- developed whole of government media protocols for enquiries on the Yoorrook Justice Commission

- led on support for major ministerial announcements around Treaty negotiations with the First Peoples’ Assembly of Victoria

- supported a partnership between Digital Victoria and Code Like a Girl

- supported the role of the Service Victoria app in the state’s COVID-19 response.

DPC developed and delivered communication strategies to support campaigns and announcements including the Recognition Matters campaign, the Diversity on Boards campaign and VPS-wide COVID-19–related internal communications and announcements. Products included more than 115 videos covering content including on the State Budget, NAIDOC Week live events and milestones such as the path to Treaty, Truth and Justice for First Peoples in Victoria.

DPC’s Protocol and Events team provided strategic advice and oversight of the protocol policies and functions of government and delivered numerous events, visits and meetings including Australia Day public events and programs; the ANZAC Day State Luncheon; facilitation support for the QUAD Foreign Ministers’ Meeting and Commonwealth Games Federation delegation visit; and significant ceremonial events including the State Memorial Services for Victoria Police and Mr Shane Warne AO.

Support strong policy outcomes for First Peoples by driving whole of government policy and reform in the Treaty and First Peoples portfolio

In 2021–22 DPC, primarily through the First Peoples–State Relations group, continued to drive both whole of government and internal Aboriginal affairs policy and reform in partnership with First Peoples. A key milestone was establishing the DPC Board of Management Subcommittee on Self-Determination Reform. The subcommittee has an advisory role and supports DPC to progress significant reform underway in the Treaty and First Peoples portfolio such as progressing treaty; responding to and supporting the Yoorrook Justice Commission; leading whole of government reform under the National Agreement on Closing the Gap and the Victorian Aboriginal Affairs Framework 2018–2023 (VAAF); and promoting cultural rights. The subcommittee also performs a key role in improving internal systems, policies and processes to enable self-determination.

In March 2022 DPC, in partnership with the Department of Justice and Community Safety, set up the landmark $155 million Stolen Generations Reparations Package. The package is testament to the strength of Stolen Generations and their families, who have long fought for justice. To ensure the package was developed for and by Stolen Generation survivors, DPC established the community-led Stolen Generations Reparations Steering Committee to lead engagement on the package’s design. Assessment of applications is underway, with some advance payments to people who are terminally or critically ill. DPC will continue to work alongside the Department of Justice and Community Safety to ensure the package meets community expectations.

DPC is driving preparation across government to support Victoria’s ongoing treaty process. To build capability for this critical work, DPC is engaging with Victorian Government departments and agencies to ensure government is ready to respond to the transformational change that treaty is expected to bring. This includes a Treaty Interdepartmental Committee of senior representatives and a working-level network of Treaty Coordinators from each government department to facilitate whole of government engagement.

Support the delivery of energy, climate change and environmental priorities

In 2021–22 DPC supported the Premier, departments (including the departments of Environment, Land, Water and Planning and Jobs, Precincts and Regions) and government entities in delivering the government’s energy, resources and environment commitments including:

- launching the second Victorian Renewable Energy Target Auction to bring online at least 600 megawatts of new renewable energy capacity in Victoria

- steps to establish Australia’s first offshore wind industry including through the announcement of offshore wind targets of 2 gigawatts (GW) by 2032, 4GW by 2035 and 9GW by 2040

- securing the future of gas in Victoria by remaking the Petroleum Regulations 2021 to safely govern the onshore conventional gas sector and developing the Gas Substitution Roadmap to guide the transition to sustainable gas alternatives and greater electrification

- supporting Victorian energy consumers through the extension of the $250 Power Saving Bonus for concession card holders until 30 June 2022 and eligibility expansion of the payment to all Victorian households from 1 July 2022

- introducing legislation to reform governance arrangements for Victoria’s alpine sector, including establishing the new statutory authority, Alpine Resorts Victoria

- supporting the release of the Marine and Coastal Strategy, Victoria’s first 5-year implementation plan to support sustainable use and improve how marine and coastal environments are managed

- continuing to support circular economy reforms including introducing Recycling Victoria as the new waste and recycling sector regulator and developing Victoria’s Container Deposit Scheme.

Support delivery of the government’s infrastructure program

In 2021–22 DPC continued to work with the Department of Transport and the Major Transport Infrastructure Authority on many of the major transport projects in construction including the Level Crossing Removal Project, Metro Tunnel Project, North East Link Project, West Gate Tunnel Project and multiple road upgrades. The government has 165 major road and rail projects being constructed or planned at an investment of $90 billion and the creation of more than 18,000 jobs. DPC has also continued to work across government in supporting the Suburban Rail Loop Authority to progress the Suburban Rail Loop project.

DPC worked with partners across government and, in particular, the Department of Environment, Land, Water and Planning to introduce new planning pathways for state projects including establishing the State Project Concierge service.

Support to establish Breakthrough Victoria and administration of the Victorian Jobs and Investment Fund

In 2021–22 DPC has:

- supported the establishment and early operation of Breakthrough Victoria Pty Ltd as a government-owned company to administer the $2 billion Breakthrough Victoria Fund. This fund is supporting research and technology commercialisation in the health and life sciences, digital technology, advanced manufacturing, agri-food and clean economy sectors to deliver economic and societal outcomes and grow jobs

- administered the Victorian Jobs and Investment Fund, a whole of government framework that governs investment attraction programs across multiple departments. In 2021–22 the fund helped secure more than 3,800 new jobs and over $850 million in new investment.

Support the efficient operation of markets and appropriate consumer protections

DPC has worked with the departments of Justice and Community Safety and Treasury and Finance to improve the design of government regulation to protect consumers while minimising costs on businesses and the community. In 2021–22 this included changes to casino regulation in response to the Royal Commission into the Casino Operator and Licence, establishing new gambling and liquor regulators, decriminalising sex work in Victoria, adopting an automatic mutual recognition scheme for occupational licences and various projects funded through the Regulatory Reform Incentive Fund.

Support engagement with international partners to improve investment, trade and other whole of government outcomes

DPC has worked across government in 2021–22 to further Victoria’s international engagement objectives by:

- supporting whole of government cooperation with key international partners to promote trade, investment and cultural and education ties that benefit Victorians, including facilitating engagement between the diplomatic community and Victorian leaders including the Premier and Governor

- collaborating with Asia Society Australia and the Australia-India Institute to enhance Victoria’s connections to, engagement with and knowledge of Asia

- supporting foreign investment through the Victorian Jobs and Investment Fund.

Digital government and communications

Drive digital transformation through a whole of government digital strategy, creating a cohesive and modern approach to ICT and taking a more agile and coordinated approach to funding digital initiatives

Digital Victoria launched the Victorian Government Digital Strategy 2021–2026 in November 2021. The strategy provides a blueprint for how the Victorian Government will accelerate change and invest in the digital infrastructure and skills required to serve the people and businesses of Victoria over the next 5 years. It sets the vision to:

- enable better, fairer and more accessible services

- create a digital-ready public sector

- grow a thriving digital economy.

Digital Victoria has made significant progress in delivering important strategic and foundational activities to ensure transformation efforts focus on what is critical to deliver the vision. This includes the transition to common, connected platforms that reduce complexity and unlock productivity and delivering strategic investment models to coordinate investment in digital services to improve the Victorian citizen experience.

Deliver better customer experiences through insightful design and public engagement, improving trust and participation with the Victorian Government

Engage Victoria is the government’s online consultation platform that enables Victorians to share their ideas and opinions and converse with others on a range of policies, programs, issues and topics relevant to Victoria. In 2021–22 Engage Victoria conducted 208 consultations across all government departments and 8 agencies including Parks Victoria, the Environment Protection Authority and the Major Transport Infrastructure Authority. It received more than 1,064,000 visitors and over 93,000 pieces of feedback on the platform. Victorians took part in many important consultations including the Annual Victoria Police Community Sentiment Survey, shaping Homes Victoria’s new social housing development and contributing to the design of critical transport projects including North East Link and the Suburban Rail Loop.

Digital Victoria has continued to embed human-centred design across government to ensure services align with the needs of Victorians. In 2021–22 the human-centred design website was visited more than 31,400 times and over 2,500 copies of the playbook have been downloaded. Training was delivered to 600 people from 81 government entities and departments from across the VPS.

Implement a cyber security strategy that focuses on the safe and reliable delivery of government services and better protects businesses and the community from the growing threat of cyber crime

Digital Victoria launched Victoria’s Cyber Strategy in September 2021, setting the government’s cyber agenda for the next 5 years. Three outcomes underpin the strategy: the safe and reliable delivery of government services; a cyber safe place to work, live and learn; and creating a vibrant cyber economy.

Throughout 2021–22 Digital Victoria worked with public sector departments and agencies to grow the adoption of baseline security controls and improve protection of government services. To combat email authentication risks Digital Victoria is leading the public sector’s implementation of Domain-based Message Authentication, Reporting and Conformance across all departments, agencies and local councils.

Digital Victoria has further contributed to the cyber maturity of Victorian public bodies through the ongoing delivery of cyber security training, programs uplifting cloud security and increasing public sector visibility of Victoria’s mitigation strategy maturity.

Unlock improved service delivery by using data, analytics and artificial intelligence to better identify and understand Victoria’s needs

In 2021–22 the Victorian Centre for Data Insights (VCDI) led data-driven initiatives to improve policy design, service delivery and efficiency across the Victorian Government while ensuring data is used safely, securely, legally and ethically.

VCDI supported the government’s COVID-19 response and recovery activity by enabling rapid reporting and analysis on public health and economic impacts while also accelerating data sharing between Victoria and other Australian jurisdictions through new data sharing policy initiatives.

VCDI expanded its strategic partnerships program, engaging with government departments and agencies on more than 15 initiatives to uplift data analytics, management, governance and strategic and technical capabilities. The program also supported critical government priorities including in the response to the Royal Commission into Victoria’s Mental Health System, Regional Economic Development Strategies and Local Jobs First Policy.

Provide open government data to the public in a safe, secure, lawful and ethical way, empowering our public and private sectors to make better decisions and strengthening collaboration with our digital and technology industry

Through the government’s open data portal ( data.vic.gov.au), Digital Victoria has supported the public to search, discover and access Victorian Government data. Vicmap data, Victoria’s foundational spatial data, and data relating to school zones, water fluoridation and real-time train positions, is available from the portal. In 2021–22 the portal saw a record 721,612 sessions, up from 432,729 sessions in the previous year due to public demand for COVID-19 data.

Digital Victoria engaged in extensive VPS and public consultation, finalising its review of the DataVic Access Policy in September 2021. It is expected that an updated Open Data Policy will be released in 2022–23, refreshing the government’s commitment and practice of safely and ethically releasing government data for public reuse.

Digital Victoria also continued to work with citizens and industry to identify opportunities and to promote the government’s open data, including through its sponsorship of GovHack.

Prioritise open and efficient ICT spend and purchasing processes to reduce costs, improve procurement outcomes and support our local small and medium technology enterprises

Digital Victoria has led a number of ICT procurement and investment reform activities throughout 2021–22 to maximise value for the Victorian public sector.

The Victorian Government IT Dashboard (https://itdashboard.digital.vic.gov.au) was updated quarterly to provide the Victorian public with transparency of government ICT projects with a total value of $1 million or more.

Six State Purchase Contracts with an annual spend of $440 million delivered estimated financial benefits exceeding $100 million. Digital Victoria also began work on developing Digital Marketplace — a centralised online platform for the government to procure ICT and infrastructure more effectively. The Digital Marketplace will simplify and enhance the procurement process for small, local and social businesses to do business with government. A proof of concept was delivered in June 2022. The minimal viable product is now under development.

Create common corporate and public digital platforms across all government departments to improve productivity and staff experience

Digital Victoria continued to modernise departmental processes through the operation and delivery of common platforms that are accessible across government including the Common Corporate Platforms Program, Single Digital Presence (SDP), Digital Public Notices and the whole of government Application Programming Interface (API) Capability Program.

During 2021–22 the Common Corporate Platform program, which focuses on the design and implementation of modern, cloud-based platforms and standardised processes for human capital management, finance and procurement functions, has:

- established a portfolio governance board

- developed an implementation roadmap

- aligned human resources processes across government

- developed the whole of government platform for human capital management and integrated the first modules — Recruitment, Onboarding, Employee Central and Employee Central Payroll — into the platform.

The SDP program has continued to make it easier for Victorians to find, access, understand and use Victorian Government information. In 2021–22 the program enhanced the platform’s security, safety and reliability, improved its governance and processes, and delivered training programs to uplift capability across government. More than 50 web presences were delivered using SDP in 2021–22, with representation from 7 departments and various other organisations and agencies. More than 500 VPS staff now use the platform’s content management system, and the SDP community of practice continues to evolve and grow with more than 600 registered members. The year also saw more than 300 participants undertake writing for the web sessions, with another 130 attending Google Analytics training — both programs helping to upskill the VPS to deliver improved online experiences.

Digital Victoria’s API Capability Program supported departments and agencies to securely connect their systems and applications to other systems and data sources and to find or update data in real time. During 2021–22 the API program implemented, supported and contributed to critical government priorities including:

- the state’s COVID-19 emergency response

- contact tracing API for tracking positive COVID-19 infection spikes

- integrating systems between Family Safety Victoria, Victoria Police and Court Services Victoria to facilitate data sharing

- integrating Court Services Victoria’s systems with the Department of Justice and Community Safety.

In addition, the program also built integrations with the Commonwealth Government’s document verification services, which helped determine eligibility for various individual and business grants.

Enhance customer experience with more digital services for Victorians

Service Victoria has continued to modernise, expand and personalise government services in 2021–22.

New services were added to Service Victoria’s website and app, including the Sick Pay Guarantee, Disability Worker Registration Screening, Victorian Travel Voucher Scheme, Seniors Travel vouchers and Get Active Kids vouchers.

More than a billion transactions took place between Victorians and the government, and the Service Victoria app was the most downloaded in the country after being installed on 6.6 million devices.

Service Victoria also played an important role in Victoria’s COVID-19 response, enabling rapid deployment of a range of digital services including supporting Victoria to be the first jurisdiction to help customers add their COVID-19 vaccination certificate to their contact tracing check-ins.

Industrial Relations

Drive cooperative and productive workplace relations in the Victorian public sector by developing and facilitating compliance with the Victorian Government’s industrial relations policy and overseeing the timely and efficient resolution of enterprise bargaining

In 2021–22 DPC’s Industrial Relations Victoria (IRV) provided leadership and support on public sector bargaining matters. This included assisting portfolio departments and agencies to finalise about 80 new public sector enterprise agreements during the transitional period in the lead up to the 1 January 2022 introduction of the new wages policy. IRV, with the Department of Treasury and Finance, led on developing the new wages policy and its implementation.

IRV worked with VPS employers and other stakeholders to develop and publish 35 common practice policies to support the consistent application of the current Victorian Public Service Enterprise Agreement.

Deliver and support policy and legislative reform that contributes to fair, productive and secure Victorian workplaces, including promoting gender pay equity

Following an in-depth review of the Child Employment Act 2003, IRV developed the Child Employment Amendment Bill 2022, which makes amendments to the Act to improve the child employment regulatory framework and strengthen protections for children in the workplace. The Bill received royal assent on 28 June 2022.

IRV has led development of submissions to significant legal proceedings in the past year, advocating for:

- secure and fair employment in a range of settings

- increases to the national minimum wage under the Fair Work Commission’s Annual Wage Review process

- paid family and domestic violence leave

- a historic minimum wage floor for piece rates in the Horticulture Award.

IRV has also contributed to other whole of government submissions to the Commonwealth and the Fair Work Commission on:

- supporting fair treatment for Pacific workers through labour mobility initiatives and seasonal worker programs

- supporting wage increases for aged-care workers in recognition of the increased complexity and responsibility of their work and historical gendered undervaluing.