- Published by:

- Department of Premier and Cabinet

- Date:

- 29 Oct 2021

DPC’s 2020–21 Annual Report and accompanying financial statements present a summary of the department’s performance over the 2020–21 financial year.

Further information about DPC portfolio entities can be obtained, where applicable, from their individual 2020–21 annual reports.

Responsible body’s declaration

"In accordance with the Financial Management Act 1994, I am pleased to present the Department of Premier and Cabinet’s annual report for the year ending 30 June 2021."

Jeremi Moule, Secretary

October 2021

Secretary’s foreword

The Department of Premier and Cabinet (DPC) leads and coordinates the whole of government policies and performance that serves all Victorians.

2020–21 was a demanding year for all Victorians. The response to the impact of COVID-19 was and will remain a major focus for government as we navigate through recovery and our new ways of living and working.

The demands of work, while also navigating the impacts of public health directions on our personal lives, has been an enormous challenge for our people, as it has been for all Victorians.

In rising to these challenges, many parts of the Victorian public service and the public sector have changed the ways in which we work. In our adaption to fast-changing circumstances, we have never been more responsive, more innovative, and more collaborative in delivering and advising on the policies and services of government.

In addition to adapting and responding to COVID-19 challenges, DPC has also changed to reflect the priorities of the government.

This is exemplified in the establishment of the First Peoples–State Relations group in April 2021. This group is charged with leading the delivery of lasting change and strengthening self-determination for Aboriginal Victorians and Traditional Owners by prioritising work on treaty and truth.

In the short term, the First Peoples–State Relations group has also worked closely across government and with community to deliver self-determined, place-based responses to COVID-19 impacts. One such response includes the $10 million COVID-19 Aboriginal Community Response and Recovery Fund as part of a $23 million whole of Victorian government Aboriginal-specific COVID-19 package.

DPC also established Digital Victoria to streamline and accelerate digital reform across government and to contribute data analytics more easily to better inform decision-making.

More broadly, DPC continues to demonstrate our unwavering commitment to leading strong policy outcomes, and professional public administration.

Since its establishment in DPC in 2019, the work of the Fairer Victoria group has centred on fostering inclusive and engaged communities, including across the equality, multicultural affairs, veterans, women and youth portfolios. In February 2021, Fairer Victoria transferred from DPC to the Department of Families, Fairness and Housing. Its place in this newly created department brings together a dedicated focus to improve outcomes for the most vulnerable in Victoria.

Within DPC, this priority is not lost. Two years after its establishment, the Royal Commission into Victoria’s Mental Health System handed down its final report on 2 March 2021. Following the government’s acceptance of the Report’s 65 recommendations, DPC has worked closely with the Department of Health to support the planning and delivery of reforms to Victoria’s mental health system and services.

In March 2021 DPC supported the establishment of Breakthrough Victoria Pty Ltd to oversee the Breakthrough Victoria Fund. The fund, which was announced in the 2020–21 Victorian Budget, will drive investment in research and innovation in Victoria, and support Victoria’s economic recovery.

It is difficult to fulsomely list all of DPC’s achievements in 2020–21, but the breadth of information in this annual report describes and accounts for that activity.

I am extremely proud to lead a department and a public service that has shown tremendous resilience and the utmost dedication to improving outcomes for our citizens, businesses, and each other.

I look forward to continuing to work alongside my colleagues at DPC and the Victorian Secretaries’ Board to drive a high performing and professional public service for all Victorians.

Jeremi Moule

Secretary

About us

DPC’s vision is to be a recognised and respected leader in whole of Victorian government policy and performance.

Our vision

The Department of Premier and Cabinet’s (DPC’s) vision is to be a recognised and respected leader in whole of Victorian government (WoVG) policy and performance.

Our mission

DPC’s mission is to support the people of Victoria by:

- helping government achieve its strategic objectives

- providing leadership to the public sector to improve its effectiveness

- promoting collaboration across government to drive performance and improve outcomes.

DPC supports the Victorian Government’s commitment to a stronger, fairer, better Victoria by promoting excellence in government service delivery and reform.

Our values

DPC upholds the public sector values as outlined in the Public Administration Act 2004(opens in a new window).

Responsiveness

- Providing frank, impartial and timely advice to the government.

- Providing high-quality services to the Victorian community.

- Identifying and promoting best practice.

Integrity

- Being honest, open and transparent in our dealings.

- Using powers responsibly.

- Reporting improper conduct.

- Avoiding any real or apparent conflicts of interest.

- Striving to earn and sustain public trust of a high level.

Impartiality

- Making decisions and providing advice on merit without bias, caprice, favouritism or self-interest.

- Acting fairly by objectively considering all relevant facts and applying fair criteria.

- Implementing government policies and programs equitably.

Accountability

- Working to clear objectives in a transparent manner.

- Accepting responsibility for our decisions and actions.

- Seeking to achieve best use of resources.

- Submitting ourselves to appropriate scrutiny.

Respect

- Treating others fairly and objectively.

- Ensuring freedom from discrimination, harassment and bullying.

- Using others’ views to improve outcomes on an ongoing basis.

Leadership

- Actively implementing, promoting and supporting these values.

Commitment to human rights

- Making decisions and providing advice consistent with the human rights set out in the Charter of Human Rights and Responsibilities Act 2006(opens in a new window).

- Actively implementing, promoting and supporting human rights.

Our objectives

DPC’s objectives are as follows.

Strong policy outcomes

- Pursuing policy and service delivery excellence and reform.

- Leading the public sector response to significant state issues, policy challenges and projects.

- Supporting the effective administration of government.

Engaged citizens

- Supporting and promoting full participation in strong and vibrant communities.

- Empowering citizens to participate in policymaking and service design.

- Ensuring a holistic approach to social policy and service delivery.

Professional public administration

- Fostering and promoting a high-performing public service.

- Ensuring effective whole of government performance and outcomes.

- Protecting the values of good public governance, integrity and accountability in support of public trust.

High-performing DPC

- Empowering our people and investing in our culture.

- Ensuring efficient and effective processes and systems.

- Ensuring good governance and risk management.

Our ministers

The below ministers are supported by DPC.

Premier of Victoria

The Hon Daniel Andrews MP

The Premier is Victoria’s head of government. DPC advises and supports the Premier and his portfolio.

The Premier is the main channel of communication between the Governor, as Head of State, and Cabinet, and between the Victorian Government and other state and territory governments.

The following DPC entity is a part of the Premier’s portfolio:

- Office of the Governor.

Contact details

1 Treasury Place

East Melbourne VIC 3002

Email: daniel.andrews@parliament.vic.gov.au

Website: www.premier.vic.gov.au

Minister for Government Services

The Hon Danny Pearson MP

DPC advises and supports the Minister for Government Services and his portfolio, which includes Digital Victoria and public sector administration and reform.

The Minister for Government Services is also responsible for the following DPC portfolio entities:

- Cenitex

- Office of the Chief Parliamentary Counsel

- Office of the Victorian Government Architect

- Public Record Office Victoria

- Service Victoria

- Victorian Electoral Commission

- Victorian Independent Remuneration Tribunal

- Victorian Public Sector Commission.

In addition to his DPC responsibilities, Minister Pearson is the Assistant Treasurer, Minister for Regulatory Reform and Minister for Creative Industries.

Contact details

1 Macarthur Street

East Melbourne VIC 3002

Email: danny.pearson@parliament.vic.gov.au

Website: www.dannypearson.com.au

Minister for Industrial Relations

Tim Pallas MP

DPC advises and supports the Minister for Industrial Relations and his portfolio. This includes DPC’s Industrial Relations Victoria who work towards achieving a positive working environment for all Victorians.

The Minister for Industrial Relations is also responsible for the following DPC portfolio entities:

- Labour Hire Authority

- Portable Long Service Authority.

In addition to his DPC responsibilities, Minister Pallas is the Treasurer and the Minister for Economic Development.

Contact details

1 Treasury Place

East Melbourne VIC 3002

Email: tim.pallas@parliament.vic.gov.au

Website: www.timpallas.com.au

Minister for Aboriginal Affairs

Gabrielle Williams MP

DPC advises and supports the Minister for Aboriginal Affairs and her portfolio. This includes oversight of First Peoples–State Relations, who focus on promoting cultural rights, self-determination, treaty and truth.

The Minister for Aboriginal Affairs is also responsible for the following DPC portfolio entity:

- Victorian Aboriginal Heritage Council.

In addition to her DPC responsibilities, Minister Williams is the Minister for Women and Prevention of Family Violence.

Contact details

50 Lonsdale Street

Melbourne VIC 3000

Email: gabrielle.williams@parliament.vic.gov.au

Website: www.gabriellewilliams.com.au

Other officials

Sonya Kilkenny MP, Cabinet Secretary

DPC’s Cabinet Office provides support to the Cabinet Secretary for the operations of the Cabinet process and supports the Cabinet Secretary in her role.

Contact details

Email: sonya.kilkenny@parliament.vic.gov.au

Steve Dimopoulos MP, Parliamentary Secretary to the Premier

Mr Dimopoulos assists the Premier with his portfolio responsibilities.

Contact details

Email: steve.dimopoulos@parliament.vic.gov.au

Website: www.stevedimopoulos.com.au

Organisational chart

As at 30 June 2021:

The Secretary is Jeremi Moule, who leads the department comprised of 7 groups and its associated entities and agencies.

Department of Premier and Cabinet

Secretary, Jeremi Moule

Office of the Secretary

Executive Director, Jane Gardam

Recovery Tracking & Analytics

Executive Director, Marcus Walsh

Legal, Legislation & Governance

Deputy Secretary & General Counsel, Toby Hemming

Governance

Executive Director, Vicky Hudson

Office of the General Counsel

Executive Director & Deputy General Counsel, Miriam Holmes

Digital Victoria

A/Chief Executive Officer, Vivien Allimonos

Digital Strategy & Transformation

Executive Director, Lisa Tepper

Cyber Security

Chief Information Security Officer, John O’Driscoll

Victorian Centre for Data Insights

Chief Data Officer, Julian Hebden

Digital Design & Innovation

Executive Director, Jithma Beneragama

Cabinet, Communications & Corporate

Deputy Secretary, Vivien Allimonos

Cabinet Office

A/Executive Director, Rachel Cowling

Corporate Services

Executive Director, Genevieve Dolan

Corporate Governance

Director, Evelyn Loh

Public Sector Reform

Executive Director, Sam Hannah-Rankin

Strategic Communications, Engagement & Protocol

A/Executive Director, Fin Bird

Social Policy & Intergovernmental Relations

Deputy Secretary, Kate Houghton

COVID-19 Coordination & Performance / Social Recovery Families, Fairness & Housing

Executive Director, Lucy Toovey

Health / Mental Health

Executive Director, Sam Trobe

Education / Justice / Community Security & Emergency Management

Executive Director, Rebecca Jarvis

Intergovernmental Strategy

Director, Hugh Thomas

Office of the Family Violence Implementation Monitor

Director, Shasta Holland

Economic Policy & State Productivity

A/Deputy Secretary, Chris Miller

Economic Development

A/Executive Director, Sophie Colquitt

Infrastructure, Planning & Major Projects

A/Executive Director, Nanette Fitzgerald

Economic Strategy

Executive Director, Heather Ridley

International & Events / Breakthrough Fund

Executive Director, Rob Holland

Energy, Resources & Environment

Executive Director, Matt Minchin

First Peoples–State Relations

A/Deputy Secretary, Elly Patira

Traditional Owner Relationships and Heritage

Executive Director, Tim Kanoa

Treaty Negotiations and Strategy

Lead Negotiator, Shen Narayanasamy

Self-Determination Policy and Transformation

Executive Director, Travis Lovett

Industrial Relations Victoria

Deputy Secretary, Matt O’Connor

Private Sector

Executive Director, Lissa Zass

Public Sector

Executive Director, Kath Fawcett

Portfolio entities

Administrative Offices

- Office of the Governor

- Office of the Chief Parliamentary Counsel

- Office of the Victorian Government Architect

- Public Record Office Victoria

- Service Victoria

Other entities

- Victorian Public Sector Commission

- Special bodies

- Victorian Electoral Commission

- Electoral Boundaries Commission

- Victorian Independent Remuneration Tribunal

Public entities

- Breakthrough Victoria Fund Pty Ltd

- Cenitex

- Labour Hire Authority

- Portable Long Service Authority

- Victorian Aboriginal Heritage Council

Who we are

Find changes to the department, our groups, senior executives, administrative offices and other entities.

Changes to the department during 2020–21

On 1 July 2020, following machinery of government (MoG) changes, Bushfire Recovery Victoria transferred from DPC to the Department of Justice and Community Safety. Bushfire Recovery Victoria was established in January 2020 at DPC to help regions rebuild and recover after the 2019–20 Eastern Victorian bushfires.

Also on 1 July the Service Systems Reform branch transferred from DPC to the Department of Jobs, Precincts and Regions. Service Systems Reform oversees a program of WoVG policy development and reforms that aim to improve social and economic outcomes for Victorians.

On 1 August 2020 Cenitex was transferred from the Department of Treasury and Finance to DPC, to align with the Digital Victoria group. Cenitex provides reliable, robust and contemporary shared ICT services and technology to its government department and agency customers.

Further MoG changes, effective from 1 December 2020, saw the Jobs and Skills Exchange, a job-matching platform to support workforce mobility across the Victorian public service (VPS), transferred from DPC to a DPC portfolio entity — the Victorian Public Sector Commission.

On 1 February 2021 DPC’s Fairer Victoria group and associated portfolio entities (Respect Victoria, Queen Victoria Women’s Centre Trust, Victorian Multicultural Commission, LanguageLoop, the Shrine of Remembrance Trustees and Victorian Veterans Council) transferred to the Department of Families, Fairness and Housing.

Fairer Victoria supported the ministerial portfolios of equality, multicultural affairs, prevention of family violence, veterans, women and youth.

Our groups

DPC consists of seven groups:

- Legal, Legislation and Governance

- Digital Victoria

- Cabinet, Communications and Corporate

- Social Policy and Intergovernmental Relations

- Economic Policy and State Productivity

- First Peoples–State Relations

- Industrial Relations Victoria.

Legal, Legislation and Governance

The Legal, Legislation and Governance group delivers public sector legal, legislation and governance expertise and combines the Office of the General Counsel (OGC) and the Governance Branch.

OGC provides legal and policy advice, including in the areas of administrative, constitutional and corporate law. OGC’s policy focus is on issues in the Premier’s and the Minister for Government Services’ portfolios, principally in relation to Victoria’s public sector, electoral system and subordinate legislation. OGC also supports DPC in developing legislative and regulatory proposals and manages the department’s freedom of information functions.

The Governance Branch unifies DPC’s efforts to promote good governance and public administration, high-quality decision and policymaking, government integrity and accountability, and trust in public institutions.

Digital Victoria

The Digital Victoria group was established in April 2021 to drive digital transformation across the Victorian Government. Digital Victoria connects Victoria’s public digital and information technology infrastructure, making it easier for business, communities and citizens to connect with government and to foster Victoria’s digital economy. Digital Victoria will define Victoria’s digital strategy for 2021–2026, champion the use of data and new technologies and guide and support the public service to create efficiencies and collaborate to better serve Victorians. The branches that make up the group are: Digital Strategy and Transformation; Digital Design and Innovation; Victorian Centre for Data Insights; and Cyber Security.

Cabinet, Communications and Corporate

The Cabinet, Communications and Corporate (CCC) group provides services and VPS-wide advice to support robust public administration and promote DPC’s role as the First Minister’s department. CCC provides timely and practical guidance on the operation of Cabinet, Cabinet Committees and the Executive Council. The group leads work to support DPC to meet integrity, financial accountability and institutional governance obligations to parliament and ministers and provides specialist communication, event, behavioural insights and protocol advice across government. CCC also provides the operational backbone to DPC and its entities through finance; operations; people and culture; and procurement services and assistance.

Social Policy and Intergovernmental Relations

The Social Policy and Intergovernmental Relations group brings together social policy expertise with coordination of the State’s intergovernmental relations. The group provides policy advice on the following portfolios: health; mental health; education; justice; community security and emergency management; and families, fairness and housing. The group also leads oversight and coordination of intergovernmental advice, COVID-19 pandemic response efforts and the government’s response to the Royal Commission into Victoria’s Mental Health System. It also supports the Office of the Family Violence Reform Implementation Monitor.

Economic Policy and State Productivity

The Economic Policy and State Productivity group leads economic policy advice to the Premier and Cabinet. The group works in collaboration with relevant departments and agencies to ensure a coordinated WoVG approach to policy and projects in the areas of economic development and recovery; fiscal strategy; regional and suburban development; local government outcomes; regulatory reform; consumer affairs; gambling; racing; major events; workplace safety; international engagement; infrastructure; planning; precincts; transport; energy; agriculture; resources; and the environment.

First Peoples–State Relations

The First Peoples–State Relations group was established in April 2021 and is responsible for an extensive program of nation-leading work in the areas of cultural rights, self-determination, treaty and truth with First Peoples. The group recognises Victoria’s First Peoples as the self-determining drivers of Aboriginal affairs in Victoria and is committed to building ongoing, just and respectful relationships between self-determining First Peoples and the State. The group performs statutory functions under the Aboriginal Heritage Act 2006 and works with First Peoples on cultural heritage management and protection in ways which recognise the leading role of strong and engaged Traditional Owners.

Industrial Relations Victoria

The Industrial Relations Victoria (IRV) group provides strategic industrial relations legislative, policy and technical advice to government and departments. IRV engages with Victorian employers, employees and their representatives to support a positive industrial relations environment, and to advocate for fair and productive workplaces, secure work and gender pay equity. IRV also oversees industrial relations matters and enterprise bargaining policy and processes across the Victorian public sector. IRV consists of three branches: Private Sector Industrial Relations, Public Sector Industrial Relations, Wage Inspectorate Victoria and the Office of the Deputy Secretary.

DPC’s senior executives

Secretary

Jeremi Moule was appointed as the Secretary of DPC in October 2020. Prior to this role, he was DPC’s Deputy Secretary of Governance Policy and Coordination, a position he held since August 2018.

Jeremi has held various executive positions in the Victorian and South Australian public services over a 17-year period. He started his career as a journalist and was the CEO of a registered training organisation. Jeremi lives in Bendigo and has worked extensively in regional Victoria.

He holds a journalism degree from the University of South Australia and is a graduate of the Australian Institute of Company Directors.

Deputy Secretary, Cabinet, Communications and Corporate & A/Chief Executive Officer, Digital Victoria

Vivien Allimonos was appointed to the role of Deputy Secretary of Governance and Policy Coordination (now Cabinet, Communications and Corporate) in March 2021. Vivien also acted as the Chief Executive Officer of Digital Victoria until September 2021. Prior to DPC, Vivien was the Chief Communications Officer at the Department of Education and Training. Vivien has more than 20 years’ experience in public administration, with a focus on international affairs, trade and communications. She has held various executive positions in the Victorian and Australian public services as well as the US State Department. She holds an honours degree in commerce/arts from the University of Melbourne and was listed in IPAA Victoria’s Top 50 Public Sector Women 2020.

Deputy Secretary, Economic Policy and State Productivity

Tim Ada began in the role of Deputy Secretary of Economic Policy and State Productivity in April 2019. Previously, Tim was Deputy Secretary of the Department of Jobs, Precincts and Regions, where he was responsible for the strategic development of key industry sectors including manufacturing, life sciences, international education, and the delivery of telecommunications and employment programs.

Tim has a Master of Agriculture Sciences from the University of Melbourne. He grew up in rural Victoria.

Chris Miller is acting in the role of Deputy Secretary of Economic Policy and State Productivity for the period from April to October 2021. Chris substantively serves as Executive Director of the Infrastructure, Planning and Major Projects Branch at DPC.

Deputy Secretary, First Peoples–State Relations

Elly Patira was appointed as the Acting Deputy Secretary of First Peoples–State Relations in April 2021. Elly is a lawyer and policy adviser with broad experience across constitutional, Indigenous and minority rights law and policy, both domestically and internationally. She holds a Bachelor of Arts and JD (Juris Doctor) from the University of Melbourne and a Master of International Human Rights Law from the University of Oxford. Elly has held various executive positions in the Aboriginal Affairs portfolio at DPC. Elly has previously worked as an academic, in the corporate sector, for Aboriginal organisations and as an adviser during the Fijian constitution-making process.

As Acting Deputy Secretary, Elly is responsible for an extensive program of priority work with First Peoples in the areas of treaty, truth and transitional justice, self-determination and cultural rights and protection.

Deputy Secretary, Industrial Relations Victoria

Matt O’Connor was appointed as the Deputy Secretary of Industrial Relations Victoria in April 2015.

Matt has worked in the Victorian Government since 2003. He has overseen the development of industrial relations legislative and policy reforms including wage theft, labour hire, long service leave and public sector employment protections. Matt has steered the government’s public sector industrial relations strategy for several years and, more recently, played a pivotal role in the successful conclusion of the agreement covering the VPS. He has led the government’s participation in various legal proceedings in the Fair Work Commission including advocating for entitlements for frontline workers affected by the COVID-19 pandemic.

Matt provides strategic input on a range of WoVG industrial relations matters. He has also represented the Victorian Government in consultations with the Australian Government on federal industrial relations legislative proposals, including amendments to the Fair Work Act 2009.

Deputy Secretary/General Counsel, Legal, Legislation and Governance

Toby Hemming was appointed as General Counsel in May 2018.

Toby has significant experience in the Victorian public sector, having held senior positions in organisations including the County Court of Victoria, the Victorian Managed Insurance Authority and the Emergency Services Telecommunications Authority.

Toby holds degrees in the areas of law, arts and corporate governance. He is a graduate of the Australian Institute of Company Directors and has completed Executive Fellows programs at Harvard University’s Kennedy School of Government and the Australia and New Zealand School of Government.

Deputy Secretary, Social Policy and Interdepartmental Relations

Kate Houghton was appointed as Deputy Secretary of Social Policy in DPC in November 2018.

Kate has led many teams across a variety of portfolios within the VPS. Before joining DPC she was Deputy Secretary of Police and Crime Prevention at the then Department of Justice and Regulation. Kate spent many years working within the natural resources and environment portfolio. She led the Water and Catchments group as Deputy Secretary and the Environment Policy Division as Executive Director.

Kate has an honours degree in economics and a Master of Environment. She is also an Institute of Public Administration Australia Fellow.

Administrative offices

Administrative offices are established and abolished through orders under section 11 of the Public Administration Act, and each is established in relation to a department.

DPC is responsible for the effective, efficient and economical management of the following administrative offices.

Office of the Chief Parliamentary Counsel

The Office of the Chief Parliamentary Counsel transforms policy into legislation and advises the government on its legislative program. The office is responsible for ensuring up-to-date public access to authoritative Victorian legislation. The Office of the Chief Parliamentary Counsel is also the Government Printer for Victoria, responsible for printing Victorian legislation.

Office of the Governor

The Office of the Governor supports the Governor of Victoria in carrying out all aspects of their official duties for the benefit of the Victorian community and maintains Government House and grounds as a unique heritage community asset. The Governor’s role includes constitutional and ceremonial duties, community and international engagement, as well as official municipal and regional visits.

Office of the Victorian Government Architect

The Office of the Victorian Government Architect (OVGA) provides leadership and independent advice to government about architecture and urban design. OVGA puts quality of design at the centre of all conversations about the shape, nature and function of our cities, buildings and landscapes. OVGA’s activities include reviewing significant state and local government projects as well as commercial projects with a significant impact on the public. OVGA also leads on significant good-design initiatives and provides input, advice and advocacy on policies and issues of relevance to the Victorian Government.

Public Record Office Victoria

The Public Record Office Victoria (PROV) maintains the archives of the State Government of Victoria, holding records dating from the mid-1830s to today. PROV manages these for use by the government and people of Victoria. PROV’s collection contains records of decisions, events, people and places that have shaped the history of Victoria. PROV sets mandatory recordkeeping standards for state and local government agencies and provides support and advice on recordkeeping to government.

Service Victoria

Service Victoria is a WoVG service capability created to improve the way government transactions are delivered to Victorians. Service Victoria brings together key government digital transactions in one place and has played an important role in the Victorian Government’s COVID-19 response, developing the quick response (QR) code system check-in service and the Service Victoria mobile app. Service Victoria is responsible for implementing the Service Victoria Act 2018 and provides customer service and identity verification functions.

Other entities

DPC supports the Premier and its ministers in their responsibilities for the Victorian Public Sector Commission and the following special bodies and public entities.

Special bodies

Special bodies are defined in section 6 of the Public Administration Act and are created under separate legislation:

- Electoral Boundaries Commission

- Victorian Electoral Commission

- Victorian Independent Remuneration Tribunal.

Public entities

Public entities include statutory authorities, state-owned enterprises, state-owned corporations and formally constituted advisory boards that perform functions outside of the public service:

- Breakthrough Victoria Fund Pty Ltd

- Cenitex

- Labour Hire Authority

- Portable Long Service Authority

- Victorian Aboriginal Heritage Council.

Five-year financial summary

Summary of factors that affected our performance in 2019–20 and the preceding 4 reporting periods.

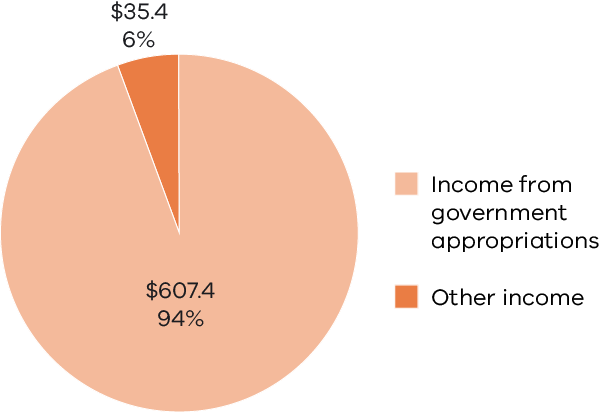

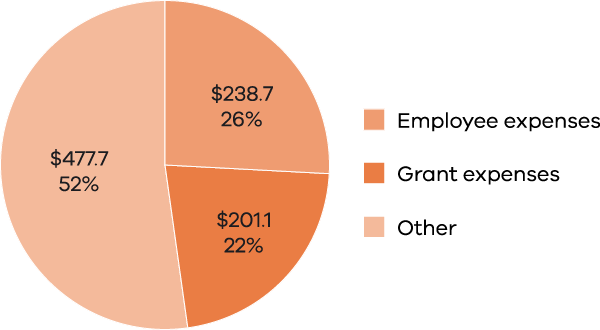

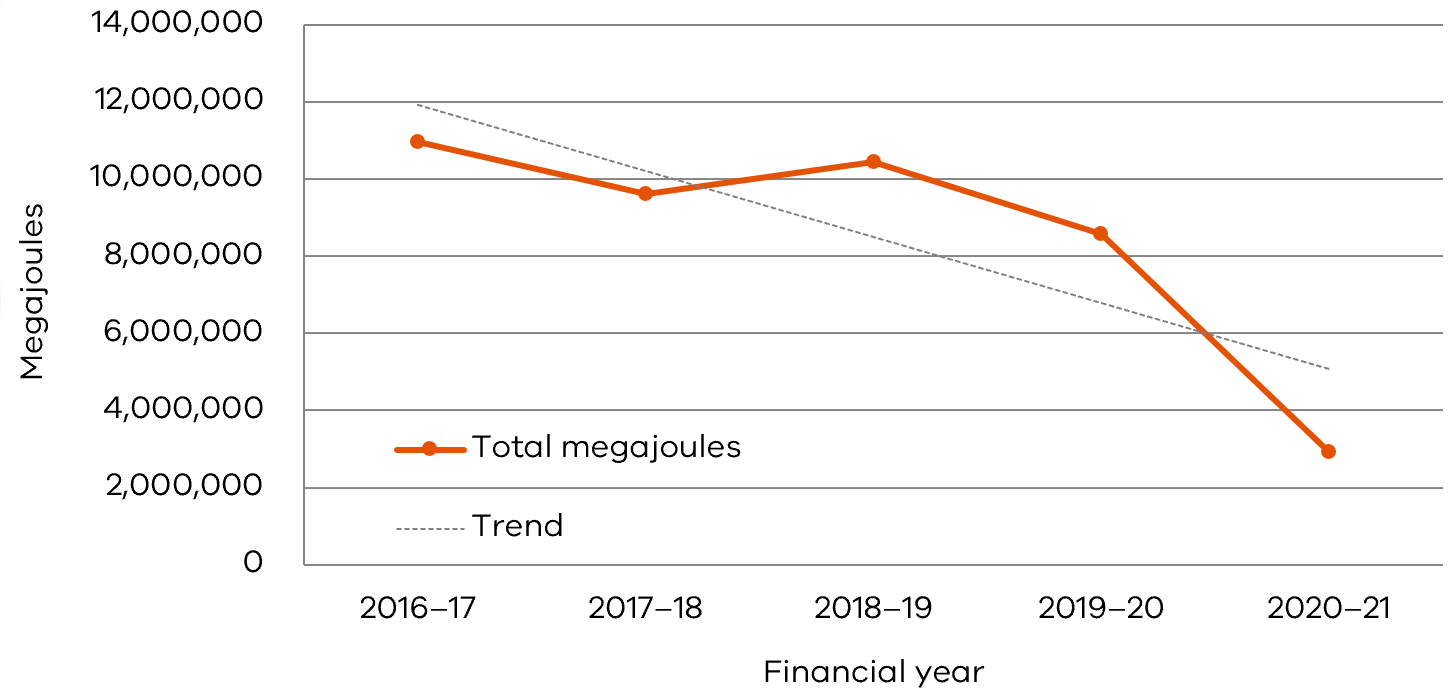

Key financial indicators from 2016–17 to 2020–21

| Department-controlled activities | 2020–21 $’000 (1) |

2019–20 $’000 (2) |

2018–19 $’000 (3) |

2017–18 $’000 (4) |

2016–17 $’000 (5) |

| Income from government | 607,413 | >726,920 | >720,119 | >520,002 | >479,130 |

| Total income from transactions | >642,804 | >818,062 | >760,318 | >580,778 | >518,324 |

| Total expenses from transactions | (632,174) | (825,276) | (750,323) | (573,028) | (496,796) |

| Net result from transactions | 10,630 | (7,214) | 9,995 | 7,750 | 21,528 |

| Net result for the period | 13,048 | (7,666) | 8,583 | 7,966 | 22,195 |

| Net cash flow from operating activities | 35,597 | 17,883 | 35,134 | 15,980 | 33,375 |

| Total assets | 881,214 | 866,022 | 876,813 | 847,231 | 813,404 |

| Total liabilities | 95,703 | 116,514 | 116,711 | 90,268 | 77,749 |

Footnotes

- The decrease in 2020–21 income and expenditure is mainly due to MoG changes where Fairer Victoria transferred from DPC to the Department of Families, Fairness and Housing on 1 February 2021, and Bushfire Recovery Victoria transferred to the Department of Justice and Community Safety from 1 July 2020. An increase in assets is driven by asset revaluations. Transfer of employee and supplier liabilities to the Department of Families, Fairness and Housing contributed to a decrease in liabilities.

- The increase in 2019–20 income and expenditure is mainly due to bushfire recovery activities and responses to COVID-19. DPC’s assets decreased due to reductions in financial assets, from the use of funding received in prior financial years, and MoG decisions where functions were transferred from DPC.

- The increase in 2018–19 income and expenditure is mainly due to new government initiatives delivered during the year, including Pick My Project, Multicultural Community Infrastructure programs and the Victorian Jobs and Investment Fund. Separately, there was increased income and expenditure due to the 2018 state election. Assets increased due to investments in modernising DPC’s office spaces and further investments in Service Victoria’s digital services platform. DPC’s liabilities increased due to higher payables and employee liabilities because of growth and MoG transfers into DPC.

- The increase in income from transactions and an increase in expenses from transactions in 2017–18 relate to new government initiatives carried out during the year. Separately, the increase in total assets is mainly due to building Service Victoria's digital services platform.

- The full-year impact of significant new initiatives affected DPC’s operations in 2016–17. Asset balances were impacted by asset revaluations during the year.

Progress towards achieving departmental objectives

Outcomes we achieved during the year against our key initiatives and projects.

This section reports on the outcomes the Department of Premier and Cabinet (DPC) achieved during the year against key initiatives and departmental objectives.

This section also reports on DPC’s actions in responding to the impacts of COVID-19.

Departmental output changes during 2020–21

Due to machinery of government (MoG) changes effective 1 February 2021, the following departmental outputs have been transferred to the Department of Families, Fairness and Housing: LGBTIQ+ equality policy and programs; multicultural affairs policy and programs; support for veterans in Victoria; women’s policy; and youth.

Departmental objectives, indicators and linked outputs

DPC’s medium-term objectives, associated indicators and linked outputs as set out in the 2020–21 Victorian Budget Paper No. 3 — Service Delivery are shown below.

Objectives: Strong policy outcomes

Indicators

- DPC’s policy advice and its support for Cabinet, committee members and the Executive Council are valued and inform decision making

- The development and effective use of technology supports productivity and competitiveness

Outputs

- Government-wide leadership, reform and implementation.

- Strategic advice and government support.

- Digital government and communications.

- Office of the Victorian Government Architect.

- Industrial relations.

Objectives: Engaged citizens

Indicators

Increased opportunities for participation by members of the Victorian community in the social, cultural, economic and democratic life of Victoria.

Outputs

Aboriginal policy, strengthening Aboriginal cultural heritage and communities.

Objectives: Professional public administration

Indicators

A values-driven, high-integrity public service characterised by employees who collaborate across government and in partnership with the community and other sectors, and who use evidence to support decisions that drive the progress of Victoria socially and economically.

Outputs

- Advice and support to the Governor.

- Chief Parliamentary Counsel services.

- Management of Victoria’s public records.

- Public administration advice and support.

- State electoral roll and electoral events.

DPC’s fourth objective — High-performing DPC — underpins all work of the department. It does not have specific outputs or funding.

Strong policy outcomes — key initiatives

This objective pursues policy, service and administration excellence and reform. It leads the public sector response to significant state issues, policy challenges and projects. It supports the effective administration of government and the delivery of policy and projects that enable increased productivity and competitiveness in Victoria.

DPC’s outcomes on the following key initiatives have helped us achieve the ‘Strong policy outcomes’ strategic objective.

Supporting the government’s response to COVID-19

DPC played a key role in supporting government decision making in response to COVID-19. This included supporting government decision making at National Cabinet and the Coordinating Ministers Committee of Cabinet by working across government to coordinate advice on policies to help manage COVID-19. This includes supporting the vaccination rollout, Victoria’s approach to quarantine and management of major events and international arrivals.

DPC, along with the Department of Health (DH) and Department of Treasury and Finance (DTF), provided support to develop a national partnership agreement on COVID-19 to formalise the Australian Government’s commitment to the response and bringing together the private and public hospital systems to work as one.

DPC worked closely with its counterparts in the Australian Government on the delivery of the Victorian Quarantine Facility.

Since February 2021 DPC has collaborated with DH to coordinate and implement Australia’s COVID-19 Vaccine National Roll-out Strategy to deliver equitable access to vaccinations for all eligible Victorians. DPC has been working with DH to ensure Victorians have safe, efficient and easy access to vaccines as soon as they are eligible and has supported engagement through National Cabinet to ensure Victoria’s priorities are considered under the Australian Government’s COVID-19 vaccination program.

Further, the 2020–21 ‘Whole of Victorian Government (WoVG) emergency management forums, meetings and exercises facilitated’ performance measure result is significantly higher than the target due to an increased number of meetings to coordinate the government’s response to COVID-19.

COVID-19 response — public health communications campaigns

In 2020–21 DPC’s central Communications and Campaigns teams led the WoVG communications, which reviewed and delivered over 2,000 communication materials. Major advertising campaigns were delivered at a rapid pace to support the public to engage with public health orders. There was a major focus on reaching culturally and linguistically diverse audiences, with most campaigns translated into 57 different languages, complemented by major community engagement efforts and strong partnerships with community and religious leaders. Collaboration across departments was key, with a digital platform established as a central source of COVID‑19 information.

As the COVID-19 response evolved, so too did the communications response. Efforts in 2021 focussed on supporting the uptake of the Service Victoria QR code check-in service, and vaccination. A strong body of evidence has been developed as a result of the work of the central communications teams, in how to effectively ensure consistency of message, increase outreach to hard-to-reach communities and deliver crisis communications over a sustained period.

Supporting self-determined, place-based responses to COVID-19 impacts

DPC delivered a $10 million COVID-19 Aboriginal Community Response and Recovery Fund as part of a $23 million WoVG Aboriginal-specific COVID-19 package. The fund was established to support Aboriginal Victorians in delivering community-led initiatives to respond to the impacts of COVID-19.

Funding was awarded to 81 Aboriginal Victorians, Aboriginal organisations and Traditional Owner Groups across the state, totalling more than $9.9 million. A range of small, medium and large organisations were supported, with 48 metropolitan-based initiatives and 33 rural or statewide initiatives. The fund had a rigorous,self-determined assessment process that involved relevant departments responsible for administering the funding; Aboriginal Community Controlled Organisation members of the former COVID-19 Aboriginal Community Taskforce; and the Minister for Aboriginal Affairs.

Funded initiatives addressed a range of critical COVID-19 impacts:

- emergency relief such as food hampers and vouchers for essential goods

- outreach and brokerage such as wraparound housing supports and outreach to cohorts such as Elders and young people disengaged from school

- cultural strengthening such as cultural healing initiatives, cultural camps, a social enterprise cafe and events on Country

- improved social and emotional wellbeing such as counselling and other therapeutic supports, mental health literacy and community sporting events.

With the remaining funds, DPC has engaged an Aboriginal organisation, Inside Policy, to evaluate the initiatives and provide an evidence base for self-determined responses. This evaluation is due by the end of 2021.

Keeping Victorians informed and connected through COVID-19

To help Victorians stay informed about how to comply with COVID-19 restrictions, Digital Victoria launched the Coronavirus Victoria hub website. The website includes helpful topics such as advice for primary close contacts and households, public exposure sites (including maps), the Victorian Travel Permit System, the Radius maps, where to get tested and how to book vaccine appointments. Much of this content has been translated into more than 50 languages to support culturally and linguistically diverse communities. The COVID-19 Victoria hub had more than 50 million visits in 2020–21.

Digital Victoria launched Victoria Together in May 2020, which collated Victoria’s top digital content from cultural organisations and promoted it across the Victoria Together website and social channels. Over 2020–21 Victoria Together provided Victorians with homegrown entertainment during the COVID-19 pandemic, such as the State of Music — the flagship content series watched by more than one million Victorians. It connected isolated or disadvantaged communities to experiences from leading cultural institutions and community organisations and created an income stream for Victorian content creators, including making $1.45 million in grants available to

29 grassroots organisations.

Data insights to enable better decisions and outcomes powered by analytics

In 2020–21 the Victorian Centre for Data Insights (VCDI) enhanced the Victorian Government’s crisis and recovery decision making by bringing together and presenting COVID-19-related data from across the Victorian Government and other sources. As a result, the government is using these digital tools to achieve significant productivity improvements, inform targeted policies and programs, and tackle mission-critical responsibilities and recovery efforts in a more responsive manner. VCDI is doing this through rapid reporting, mitigating new data-related risks and providing government with timely and accurate intelligence — efforts that rely on access to trusted, quality data.

VCDI has also built strong and effective strategic partnerships with key Victorian public service (VPS) agencies, covering diverse policy areas from emergency management, to improving health prevention, road safety and financial reporting. VCDI has also focused on informing priority policy and service delivery through data sharing and use, including continuing to build an enduring linked social services data resource and developing a WoVG approach to data sharing policy. VCDI’s use of data analytics, data management/governance and technical and strategic advice continues to enhance the Victorian Government’s use of data to improve outcomes for the community and build data expertise across the VPS.

Cybersecurity strategy for better detection, prevention and response to cyber attacks

In 2020–21 Digital Victoria finished implementing the Victorian Government Cyber Security Strategy 2016–2020 to improve cyber resilience and governance in government and major infrastructure and service providers.

This work included support for more than 140 organisations with over 900 cyber incidents through: the Victorian Government Cyber Incident Response Service; completing an integrated Victorian Government Security Operations Centre model; developing and deploying the Emergency Services Cybersecurity Program; and improving procurement mechanisms to allow government to access private sector cyber services more easily.

DPC’s Cyber Security Unit contributed to the cyber maturity of Victorian public bodies with the rollout of cyber training for VPS employees; cyber training for directors and board members in the health and water sectors; and the survey of the cyber maturity of critical infrastructure and government entities against Essential Eight, a series of baseline mitigation strategies recommended for organisations taken from the Australian Government’s Strategies to Mitigate Cyber Security Incidents.

Digital Victoria also developed a new cyber strategy, which will increase the focus to include the Victorian economy and community.

Modernising systems and processes to improve government productivity

DPC continued to modernise departmental processes through the operation and delivery of common platforms that are accessible across government, including Single Digital Presence (SDP) and the WoVG Application Programming Interface Capability Program.

SDP provides a sustainable, scalable, secure and accessible publishing platform that reduces the cost and time to deliver high-quality digital presences for government agencies. SDP has made it easier for Victorians to find, access, understand and use Victorian Government information.

In 2020–21 SDP enhanced the platform’s security, safety and reliability, improved its governance and processes, and delivered training programs to uplift capability across government. More content was migrated onto SDP, with 100 new or migrated web presences consolidated onto SDP from nine departments. SDP scaled to 111 million annual sessions across the platform while continuing to develop and support existing users. SDP trained more than 500 VPS staff to use the platform’s content management system and more than 800 VPS staff on writing for the web. The SDP community of practice has grown to 480 members, with 250 of those attending training for Google Analytics to help use insights to improve user experiences.

In 2020–21 the WoVG Application Programming Interface Capability Program continued to provide departments with a range of modern technology products and professional services that support data-sharing initiatives across all government departments. The program improved its platform architecture and approach to security, consulted with departments to discover and implement integrations for key data sharing use cases and built capability within departments to use self-service tools.

During 2020–21 the program supported the build of a contact tracing solution underpinned by secure and robust data sharing. It supported Family Safety Victoria’s implementation of the recommendations in the Royal Commission into Family Violence through integrations with the DH child protection system and Corrections Victoria’s prisoner information systems. Departments are using the platform for back-office financial system integrations, as well as integrations with the Australian Government for access to document verification systems and for small business grant approvals.

Prioritising open and efficient IT spend and improving government digital processes

DPC continued to prioritise open information, efficient digital services, strong modern systems/technology and increased staff capability. In 2020–21 DPC:

- continued to support transparent government IT project spend through coordinating and publishing the Victorian Government IT dashboard (which shows the status of government IT projects with a total value of $1 million or more)

- developed a WoVG assurance and investment management framework for digital and IT projects. This framework will maximise value through more strategic IT investments, prevent project cost overruns, support project teams to deliver successful outcomes, and ensure transparency and visibility of project benefits

- worked with all parts of government to improve the success rate of IT-enabled business projects through delivering capability uplift programs.

Fostering innovation and new ways of working in the public sector through human-centred design

Following the launch of the Human-Centred Design Playbook — an online practical guide for VPS staff who are designing, procuring or managing human-centred design projects — Digital Victoria has continued to embed human-centred design across government to ensure government services are aligned with the needs and desires of Victorians.

In 2020–21 the website (vic.gov.au/human-centred-design-playbook) has been visited more than 27,600 times and over 2,700 copies of the playbook have been downloaded. In September 2020 DPC launched an online training course in human-centred design to accompany the playbook and has served more than 350 people from 74 government entities and departments from across the VPS. The playbook was a finalist in the 2020 Victorian Premier Design Awards, selected as one of five finalists for strategic design.

Building safer and more resilient Victorian communities

In collaboration with all Victorian Government departments, DPC has continued to strengthen emergency management arrangements and implement a strong reform agenda in response to the Inspector-General for Emergency Management (IGEM) Inquiry into the 2019–20 Victorian Fire Season, IGEM’s Review of 10 Years of Reform in the Emergency Management Sector and the COVID-19 Hotel Quarantine Inquiry.

DPC, in partnership with Emergency Management Victoria, also continues to work with other jurisdictions through the Australia–New Zealand Emergency Management Committee to strengthen disaster resilience by addressing the National Federation Reform Council priority recommendations from the Royal Commission into National Natural Disaster Arrangements.

Further in 2020–21, DPC supported Victorian and national counterterrorism reforms through the Australia–New Zealand Counter-Terrorism Committee and worked to implement the recommendations of the Expert Panel on Terrorism and Violent Extremism Prevention and Response Powers.

DPC also continued to coordinate the protection of Victorian Government personnel and its information and physical assets through implementing protective security measures.

Supporting engagement with the Royal Commission into Victoria’s Mental Health System

Before releasing its final report on 2 March 2021, DPC supported the government’s engagement with the Royal Commission into Victoria’s Mental Health System in partnership with the former Department of Health and Human Services and Mental Health Reform Victoria. Combined with its interim report, the royal commission made 74 recommendations to government, setting out a 10-year reform journey to ensure all Victorians get the mental health support they need, when they need it and close to home.

In partnership with DH, DPC worked to establish governance structures to facilitate government-wide approaches to improve mental health and wellbeing and oversee the implementation of the royal commission’s recommendations. These include a Mental Health and Wellbeing Cabinet Committee, a Mental Health and Wellbeing Victorian Secretaries’ Board Committee, a Suicide Prevention and Response Victorian Secretaries’ Board Sub-Committee and an Interdepartmental Committee on Mental Health and Wellbeing Promotion.

DPC will continue to work with DH to support and monitor the government’s implementation of the reforms and delivery of the record $3.8 billion investment package contained in the 2021–22 Victorian Budget.

Supporting the modernisation of the youth justice system

In 2020–21 DPC continued to support the implementation of the Youth Justice Strategic Plan 2020–2030 and is coordinating work to support the introduction of a new Youth Justice Bill. DPC also continued to support work to modernise Victoria’s youth justice system via the new youth justice centre in Cherry Creek.

DPC has supported the implementation of recommendations from Our Youth, Our Way — Inquiry into the Over-representation of Aboriginal Children and Young People in Victoria's Youth Justice System by the Koori Youth Justice Taskforce and the Commission for Children and Young People.

Reform and oversight of the recommendations made by the Royal Commission into Family Violence

DPC continued to coordinate and oversee implementation of the government’s family violence reform agenda including leading the WoVG effort to deliver the Royal Commission into Family Violence recommendations across the VPS. DPC led the development of the Second Rolling Action Plan 2020–23 and the Family Violence Outcomes Framework Measurement and Monitoring Implementation Strategy, both of which were released in December 2020.

As of 1 February 2021, the functions of DPC’s Family Violence branch moved to the Department of Families, Fairness and Housing as a result of MoG changes. DPC continues to provide WoVG coordination and oversight of the family violence reforms.

The implementation of more than two-thirds of the Royal Commission into Family Violence recommendations of 30 June 2021 demonstrates the progress towards the reform of the family violence system; however, there is more work to do to deliver on desired outcomes and to learn from the progress to date.

Supporting the Family Violence Reform Implementation Monitor

The Family Violence Reform Implementation Monitor’s fourth report was tabled in the Victorian Parliament on 6 May 2021 and examined progress in the five years since the Royal Commission into Family Violence as well as identifying reform areas that require more effort. The report also detailed key implementation activities over the 12 months to 1 November 2020.

The report findings and areas for future focus were informed by consultations with more than 65 individuals and organisations, materials provided by government implementation agencies and 125 submissions to the Monitor from the family violence and broader community services sector. As part of the 2020/21 Victorian Budget, funding was provided to continue the function of the Monitor’s office until the end of 2022.

Supporting a stronger skills and training system

During 2020–21 DPC provided timely advice to government on key reforms affecting the skills and training system, including supporting its response to the Skills for Victoria’s Growing Economy Review.

This work has focused on supporting the Department of Education and Training to establish the Victorian Skills Authority and the Office for TAFE Coordination and Delivery, which will help create a more collaborative VET system and strengthen Victoria’s social and economic recovery from COVID-19.

Providing economic advice on current and future economic challenges and opportunities

In 2020–21 DPC continued to work closely with DTF and other departments to support the government’s economic growth objectives. This included advising on taxation, fiscal strategy, workplace safety, local government, regulation, consumer and gambling policy, and transport policy and infrastructure delivery. DPC also supported the Premier in the annual State Budget process and the implementation of initiatives to reprioritise government spending.

Since the onset of COVID-19, DPC has actively supported Victorian Government departments to identify and develop measures to assist businesses and individuals.

Supporting industry capability, capacity and growth

In 2020–21 DPC supported the Premier and relevant departments to:

- develop policies and programs to support industry recovery and development, as a key driver of Victoria’s economic performance

- respond to the economic impacts of COVID-19 and longer-term bushfire and drought impacts

- position Victoria for longer-term economic growth through targeted policy advice and administration of the Victorian Jobs and Investment Fund

- establish Breakthrough Victoria Pty Ltd as the state’s independent manager of the Breakthrough Victoria Fund. Breakthrough Victoria will drive new Victorian jobs through investments in research commercialisation and innovation.

In 2020–21 the Victorian Jobs and Investment Fund was pivotal to economic recovery efforts, securing private sector investments that will create more than 2,500 new Victorian jobs across a range of priority industries in metropolitan and regional locations.

Supporting the rollout of three-year-old kindergarten

During 2020–21 DPC supported government consideration of key workforce, infrastructure and change management approaches to support the Department of Education and Training’s continued implementation of the Victorian Government’s commitment to providing 15 hours of funded kindergarten programs to all three-year-old Victorians by 2029.

Rollout of the reform has progressed according to the public rollout schedule, with the delivery of funded three-year-old kindergarten progressing to 21 regional local government areas in 2021.

Supporting the health system to prepare for a range of COVID-19 scenarios

DPC continues to play a key role in ensuring the Victorian health system is prepared to manage a surge in COVID-19 cases across the state. This year DPC has continued to provide advice to government on the investment and responses needed to respond to COVID-19, including supporting significant investments in critical care beds, ventilators, personal protective equipment and infection prevention and control training to prepare health services for increased demand.

DPC will continue to work with DH to ensure the health system remains strong as we enter Phase B of the national plan to transition to Australia’s National COVID-19 Response.

Leading Victoria’s international engagement

DPC has worked across government to further Victoria’s international engagement objectives by:

- establishing a centralised model for Victoria’s compliance with Australia’s Foreign Relations (State and Territory Arrangements) Act 2020 (Cth)

- facilitating discussions between the diplomatic community and Victorian representatives, including the Premier, ministers and the Governor, to progress matters of mutual interest

- collaborating with Asia Society Australia to utilise its expertise and extensive networks to enhance Victoria’s connections to, engagement with and knowledge of Asia.

Supporting delivery of the government’s infrastructure program

In 2020–21 DPC continued its work with the Department of Transport and the Major Transport Infrastructure Authority on many of the major transport projects in construction, including the Level Crossing Removal Project, Metro Tunnel Project, North East Link Project and multiple road upgrades. The government has 165 major road and rail projects being constructed or planned at an investment of $80 billion and the creation of more than 18,000 jobs.

DPC has continued to work across government in supporting the Suburban Rail Loop Authority’s efforts to progress the Suburban Rail Loop project.

Designing and establishing new ways of working with communities

The Behavioural Insights Unit supported departments to understand the likely impact of policies and programs on Victorians’ behaviours in relation to COVID-19. International evidence was also used to support the effective implementation of policies, programs and communications for COVID‑19-related requirements such as mask-wearing and other COVID-19 safe behaviours.

Throughout 2020–21 the Innovation Network continued to support the VPS’ transition to a remote working model. Membership of the Innovation Network grew to more than 20,000 accounts over the year, highlighting the demand for the network’s training materials and events in an online environment. Many of the Innovation Network’s learning materials were translated into ‘on demand’ videos, broadening its reach to staff working remotely across Victoria.

In March 2021 the Innovation Network hosted its third annual Innovation Immersion event, held fully online over three days, with more than 2,340 unique attendees across 21 sessions, delivering 5,750 learning hours. Innovation Immersion is one of the VPS’ largest training events and supports staff to embed innovation methodologies into their everyday work.

CivVic Labs completed its third round during 2020–21. To date, 38 start-ups have worked on solutions to 13 challenges from 15 departments and agencies. In total CivVic Labs has provided $2.7 million in procurement funding to Victorian start-ups, with a 50 per cent jobs growth for start-ups proceeding to the development phase.

Promoting affordable, reliable and secure energy

In 2020–21 DPC supported the Premier, government departments (including the Department of Environment, Land, Water and Planning [DELWP] and the Department of Jobs, Precincts and Regions) and government entities in delivering government’s energy, resources and environment commitments including:

- releasing Victoria’s first Climate Change Strategy, including interim emission reduction targets of a 28–33 per cent reduction on 2005 levels by 2025, a 45–50 per cent drop by 2030 and emissions reduction pledges across the economy

- supporting progress on the $540 million investment in electricity network infrastructure for Victoria’s Renewable Energy Zones

- delivering the Energy Fairness Plan, which includes penalties of up to $1 million for energy retailers that wrongfully disconnect vulnerable Victorians and will see a ban on door-to-door sales of energy products

- procuring Australia’s largest battery, the Victorian Big Battery, which is a 300-megawatt battery installed at the Moorabool Terminal Station near Geelong

- establishing the Great Ocean Road Coasts and Parks Authority to better manage and protect the coast and parks of Victoria’s Great Ocean Road

- supporting the agriculture sector through the Agriculture Strategy, Agriculture Workforce Plan and securing entry of Pacific workers for Victorian farms

- establishing Greater Western Water by bringing together Western Water and City West Water to deliver water services to the fast-growing outer-west regions.

Digital systems to support contact tracing

In 2020–21 Digital Victoria coordinated the development of the government’s QR code system, which allows people to check in to workplaces and venues through the Service Victoria mobile app. The system provides DH contact tracers with data to help them identify and then communicate with people who may have come into contact with a confirmed case of COVID-19.

Service Victoria played an important role in the government’s COVID-19 response, allowing rapid deployment of critical new digital services. The QR check-in service was launched on 13 November 2020 and became mandatory on 28 May 2021. More than 146 million customers used the service to check-in, and the Service Victoria mobile app was downloaded 3.6 million times. The border entry permit service, launched on 21 November 2020, processed 3.3 million applications to enter Victoria, and the travel voucher service issued 160,000 travel vouchers worth $32 million over four rounds starting from 14 December 2020.

Digital public engagement through Engage Victoria

Engage Victoria is the government’s online consultation platform, providing a range of tools to enable the community to readily share their ideas and opinions and to comment on the ideas of others on a range of issues and topics relevant to Victoria. In 2020–21 Engage Victoria conducted 190 consultations across all government departments and eight agencies including Parks Victoria, the Environment Protection Authority and the Major Transport Infrastructure Authority. It received more than 875,000 visitors and 96,000 pieces of feedback on the platform.

Victorians contributed across many important consultations on Engage Victoria including informing Victoria Police service reform, helping design Victoria’s container deposit scheme and shaping critical transport projects for Melbourne Airport Rail and the Suburban Rail Loop.

Office of the Victorian Government Architect (OVGA)

OVGA continued its work to deliver high-quality design principles, processes and outcomes for the government through its involvement in various key initiatives and projects in 2021 including:

- Future Homes Project — to prepare exemplar designs for apartment buildings in established suburbs.

- Social housing — leading design quality initiatives to assist Homes Victoria to achieve high-quality, contemporary, affordable and sustainable social housing.

- Health infrastructure — working with the Victorian Health Building Authority to develop design principles and processes to support delivery of public health, mental health and aged-care infrastructure, including the Mental Health Beds Expansion Program, the new Footscray Hospital and the Frankston Hospital Redevelopment.

- Transport infrastructure — continued collaboration with the Major Transport Infrastructure Authority on Victoria’s Big Build, including the Level Crossing Removal Project and Metro Tunnel.

- Precincts — advocacy and advice on integrated precinct development in key locations such as Footscray, Arden and the Melbourne Arts Precinct Transformation.

- Design review — OVGA’s Victorian Design Review Panel continued to provide independent and authoritative advice to government through structured design reviews of a wide range of projects from across sectors including social housing, transport infrastructure, health, education, culture, tourism and civic and community buildings.

- Independent review of the value and benefits of OVGA — OVGA commissioned an independent review of its activities over the 2018–21 period. Stakeholders from government departments and agencies strongly endorsed OVGA’s contribution to improved outcomes in both capital and advocacy or policy projects — 100 per cent of respondents ‘agreed’ or ‘strongly agreed’ that OVGA services had helped to drive design quality at the strategic or systemic level, while 100 per cent of OVGA stakeholders reported that they were ‘likely’ or ‘very likely’ to use OVGA’s services again.

Promoting fair and equitable workplaces

In 2020–21 DPC’s Industrial Relations Victoria (IRV) group provided leadership and support on public sector bargaining matters including approving 42 agreements for public sector departments and agencies. IRV successfully completed significant projects for the benefit of workers and workplaces including the response to the Inquiry into the Victorian On-Demand Workforce and establishing the new statutory authority, Wage Inspectorate Victoria.

The ongoing impact of COVID-19 required new initiatives to support Victorian employers and their workforces. IRV has advised government on industrial relations legislative and policy matters during COVID-19, maintaining a framework of protections and arrangements for the public and private sector and participating in cross-department consultations with the private sector to manage the dissemination and implementation of public health directions in workplaces.

Examples of how DPC has promoted fair and equitable workplaces through IRV in 2020–21 are outlined below.

In the private sector, DPC:

- developed and published the government’s response to the Report of the Inquiry into the Victorian On-Demand Workforce and obtained implementation budget funding

- developed the Industrial Relations Legislation Amendment Act 2021, which made a number of improvements to eight pieces of legislation, together with various Regulations

- conducted a review of the Child Employment Act 2003 and worked with the Department of Justice and Community Safety to complete a review of the Private Security Act 2004

- supported the Victorian Government’s policy responses to COVID-19, directed towards supporting workers and businesses in the private sector including support for seasonal workers

- led the government’s participation in Fair Work Commission cases, including the Annual Wage Review and test cases on award variations for paid COVID-19 leave in the health and community sectors

- prepared submissions to numerous Australian Government reviews and inquiries and supported ratification of the International Labour Organization’s conventions against sexual harassment and violence at work

- supported the Equal Workplaces Advisory Council and commissioned research to provide equitable gender pay budgetary initiatives

- continued to work with the Department of Jobs, Precincts and Regions to develop the Victorian Fair Jobs Code

- supported the Transport Industry Council and the Forestry Industry Council, including a review of the Tip Truck Code of Practice.

In the public sector, DPC:

- began implementing the revised wages policy and the enterprise bargaining framework, which focuses on the Victorian Government’s operational and public sector priorities

- developed and maintained an Industrial Relations Framework and guidance for managing the effects of COVID-19 in the Victorian public sector

- developed a support package for public sector employees affected by the further lockdown and restrictions

- obtained certification of the Victorian Public Service Enterprise Agreement and supported its implementation

- oversaw the renegotiation of several major enterprise agreements including for Victoria Police, Ambulance Victoria, V/Line and public sector health professionals

- developed the Women in Construction Strategy, which supports the attraction, recruitment and retention of women in building and construction

- provided industrial relations support and advice for the government’s building and infrastructure projects

- supported the Building Industry Consultative Council

- provided industrial relations support and advice to the Public Sector Gender Equality Commissioner on establishing the Gender Equality Act 2020

- progressed a review of casual and fixed-term employment in the public service.

With Wage Inspectorate Victoria, DPC:

- established the Inspectorate as a statutory body to enforce the Wage Theft Act 2020 (which came into effect on 1 July 2021) and assumed responsibility for administering the Child Employment Act 2003, the Long Service Leave Act 2018 and the Owner Drivers and Forestry Contractors Act 2005.

- protected the safety and welfare of children working in Victoria by administering child employment laws, including assessing and issuing 5,750 child employment permits and undertaking 171 child employment investigations

- finalised 117 investigations into breaches of long service leave laws and recovered $420,242 in outstanding long service leave entitlements for employees

- answered 9,100 long service leave and child employment queries through the Inspectorate’s Information Line and responded to more than 1,600 email queries from the public

- filed four prosecutions alleging breaches of the Long Service Leave Act and Child Employment Act

- undertook regulatory responsibilities under the Owner Drivers and Forestry Contractors Act.

Progress towards achieving the objective

The output performance measures that provide information on DPC’s progress in achieving the ‘Strong policy outcomes’ strategic objective are outlined below.

Objective indicator: DPC’s policy advice and its support for Cabinet, committee members and the Executive Council are valued and inform decision making

|

Performance measure |

2017–18 |

2018–19 |

2019–20 |

2020–21 |

|

Number of briefs supporting Cabinet and Cabinet committee decision making |

1,283 |

699 |

1,136 |

1,806 |

|

Policy services satisfaction rating |

90% |

92% |

86% |

84% |

|

Policy services timeliness rating |

95% |

97% |

97% |

97% |

Objective indicator: The development and effective use of technology supports productivity and competitiveness

|

Performance measure |

2017–18 |

2018–19 |

2019–20 |

2020–21 |

|

Victorian Government entities using the Standard User Experience Framework |

11 |

24 |

30 |

74 |

|

Average monthly analysis reports generated to guide government decision making |

42.5 |

75 |

65 |

102 |

|

Average number of monthly visits to www.vic.gov.au |

317,612 |

356,362 |

1,067,943 |

1,043,658 |

Engaged citizens — key initiatives

This objective supports and promotes full participation in strong, resilient and vibrant communities. It empowers citizens to participate in policymaking and service design. It ensures a holistic approach to social policy and service delivery.

DPC’s outcomes on the following key initiatives helped us achieve the ‘Engaged citizens’ strategic objective.

The Victorian Aboriginal Affairs Framework 2018–2023

Throughout 2020–21 DPC has continued to progress WoVG self-determination reforms in line with the Victorian Aboriginal Affairs Framework 2018–2023 (VAAF). The VAAF is the government’s overarching framework for working with Aboriginal Victorians, organisations and the wider community to drive action so all Victorian Aboriginal people, families and communities are healthy, safe, resilient, thriving and living culturally rich lives.

DPC also developed the annual Victorian Government Aboriginal Affairs Report (VGAAR), which measures WoVG progress against the VAAF and fulfils a Victorian Budget Paper No. 3 commitment for DPC. The 2020 VGAAR was tabled in parliament on 24 June 2021. In addition to measuring progress against the 111 measures, for the first time, the 2020 VGAAR includes specific information on WoVG progress to enable self-determination, focusing on improvements on internal government processes, practices and policies. DPC also developed an online data dashboard to ensure VGAAR data is more transparent and accessible to the Aboriginal community and organisations.

DPC’s work to enable self-determination has included working across DPC to embed self-determination principles and enablers into their core policies, programs, business processes and delivery system. In relation to addressing trauma and supporting healing (one of the VAAF’s enablers for self-determination), DPC has supported the Stolen Generations Reparations Steering Committee to develop and deliver its report to government on the design and implementation of a Stolen Generations Reparations Package to address the trauma and suffering caused by the forced removal of Aboriginal children from their families and communities.

In 2020–21 DPC also led development of Victoria’s implementation plan for the National Agreement on Closing the Gap in partnership with the Aboriginal Executive Council, one of Victoria’s key implementation partners, to reflect the unique and diverse needs of Victoria’s Aboriginal communities.

This brings together existing and new actions that will contribute to Victoria achieving and exceeding targets under the National Agreement and the VAAF.

Advancing treaty with Aboriginal Victorians

Throughout 2020–21 DPC has worked in partnership with the First Peoples’ Assembly of Victoria (Assembly) — the first statewide, democratically elected representative body for Aboriginal Victorians in the state’s history — to progress negotiations on the treaty elements required to support future treaty negotiations.

DPC’s work to advance Victoria’s treaty process in 2020–21 has included:

- progressing detailed discussions between the State and the Assembly on the treaty elements required under the Advancing the Treaty Process with Aboriginal Victorians Act 2018 (Treaty Act), a Treaty Authority, a treaty negotiation framework and a dispute resolution process

- agreeing between the State and Assembly on treaty conduct protocols and the first treaty element — an interim dispute resolution process — to guide the relationship between parties in this phase of the treaty process

- supporting the Assembly to enhance its operations and engagement in the treaty process, and to engage with the Yoo-rrook Justice Commission

- jointly developing the terms of reference for the Yoo-rrook Justice Commission with the Assembly, in line with the State’s commitment to address historical wrongs and ongoing injustices through the treaty process, as articulated in the Treaty Act

- launching the Deadly & Proud public communications campaign in collaboration with the Assembly to further build collective understanding among all Victorians of the importance of the treaty process.

Establishing the Yoo-rrook Justice Commission