Recycling Victoria market insights reports

Recycling Victoria’s market insight reports provide a snapshot of the waste and resource recovery sector’s market resilience and include:

- market profiles for each waste stream – paper and paperboard, plastics, glass and metals

- trends and opportunities

- special topics.

The reports combine information from:

- the Australian Bureau of Statistics (ABS) export data and published market reports

- national waste and recycling data

- modelling and insights informed by consultation with industry, government, and community stakeholders.

This report includes export data to the end of August 2022, and pricing updates to the end of September 2022.

If you have any questions, comments or feedback regarding this report or suggestions for future content, please contact Recycling Victoria.

Market overview

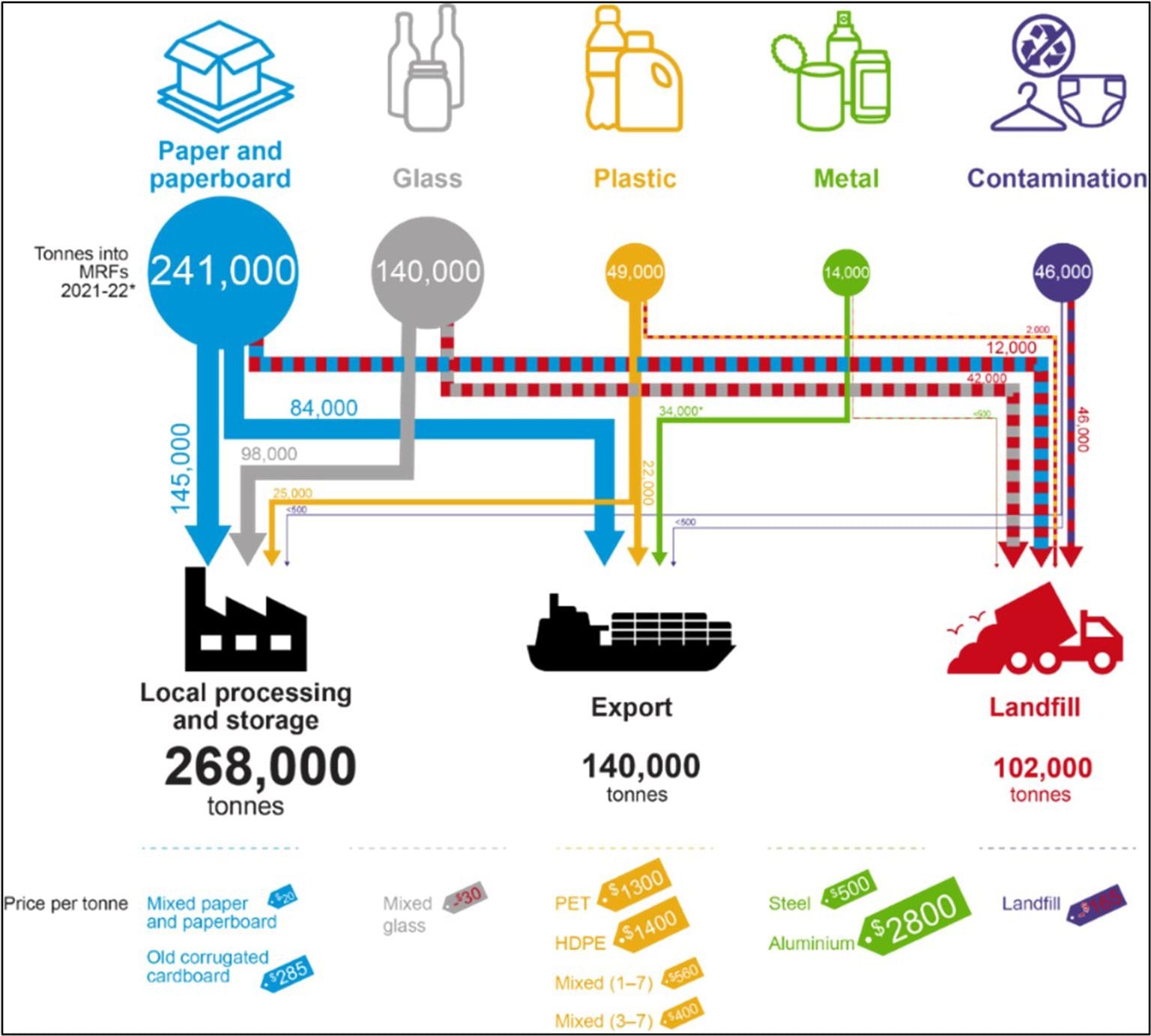

Figure 1 provides an overview of the kerbside collected recyclables flow over the 10-month period between July 2021 and April 2022. Prices are for May 2022.

Kerbside recyclable materials sent to landfill – July 2021 to April 2022

Of the 490,000 tonnes of kerbside materials collected between July 2021 and April 2022:

- 389,000 tonnes (80%) was sent to downstream processing

- 102,000 tonnes (20%) was sent to landfill.

Of the materials processed downstream, 140,000 tonnes were exported, including 20,000 tonnes of metal packaging that was sorted and stored before July 2021.

The disposal rate to landfill represents a short-term increase of 2–3% over the long term average of 17–18%.

Industry has reported the following reasons for this higher rate:

- Possible increased levels of gross contamination in kerbside bin material during the COVID-19 pandemic period (~10% contamination). Although there have been conflicting reports on the significance of this issue, it has likely reduced over the last 6 months.

- Increased landfilling levels for very low value sorted kerbside recyclables that do not have viable end-markets (~10% losses of recyclables – primarily glass fines, composite packaging formats (for example liquid paperboard) and residual mixed plastics).

There are no reports of significant stockpiling by metropolitan material recovery facility (MRF) operators as of June 2022.

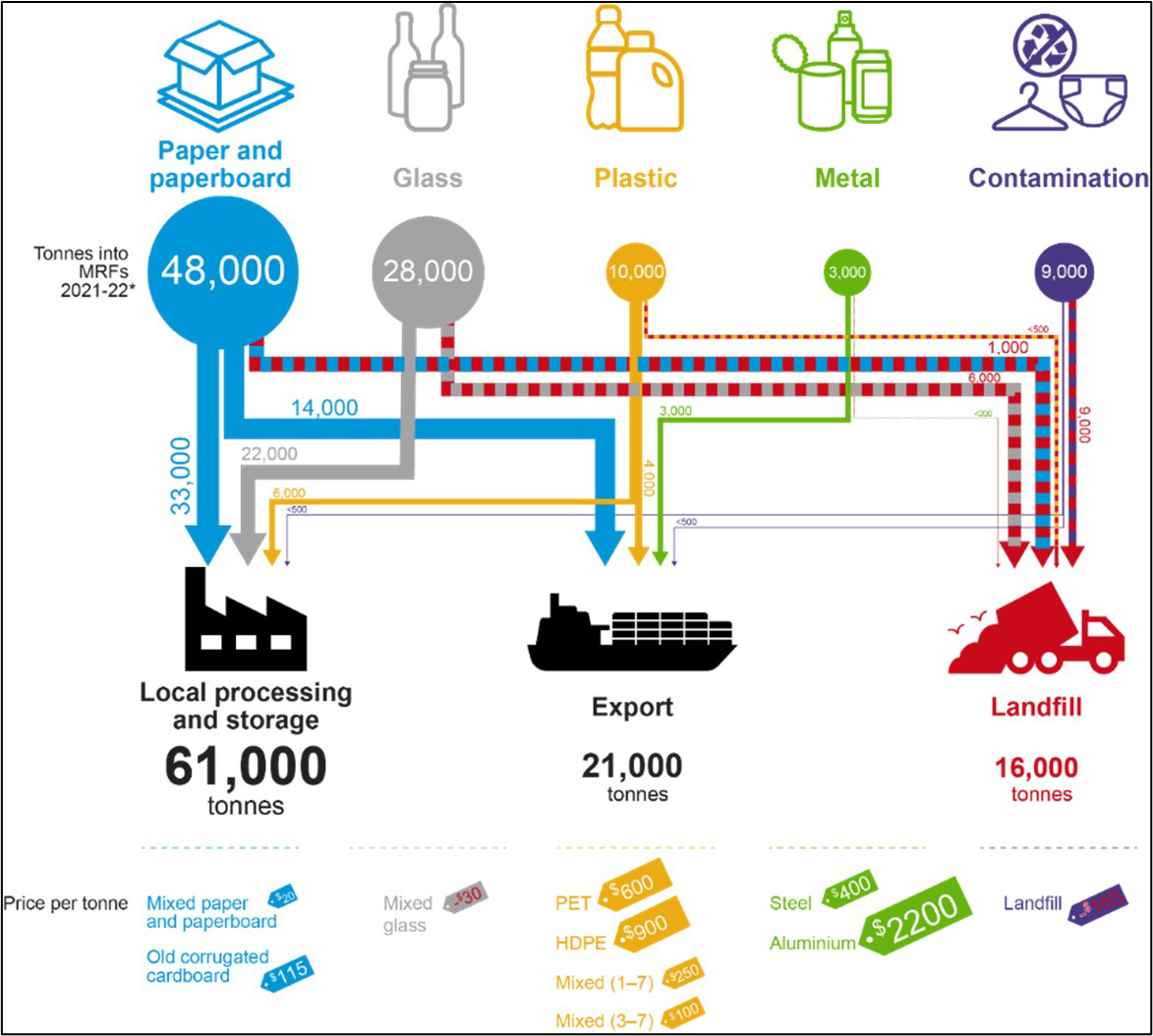

Figure 2 provides an overview of the kerbside collected recyclables over the 2-month period of July 2022 to August 2022. Prices are for September 2022.

Kerbside recyclable materials sent to landfill – July to August 2022

Of the approximately 98,000 tonnes of kerbside materials collected in the first two months of the 2022–23 financial year, 81,000 tonnes or 83% was sent to downstream processing, and 17,000 tonnes or 17% was sent to landfill in July and August 2022. Downstream processing includes export of 21,000 tonnes. The disposal rate to landfill represents a return to the longer-term average of 17–18% of materials to landfill.

There are no reports of significant stockpiling by the metropolitan MRF operators as of September 2022.

Kerbside materials exported – April 2022

In April 2022 Victoria’s exports were:

- 20% of national exported post-consumer paper and paperboard (18,000 tonnes), compared with a 29% average across 2021. The April 2022 export market share for Victoria was the lowest in the available data (from January 2015).

- 56% of national exported post-consumer plastic (4,700 tonnes of 8,400 tonnes), compared with an average 46% across 2021.

Kerbside materials exported – August 2022

In August 2022 Victoria’s exports were:

- 22% of national exported post-consumer paper and paperboard (16,000 tonnes of 93,000 tonnes), compared with an average 29% across 2021.

- 93% of national exported post-consumer plastic (2,300 tonnes of 2,500 tonnes), compared with an average 46% across 2021. This very high rate for August is unusual and is probably an anomaly.

The exports outlined above include material sourced through commercial and industrial collections (in addition to municipal kerbside collected materials), and some interstate material, for example from Tasmania. However, the data illustrates the continuing need for additional local remanufacturing capacity and demand in Victoria, particularly with respect to plastics.

This is also the case in the context of the unprocessed scrap plastics export bans which have been phased in over the last 2 years. From 30 June 2021, exports of mixed polymer scrap plastics were banned, which precipitated a 10% drop in the exports of plastics across July 2021–June 2022 (48,000 tonnes) relative to July 2020–June 2021 (53,000 tonnes).

The second (and final) export ban for scrap plastic commenced on 30 June 2022. This will again have a significant impact on Victoria, as it is no longer possible to export any recovered plastic packaging that is not sorted into a single polymer type, shredded and washed (without specific export licence exemptions). However, this impact is not yet apparent in the July and August 2022 export data.

Market wide developments

- Recycled commodity prices continue to be generally good for plastics and metals but have reduced significantly from the very high levels in the middle of the year. Across 2021 and 2022 there have been significant increases in commodity values for plastics and metals, but not for mixed paper and glass. However, plastics and metals prices have seen significant falls across August and September 2022.The fall in plastics prices have probably been increased by the introduction of the 30 June 2022 export ban.

- MRFs and reprocessors are generally operating as usual. There were no significant reported disruptions in sorting throughput for major MRF operators or downstream reprocessors as of May 2022.

- Staff and skill shortages are causing reprocessing throughput impacts. The kerbside recycling market is not immune to the low supply of available workers currently affecting every industry in Australia.The expanding local market means demand for staff and more specialised skills is increasing in an already constrained worker market, with at least two reprocessors reporting shortages are sometimes stopping operation of lines.This shortage is particularly impacting plastics reprocessors but is also a wider problem. The increasing demand may present an opportunity to provide a new industry pathway with funded trainee programs and longer-term skills training.

Market implications

- Recycled commodity prices remain strong but are trending down. Across 2021 and 2022 there have been significant increases in the commodity values for clean cardboard (but not for mixed paper and cardboard), plastics and metals, but these have all trended down sharply across August and September 2022.

- Export freight costs remain very high. Across the second half of 2021 and 2022 export container costs have increased dramatically, by a factor of 10 in some cases, but have perhaps halved since that time. For materials with a significant export exposure, this single factor has had a big impact on the profit margins for exporters of sorted packaging materials. There are also significant challenges in simply obtaining timely access to containers and shipping space.

- Significant increases in reprocessing capacity and end-markets for kerbside mixed paper are now on the longer-term horizon. In April 2021 Visy and the Victorian Government announced a $37 million joint investment for the installation of drum pulpers at Visy's Coolaroo mill. This will more than double the mill's capacity for processing kerbside mixed paper to around 150,000–200,000 tonnes per year in total, or 60% of Victoria's kerbside mixed paper and cardboard collections. The timeframe for this project completion is still uncertain, but it would ideally be completed before 1 July 2024, which is the start date of the national mixed paper export bans.

- Increases in reprocessing capacity and end markets for kerbside mixed plastics are in the pipeline. Significant increases in reprocessing capacity for polyethylene terephthalate (PET), high-density polyethylene (HDPE) and polypropylene (PP) are either underway or under advanced consideration. Local end-markets for high quality processed rPET, rHDPE and rPP appear strong. However, a gap exists between when this new capacity will be available to process MRF-sorted plastic packaging, and the earlier event of the unprocessed plastics export ban which came into force in July 2022.

Market opportunities

Market wide

- Ongoing education program to reduce kerbside contamination.

- MRF modifications for improved separation (of paper and plastics grades) and contaminant control, supported by improved packaging design and materials selection to reduce incoming low value or problematic packaging.

- Community recycling drop off points with a focus on bulk cardboard, expanded polystyrene sheets (EPS), and soft plastics.

- Development of industry pathways to provide sufficient skilled workers for the industry.

Fibre

- Large scale pulping capacity for recovered paper, either separately or integrated with virgin or recycled fibre manufacturing.

- Procurement of locally manufactured recycled products to encourage reprocessing investment.

Glass

- Implementation of new kerbside glass collection and container deposit scheme (CDS) collected glass over the next couple of years, coupled with increased recycled content targets.

- Glass kerbside bin purchase.

Plastics

- Updated recycled plastics specifications for sorted and reprocessed PET, HDPE, low density polyethylene (LDPE) and PP from kerbside sources.

- Reprocessing capability for LDPE and PP films from kerbside sources. Preferably into high-quality recycled resin that is competitive with virgin resin and is both useable onshore and exportable.

- Separation equipment for PET/PE/PP at MRF or reprocessing sites for those that currently do not have this.

- Improved packaging design to ensure single and compatible polymer use only, enabling higher recover rates and less contamination.

Report disclaimer

The information on this report was prepared in conjunction with Blue Environment, IndustryEdge and Sustainable Resource Use (SRU).

While reasonable efforts have been made to ensure that the contents of this publication are factually correct, Recycling Victoria gives no warranty regarding its accuracy, completeness, currency or suitability for any particular purpose and to the extent permitted by law, does not accept any liability for loss or damages incurred as a result of placed upon the content of this publication.

This publication is provided on the basis that all persons accessing it undertake responsibility for assessing the relevance and accuracy of its content.

Recycling Victoria does not accept any liability for loss or damage arising from your use of or reliance on the data. The inclusion of information in this report does not constitute Recycling Victoria’s endorsement of any particular facility, or any associated organisation, product or service.

Accessibility disclaimer

The Victorian Government is committed to providing a website that is accessible to the widest possible audience, regardless of technology or ability.

This page contains two embedded complex image files (Figures 1 and 2) that may not meet our minimum WCAG AA Accessibility standards.

If you are unable to read any of the content of this page, you can contact the content owners for an Accessible version.

Contact email: rvdata@delwp.vic.gov.au

Updated